In this guide, renowned trader and instructor Jyoti Budhia explains the basics of options trading for beginners. She uses her 37+ years of trading experience and 22 years of experience in options to dissect basic options concepts, decode profitable strategies, and explain market environments. Being a trainer with BSE & NSE, and having trained 5,000+ students, her teaching style will make you confident enough to start implementing options strategies right away!

Preview – What to Expect

Before we dive in, let’s take a peek into what we will be covering…

- Learn basic options concepts like buying and writing calls & puts

- Device options trading strategies like straddles, strangles, butterflies, and spreads

- Calculate the potential and realized profit, loss & breakeven prices for any strategy

- Understand the effect of prices, volatility, and time on your trade

- Manage trades from a profitability and risk management perspective

Learn from the instructor herself, get the comprehensive course here.

Basics of Options Trading

Options trading is one of the most lucrative ways to make money from the markets. However, they come with an equal, if not higher amount of risk. It’s crucial to clarify your concepts – what to buy, what to sell, and how to realize a profit by taking reasonable risk; before diving into the world of options trading.

And this guide will help you do just that.

What is a derivative?

The word ‘derivative’ is formed with the word ‘derive’, i.e. to reflect the activity or nature of something else. Hence, a derivative is an instrument that derives its value from another underlying asset or instrument. For example, the price of gold jewelry is derived from the price of gold, making the jewelry a derivative of gold – its price changes are derived from the price changes of gold.

An option is a type of derivative, and it derives its price from underlying assets like an index, stock, or event.

Derivatives are traded in contracts, which are made up of several underlying instruments, and every derivative contract has a minimum lot size, as defined by the exchange. At any given point, there are 3-month contracts for stocks, and 5-year contracts for Nifty at the most. Weekly, monthly, and quarterly contracts also exist.

These lots are bought/sold on the market and have an expiry, i.e., the contract remains in existence only until a fixed date. In India, the monthly expiry for stocks is on the last Thursday of the month. For various indices, the expiries are at:

| Index | Expiry |

| Nifty | Thursdays |

| Bank Nifty | Wednesdays |

| Financial Nifty | Tuesdays |

| Sensex | Fridays |

| Nifty Midcap | Mondays |

Remember that an expiry date is the date when the derivative contract ceases to exist, i.e. the right to buy or sell an underlying asset is lost and premium payments stop.

What is an option?

Since childhood, we are presented with multiple options on an everyday basis. ‘Shall I carry an umbrella?’, ‘What shall I eat today?’ – all of these are options we face.

But in the context of the stock markets, what is an option?

Similar to a regular option, a stock market option is a derivative that grants the right to bet in favor of or against the market at a particular price. The instrument we can bet in favor of or against can be a particular index like Nifty, Sensex, Bank Nifty, Finnifty, or Midcap Nifty; or a particular stock like Reliance Industries Ltd.

Just like 2 people are needed on opposite sides for a bet to take place, an option needs 2 parties.

An option buyer bets in favor of or against the instrument they buy an option of, and gains an amount based on the appreciation or depreciation of the contract’s pre-decided price, known as the strike price. The seller, on the other hand, is the provider of the option and earns a fee for granting the option, known as a premium.

Hence in an option contract, a buyer has the right, but not the obligation to exercise an option that a seller provides.

Example of an option contract

For example, if a contract is made to bet in favor of the Nifty gaining more than 19,500; a buyer will earn as much as the Nifty appreciates beyond 19,500 when they exercise the option; while the seller will earn a fixed fee of say Rs 100, for granting that option to the buyer. The opposite is applicable for an option contract that is made to bet against the Nifty, i.e. the Nifty dipping to a price below 19,500. Here, the buyer gains as much as the Nifty depreciates beyond 19,500 if they exercise the option; while the seller earns the fixed fee.

Buying a call option

A call option grants the right, but not the obligation to buy the underlying asset at an agreed price on or before a particular date, called the ‘expiration date’. A call option buyer pays a fee to the call seller (or writer) for having this option, known as the premium.

A ‘call’ means to go long an underlying instrument, and is bought when one expects the underlying instrument to appreciate in price. The seller of the call, on the other hand, believes that the instrument will not appreciate in price, expecting the buyer to never exercise their option.

