Options trading strategies are powerful tools that allow traders to capitalize on market movements and maximize their trading potential. By employing various options strategies, traders can profit from bullish, bearish, or even neutral market conditions. These strategies involve the buying and selling of options contracts to achieve specific trading objectives, such as hedging against risk, generating income, or speculating on price movements. Whether you’re a beginner or an experienced trader, understanding and utilizing options trading strategies can significantly enhance your trading performance and open up a world of possibilities in the financial markets.

In this blog, we will introduce you to top 10 essential options trading strategies that every trader should know. By mastering these strategies, you can gain a competitive edge in the market and elevate your trading game. Let us start by understanding these 10 strategies one by one.

Strategy 1: Covered Call

The covered call strategy is a popular options trading strategy that involves selling a call option against an underlying asset you already own. This strategy allows you to generate income from the premiums received while potentially benefiting from a limited upside gain. It can be a helpful strategy in sideways or slightly bullish markets.

Source: Investopedia

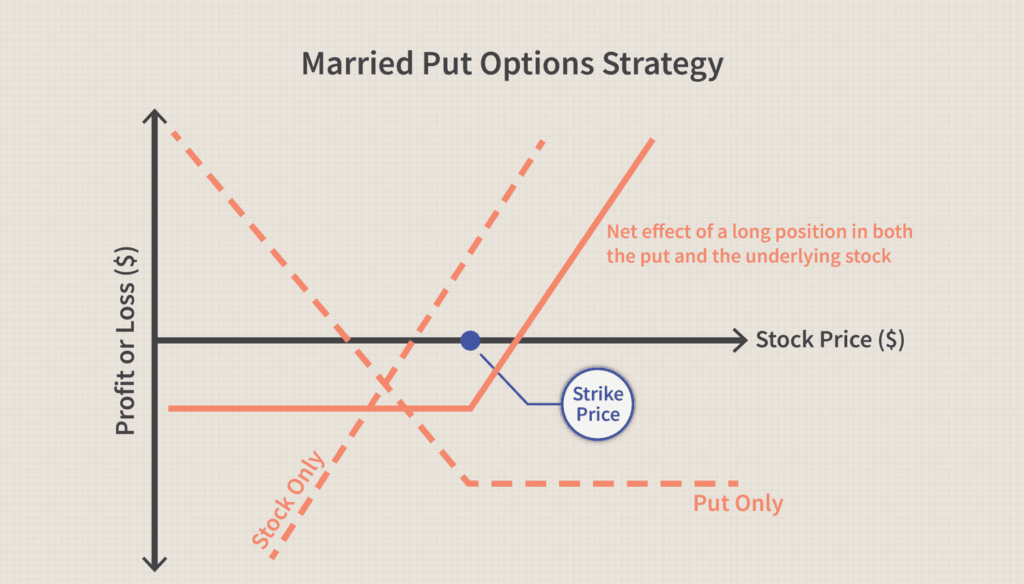

Strategy 2: Protective Put

The protective put strategy, also known as a married put, protects your stock holdings against potential downside risk. You can limit your losses if the stock price drops by purchasing a put option for the same number of shares you own. This strategy acts as insurance for your portfolio and provides peace of mind during volatile market conditions.

