Day traders use various strategies to make quick profits in the options market. While many traders rely on technical indicators, there’s an alternative called Price Action Trading. Instead of complex charts, it focuses on understanding how the underlying assets, such as stock prices, move to identify entry and exit points. If you want to learn price action option trading, this article will help you grasp its principles in simple terms.

Understanding Price Action Trading

So, what is price action in stock market? Price Action Trading is a strategy where you analyze the historical price movements of a financial asset, like stocks or currencies, to make future trading decisions. You focus on patterns, candlestick formations, and support/resistance levels in charts.

By studying historical price data, you seek to identify trends, reversals, and key entry and exit points.

This method emphasizes understanding market psychology and supply-demand dynamics to anticipate future price movements, allowing you to make trading decisions based solely on price action and market sentiment.

Mastering this strategy involves practice, patience, and a keen understanding of market sentiment.

Price Action Trading Strategies

Many traders use tools like candlestick patterns, breakouts, and trends. They also rely on the ideas of support and resistance to make their trading plans.

Here are some simple option trading price action strategies you can implement:

1. Trend Trading

Price action trend trading involves studying trends in price movements. As a new trader, you can learn from experienced peers by using techniques like the head and shoulders trade reversal.

When you spot green uptrends, open a ‘buy’ position or ‘sell’ during red downtrends, as shown in the screengrabs.

This strategy helps you effectively follow price action trends and gain valuable trading experience.

2. Pin Bar

The pin bar pattern sometimes referred to as the candlestick strategy due to its unique appearance, resembles a candle with a long wick.

It signifies a sudden reversal and rejection of a specific price level, with the wick or tail showcasing the extent of the price rejection. You can assume that the price will likely continue moving in the opposite direction of the tail.

For instance, if you spot a pin bar pattern with a lengthy lower tail, this suggests a history of rejecting lower prices, hinting that the price might soon increase. This information aids you in deciding whether to take a long or short position in the market.

Source: VCGamers Marketplace

3. Inside Bar

The inside bar pattern is a crucial two-bar options price action strategy. It features an inner bar smaller than the outer bar, residing within the high and low range of the outer bar, also known as the mother bar.

Identifying inside bars is a skillful task, as they typically emerge during market consolidation but can sometimes mislead by signaling a potential trend reversal.

As a skilled trader, your ability to quickly recognize inside bars and apply your macro knowledge is essential. Analyzing the size and position of the inside bar will guide your predictions on whether prices are likely to rise or fall, making it a valuable component of your options price action strategy.

Source: ForexBee

4. Trend Following Breakout Entry

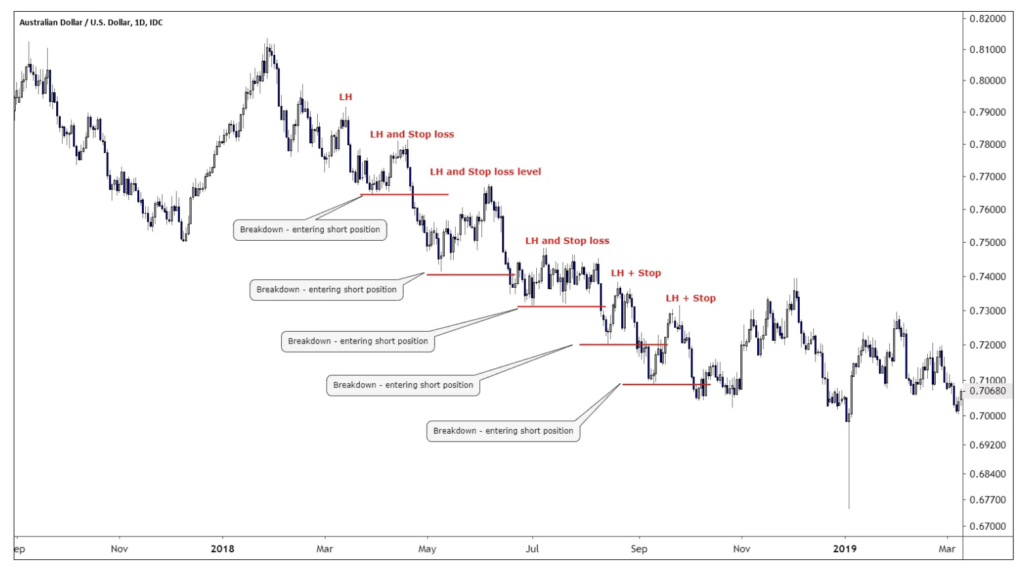

As a trader, you track major market movements with one key assumption in mind: a retracement often follows a price spike.