Note that the seller of a contract is called an ‘option writer’.

Consider that if we buy a call option of 1800 on ABC stock for Rs 25/unit for a lot size of 300, the contract price (premium to be paid) will be Rs 7,500. Here the strike price is 1,800; and the option price, i.e. premium is Rs 25.

Let’s look at what happens in the following 3 possible situations:

| Buying a 1,800 strike call option at Rs 25/unit for a lot size of 300 | |||

| Underlying Price | Value of Call Option | Profit/Loss on 1 unit (Value of call option – Premium paid) | Total Net Profit/Loss |

| 1,900 | 100 | 75 | +22,500 |

| 1,700 | 0 | -25 | -7,500 |

| 1,810 | 10 | -15 | -4,500 |

| Maximum Profit = Unlimited | |||

| Maximum Loss = 25/unit = 7,500 total | |||

| Breakeven strike price = 1,825 | |||

Buying a put option

A put option grants the right, but not the obligation to sell the underlying asset at an agreed price on or before the expiration date. A put option buyer pays a fee to the put seller (or writer) for having this option, known as the premium.

A ‘put’ means to short an underlying instrument, and is bought when one expects the underlying instrument to depreciate in price. The seller of the put, on the other hand, believes that the instrument will not depreciate in price, expecting the buyer to never exercise their option.

For example, if we buy a put option of 2,500 on ABC stock for Rs 50/unit for a lot size of 200, the contract price (premium paid) will be Rs 10,000. Let’s look at what happens in the 3 possible situations:

| Buying a 2,500 strike put option at Rs 50/unit for a lot size of 200 | |||

| Underlying Price | Value of Put Option | Profit/Loss on 1 unit (Value of put option – Premium paid) | Total Net Profit/Loss |

| 2,300 | 200 | 150 | +30,000 |

| 2,250 | 0 | -50 | -10,000 |

| 2,480 | 20 | -30 | -6,000 |

| Maximum Profit = 2,450/unit = 4,900 total | |||

| Maximum Loss = 50/unit = 1,000 total | |||

| Breakeven strike price = 2,450 | |||

It is advised to write down your calculation on paper or a board for clarity instead of just keeping a mental account. You would also realize how much of a loss you are willing to tolerate depending on different situations.

European vs. American Options

An American option allows its holder to exercise their right any time before or on the date of the expiration. A European option, on the other hand, limits execution only to the expiry date.

In India, European options have been prevalent for a long time.

Writing a call option

A call writer believes that the price of the underlying is not going to appreciate, or is going to depreciate. Hence, they take the opposite side of the call contract. Calculations of a writer’s profit are opposite to that of the buyer’s. Whatever the call buyer gains, the writer loses, and vice versa.

Assume that a call writer sells an option contract of 1,000 on ABC stock for Rs 60/unit for a lot size of 500. They would receive a premium of Rs 30,000 upfront. Let’s look at 3 possible situations:

| Selling a 1000 strike call option at Rs 60/unit for a lot size of 500 | |||

| Underlying Price | Value of Call Option | Profit/Loss on 1 unit (Value of call option + Premium received) | Total Net Profit/Loss |

| 1,200 | -200 | -140 | -70,000 |

| 900 | 0 | 60 | +30,000 |

| 1,025 | -25 | +35 | +17,500 |

| Maximum Profit = 60/unit = 30,000 total | |||

| Maximum Loss = Unlimited | |||

| Breakeven strike price = 1,060 | |||

Writing a put option

A put writer believes that the price of the underlying is not going to depreciate, or is going to appreciate. Hence, they take the opposite side of the put contract. Calculations of a writer’s profit are opposite to that of the buyer’s. Whatever the put buyer gains, the writer loses, and vice versa.