Source: Investopedia

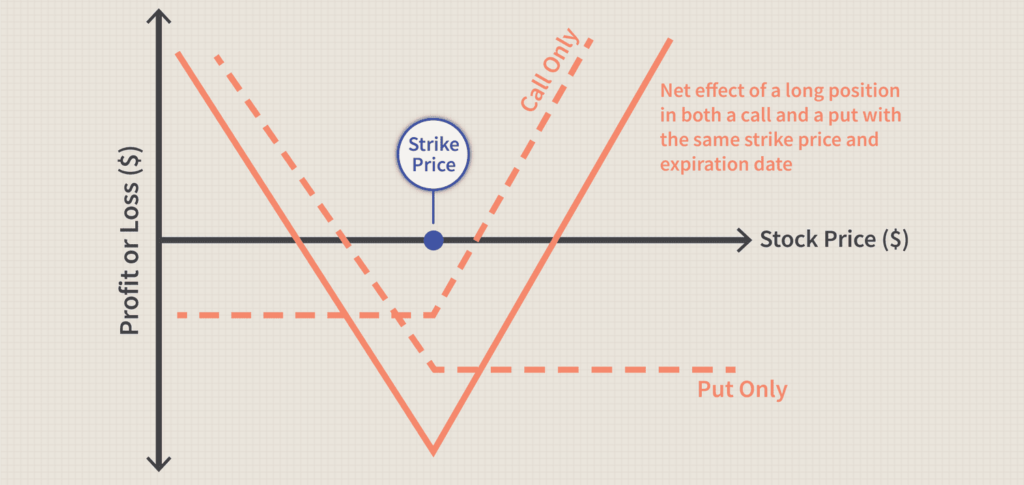

Strategy 3: Long Straddle

The long straddle strategy involves buying both a call option and a put option with the same strike price and expiration date. This strategy is effective when you expect significant price volatility but are uncertain about the direction. Suppose the stock price moves significantly in either direction. In that case, the profits from one option can offset the losses.

Source: Investopedia

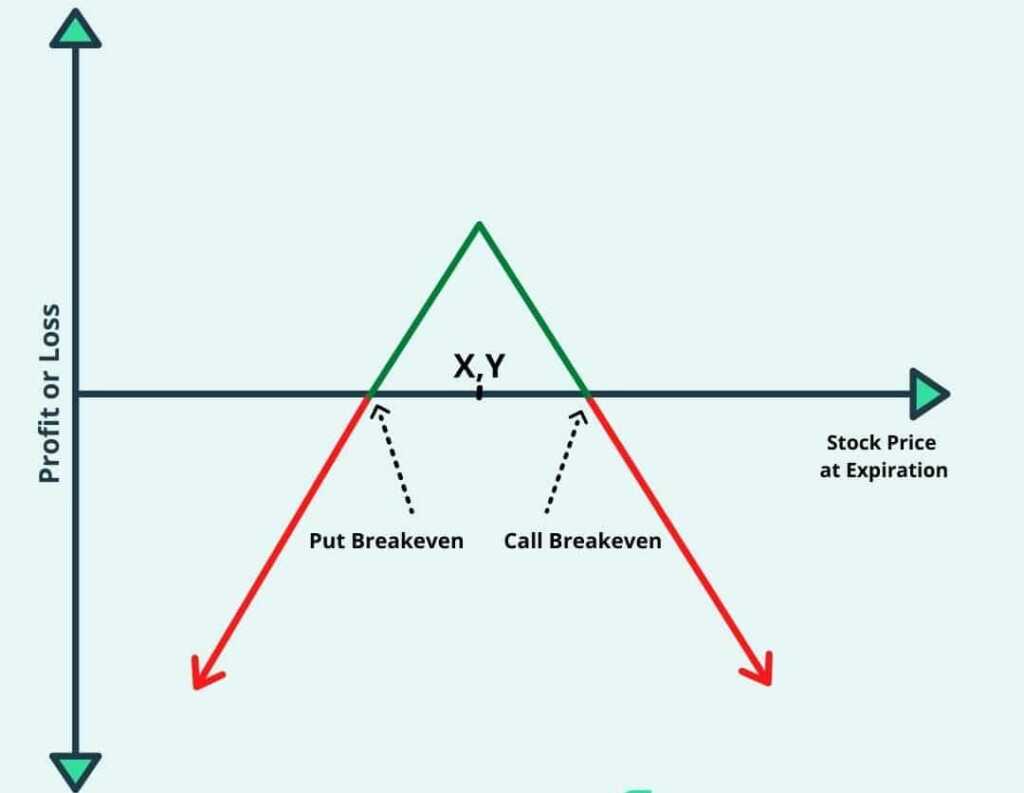

Strategy 4: Short Straddle

The short straddle strategy is the opposite of the long straddle. In this strategy, you sell both a call option and a put option with the same strike price and expiration date. This strategy is suitable when you expect the stock price to remain stable within a specific range. Collecting the premiums from selling the options allows you to generate income while assuming the obligation to buy or sell the underlying asset if the options are exercised.