When the market surpasses a defined support or resistance line, it’s considered a breakout. This serves as a signal for you to consider taking a long position if the underlying stock price is trending upward and breaks above the resistance line or a short position if it drops below the support line.

Source: InvestingCube

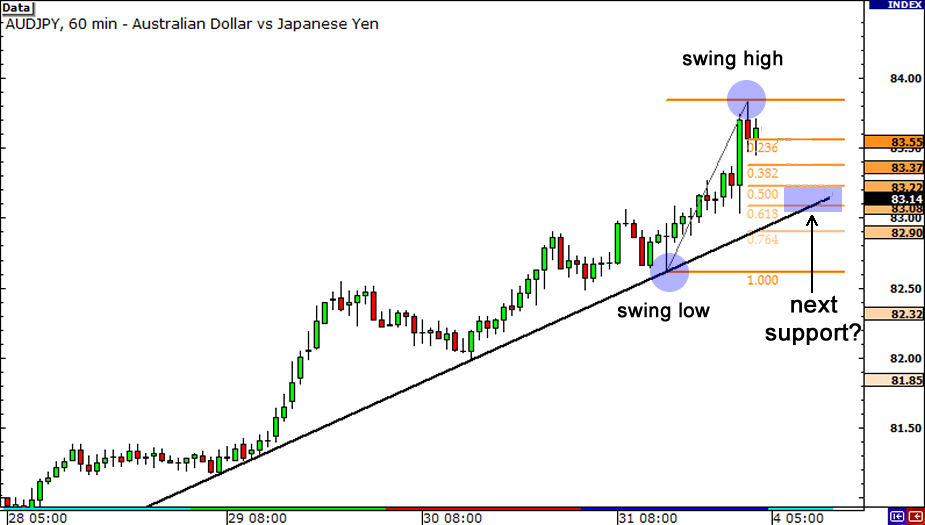

5. Trend Following Retracement Entry

This price action strategy relies on trend following. When prices decline, traders take short positions, while in the presence of incremental price increases, they consider buying.

This approach capitalizes on the persistence of higher highs and lows in an upward trend and the anticipation of price reversals during downtrends.

Source: babypips.com

6. Head and Shoulders Reversal Trade

The head and shoulders pattern is a recognizable market movement resembling a head and shoulders silhouette. Prices initially rise, then fall, followed by a further rise, another fall, and finally a lower high before a modest drop.

This pattern is widely used in price action trading, making it popular for its straightforward entry point selection (typically after the first shoulder) and stop loss placement (typically after the second shoulder).

Traders aim to capitalize on the temporary peak represented by the head, making it a favored strategy.

Source: DailyFX

Enroll in the Best Price Action Options Trading Course

Choosing a course on Price Action Options Trading from Upsurge.club is crucial for you to use it in your trading effectively. It provides the required guidance, expert insights, and practical skills essential for successful trading.

The right course helps you grasp price patterns, understand market psychology, and refine your decision-making abilities.

With Upsurge.club, you gain access to a top-notch option price action trading course that offers comprehensive training, empowering you to make informed trading choices and navigate the financial markets with confidence.

Don’t compromise on your trading education; opt for the options price action course with Upsurge.club.

Conclusion

Starting on a journey into Price Action Option Trading can be both rewarding and educational.

By understanding price action chart patterns and implementing a solid trading plan, you’ll be better equipped to navigate the complex world of options trading.

To increase your knowledge and skills further, consider enrolling in the best Price Action Options Trading course available at Upsurge.club.