For example, assume that a put writer sells an option contract of 2,500 on ABC stock for Rs 100 per unit for a lot size of 200. They would receive a premium of Rs 20,000 upfront. Remember that a put writer would want the underlying price to appreciate so that the buyer doesn’t exercise their option. Let’s look at 3 possible situations:

| Selling a 2500 strike put option at Rs 100/unit for a lot size of 200 | |||

| Underlying Price | Value of Put Option | Profit/Loss on 1 unit (Value of put option + Premium received) | Total Net Profit/Loss |

| 2,100 | -400 | -300 | -60,000 |

| 2,600 | 0 | 100 | +20,000 |

| 2,475 | -25 | +75 | +15,000 |

| Maximum Profit = 100/unit = 20,000 total | |||

| Maximum Loss = 2,400/unit = 4,80,000 total | |||

| Breakeven strike price = 2,600 | |||

To summarize, the actions when we hold a market optimistic or pessimistic view would be:

| View | Buy | Sell |

| Optimistic | Call | Put |

| Not optimistic | – | Call |

| Pessimistic | Put | Call |

| Not pessimistic | – | Put |

The pros and cons of being an option buyer vs. an option seller are:

| Side / Parameters | Option Buyer | Option Writer |

| Premium | Pays premium | Receives premium |

| Pros | Unlimited profit potential for call buyer, full exercise price less premium for put buyerMaximum loss is only up to the premium paid | Good source of premium income in stable markets |

| Cons | No benefit if the option stays out of the money | Maximum profit is limited to the premium received |

Payoffs for an option

For a call buyer, the payoff is equal to the difference between the underlying price and strike price, reduced by the premium paid, if the underlying is above the strike, or a net loss equal to the amount of premium paid is realized if the underlying is below the strike. The break-even price is the price at which the exercise of the option would yield no profit and no loss, and is equal to the amount of premium added to the exercise price.