Source: projectfinance

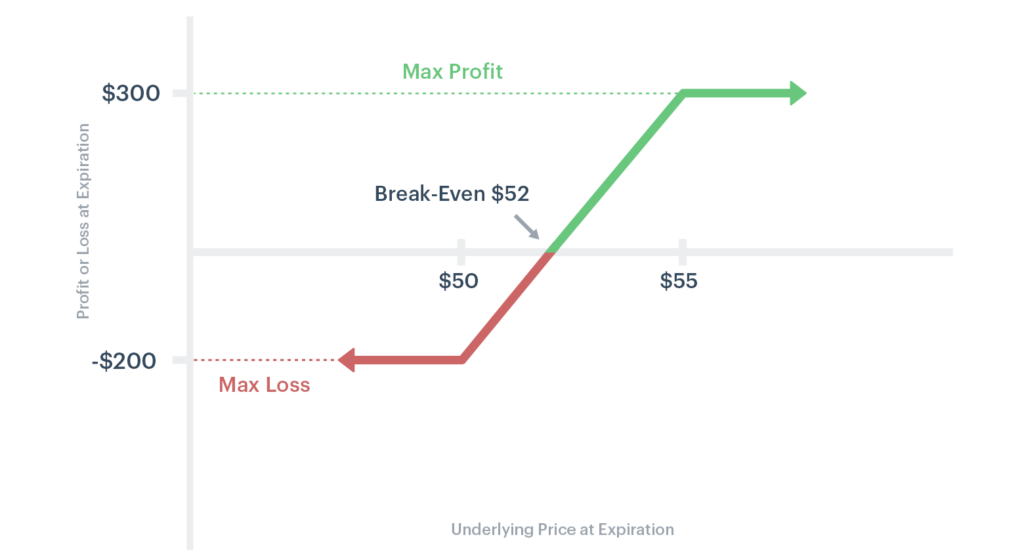

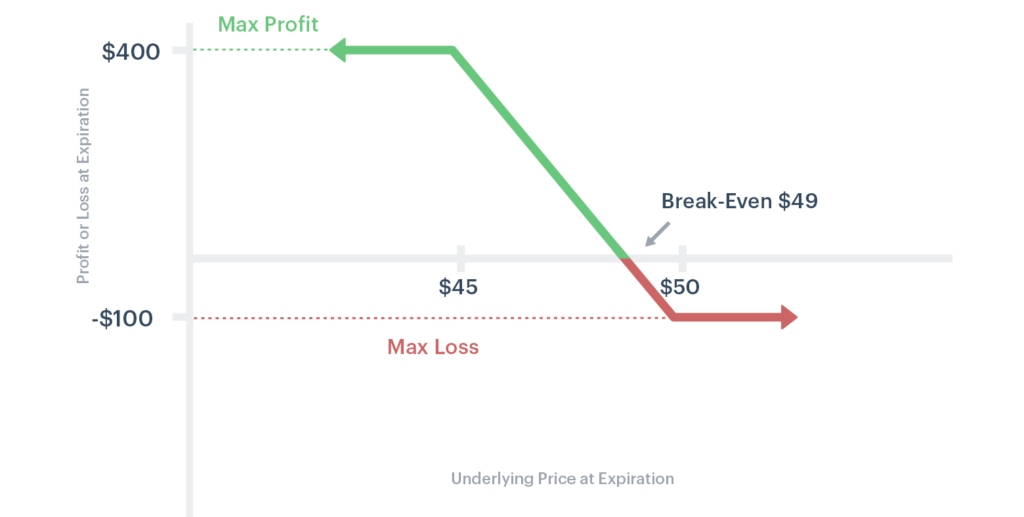

Strategy 5: Bull Call Spread

The bull call spread strategy involves buying a call option at a lower strike price and simultaneously selling a call option at a higher strike price. This strategy is employed when you anticipate a moderate bullish move in the stock price. The goal is to profit from the price increase while limiting potential losses by offsetting the purchase call option’s cost with the premium received from selling the higher strike call option.

Source: Option Alpha

Strategy 6: Bear Put Spread

The bear put spread strategy is the opposite of the bull call spread. It involves buying a put option at a higher strike price and selling it at a lower strike price. This strategy is implemented when you expect a moderate bearish move in the stock price. The objective is to profit from the price decrease while minimizing potential losses by offsetting the cost of the purchased put option with the premium received from selling the lower strike put option.

Source: Option Alpha

Strategy 7: Long Call Butterfly

The long call butterfly strategy is a neutral options strategy that combines both a bull spread and a bear spread. It involves buying a call option at a lower strike price, selling two call options at a middle strike price, and buying another one at a higher strike price. This strategy aims to profit from low volatility and a range-bound stock price.