Payoffs for a long call option

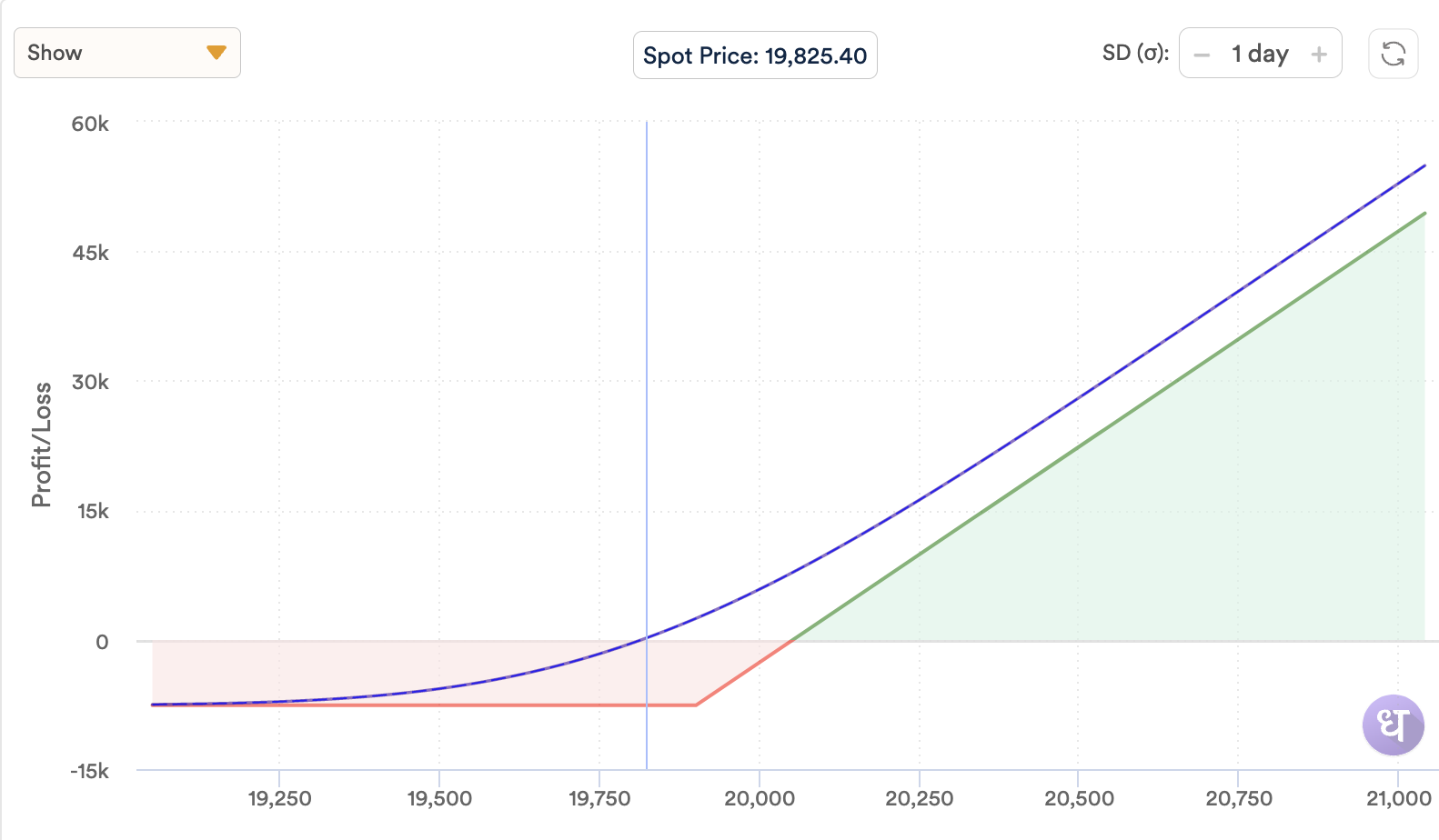

Considering buying a 19,800 call option with an expiry of 28th Sept (costing 152.15 on 8th Sept), a payoff looks like this:

Note that as of 8th September 2023, the spot price is 19,825.40 and the option is exercisable, but not profitable. One can notice the unlimited profit potential and limited loss potential.

Payoffs for a long put option

For a put buyer, the payoff is equal to the difference between the strike price and underlying price, less the premium paid, if the underlying is below the strike, or a net loss equal to the amount of premium paid is realized if the underlying is above the strike. The break-even price is the price at which the exercise of the option would yield no profit and no loss, and is equal to the amount of premium reduced from the exercise price.

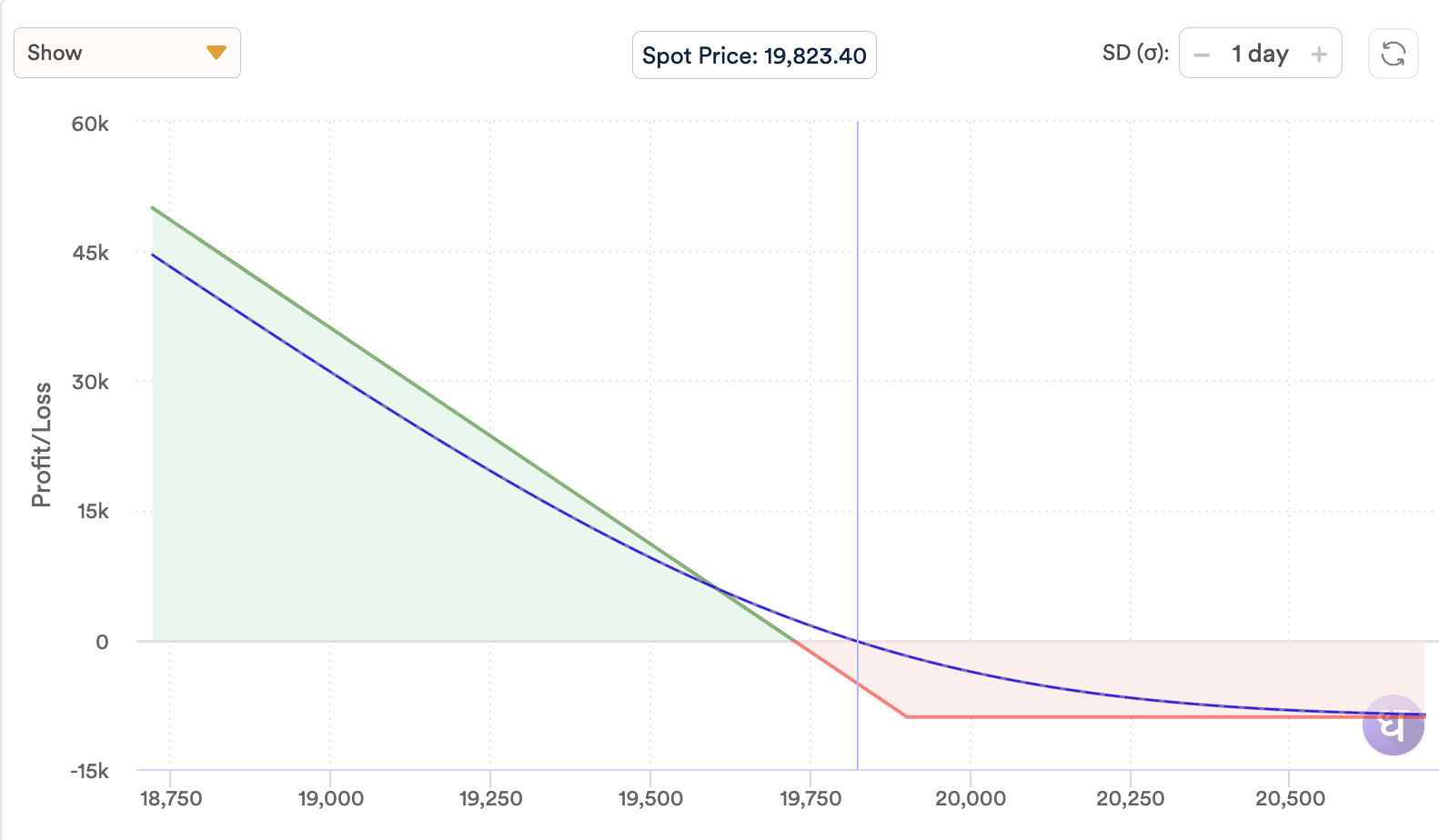

Considering buying a 19,800 put option with an expiry of 28th Sept (costing 179.20 on 8th Sept), a payoff looks like this:

Note that the spot price is 19,823.40 and the option is not exercisable, and not profitable. One can notice the limited profit potential and limited loss potential.

Payoffs for a short call option

For a call writer, the payoff is equal to and limited to the premium earned. The loss is equal to the difference between the underlying price and the strike price when the underlying price is above the strike and can be unlimited. The break-even price is the price above the strike price at which the exercise of the option would yield no profit and no loss for the seller, an up-move from the strike price such that the difference is equal to the premium earned.