Source: The Options Guide

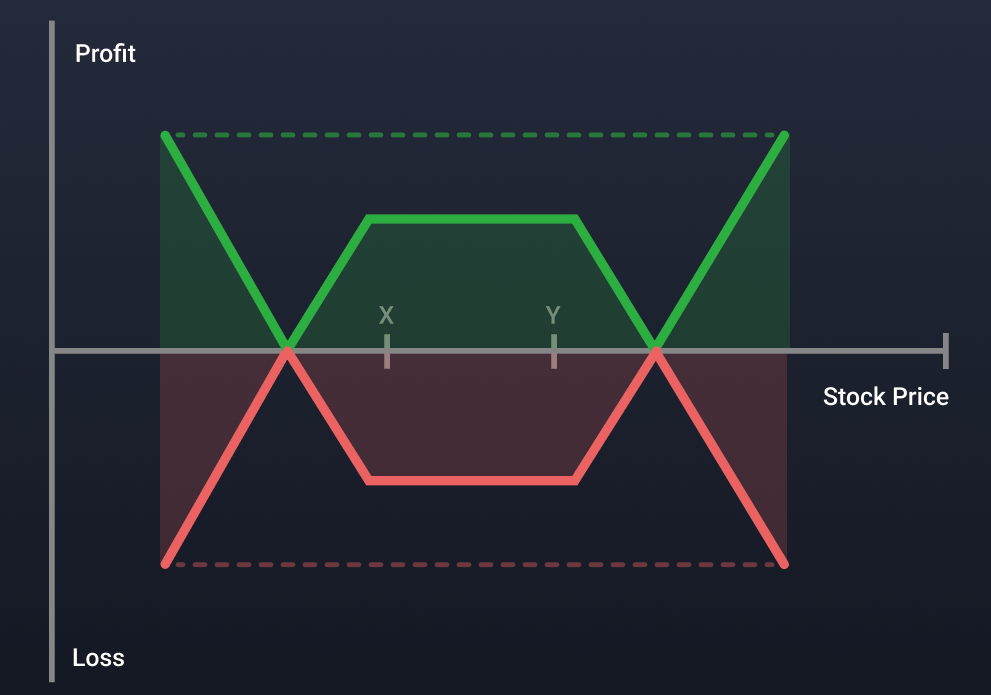

Strategy 8: Iron Condor

The iron condor strategy combines a bull put spread and a bear call spread. It involves selling a put option at a lower strike price, buying a put option at an even lower strike price, selling a call option at a higher strike price, and buying a call option at an even higher strike price. This strategy is suitable when you expect the stock price to remain within a specific range. It allows you to collect premiums while limiting potential losses.

Source: Algo Trading India

Strategy 9: Strangle

The strangle strategy is similar to the straddle strategy. Still, it involves buying out-of-the-money calls and putting options with different strike prices. This strategy is employed when you anticipate significant price volatility but are still determining the direction. The goal is to profit from a substantial price move, regardless of whether it is up or down.

Source: Dhan Blog

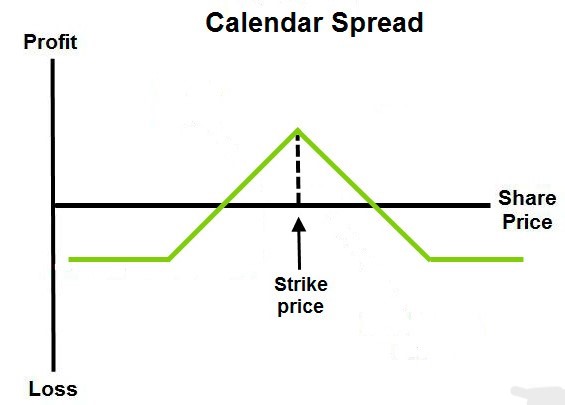

Strategy 10: Calendar Spread

The calendar spread, also known as a horizontal spread or time spread, involves buying and selling options with the same strike price but different expiration dates. This strategy is used when you expect the stock price to remain relatively stable. By capitalizing on the time decay of options, you can profit from the faster decay of the near-term option while maintaining a longer-term position.

Source: OptionClue

Conclusion

Options trading offers immense opportunities for traders to profit from market movements and diversify their trading strategies. By incorporating these 10 essential options trading strategies into your repertoire, you can adapt to various market conditions and improve your trading outcomes. Remember, practice, thorough analysis, and risk management are crucial when implementing these strategies.

If you’re eager to delve deeper into the world of options trading and unlock the full potential of these strategies. In that case, we recommend enrolling in Upsurge.club’s Most Effective Options Trading Strategies Course. This comprehensive course is designed to provide you with the knowledge, skills, and confidence to navigate the options market successfully. Whether you’re a beginner or an experienced trader, this course will equip you with the tools and strategies to make informed trading decisions. Take advantage of this opportunity to enhance your options trading proficiency and elevate your trading results.