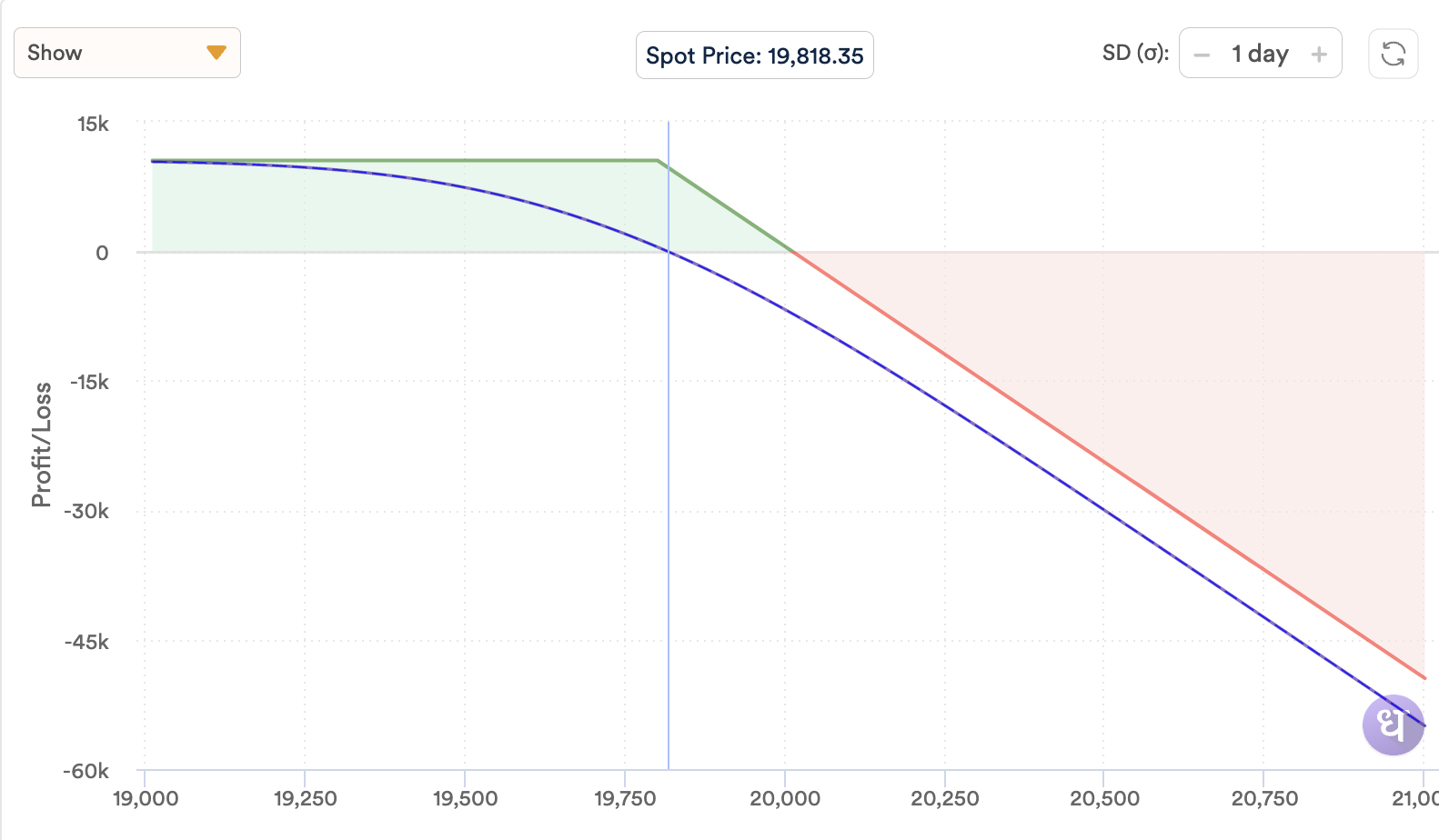

Considering selling a 19,800 call option with an expiry of 28th Sept (costing 210.40 on 8th Sept), a payoff looks like this:

Note that the spot price is 19,818.35 and the option is exercisable but profitable. One can notice the unlimited loss potential and limited profit.

Payoffs for a short put option

For a put writer, the payoff is equal to and limited to the premium earned. The loss is equal to the difference between the underlying price and strike price when the underlying price is below the strike and is limited to the underlying price less premium earned. The break-even price is the price below the strike price at which the exercise of the option would yield no profit and no loss for the seller, a dip from the strike price such that the difference is equal to the premium earned.

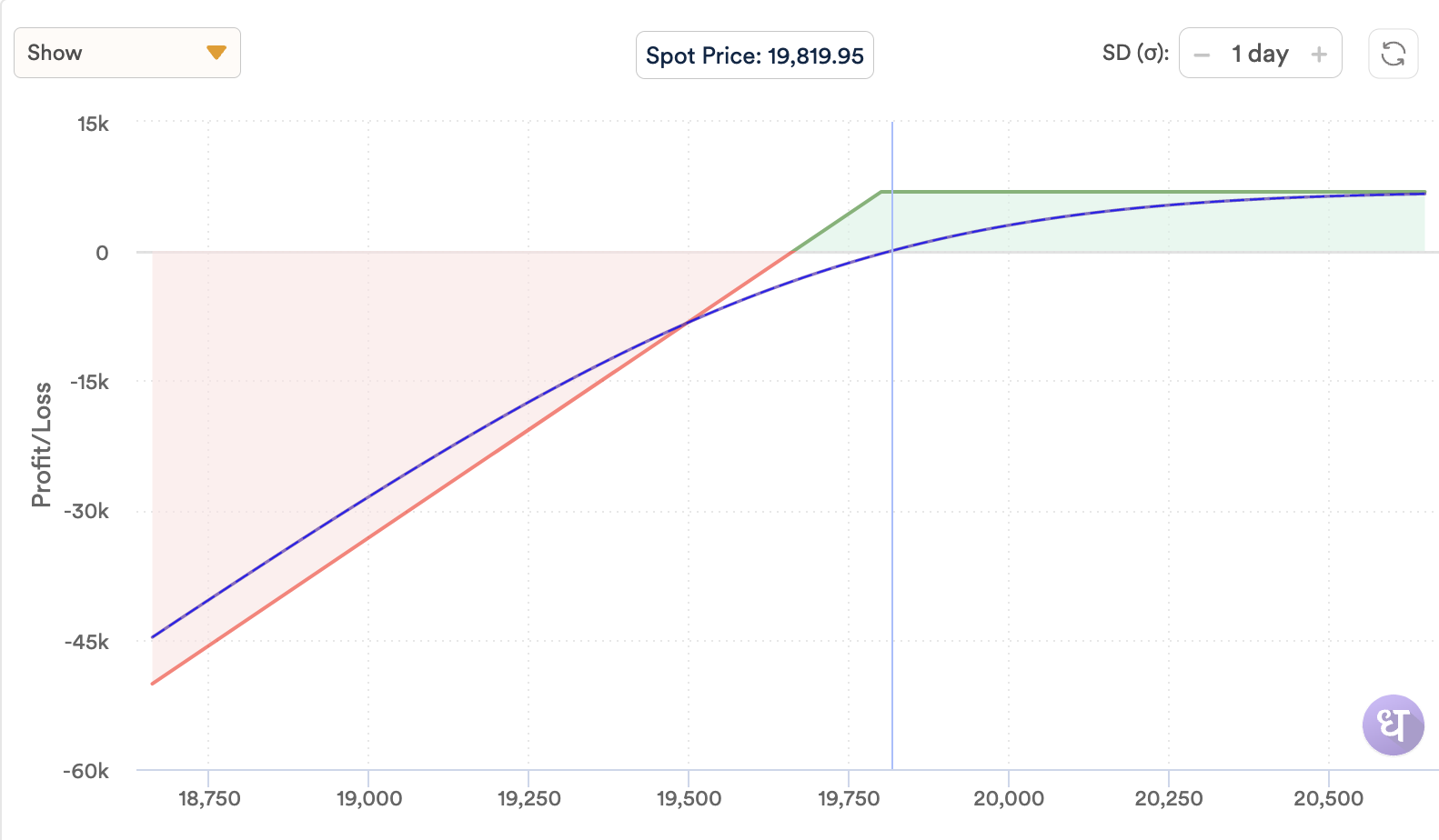

Considering selling a 19,800 put option with an expiry of 28th Sept (costing 137.95 on 8th Sept), a payoff looks like this:

Note that the spot price is 19,819.95 and the option is not exercisable, and profitable. One can notice the limited loss potential and limited profit potential.

Moneyness in Options

An option is said to be ‘in the money’ if it gives value to the buyer by exercising it. It is said to be ‘out of the money’ if the buyer gets no value by exercising it, and ‘at the money’ if the strike price is equal to the underlying price.

For example, if we buy a call option with an exercise price of 500, and the underlying price is 550, the option is said to be in the money. An underlying price below 500 makes the option ‘out of the money’ and an underlying price of 500 makes it ‘at the money’.

For a put option with an exercise price of 500, the underlying price being would have to be 450 to be in the money and an underlying price above 500 would make the option ‘out of the money’. An underlying price of 500 makes it ‘at the money’.

To summarize, an option contract with a strike price of 500 will be called:

Option with a strike price of 500 | Underlying Price | ||

| 450 | 500 | 550 | |

| Call Option | Out of the money | At the money | In the money |

| Put Option | In the money | At the money | Out of the money |

Moneyness of an option – example

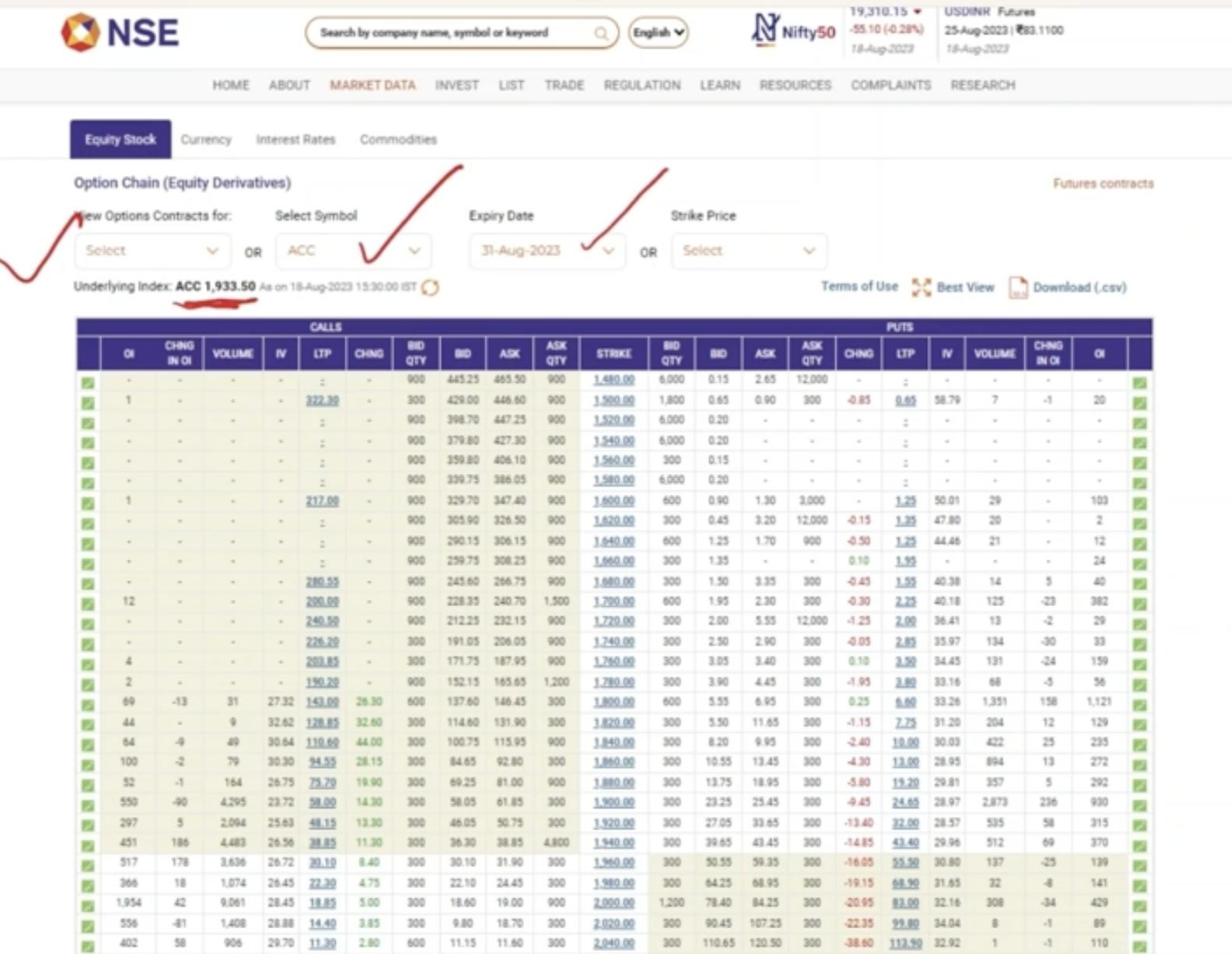

We can understand the moneyness of an option by checking the respective option chain on the NSE site. ACC Ltd.’s option chain data as of 18th August 2022 with an expiry of 31st August 2022 looked like this:

Points to note:

- The ask price is the price one asks to sell an option contract, i.e. the price we can buy it for.

- The bid price is the price one is willing to pay to buy an option contract, i.e. the price we can sell it for.

- Contracts with an off-white background are in the money and those with a white background are out of the money. Notice how a put is out of the money while a call is in the money. Both cannot be in the money at the same time, although they can be at the money at the same time.

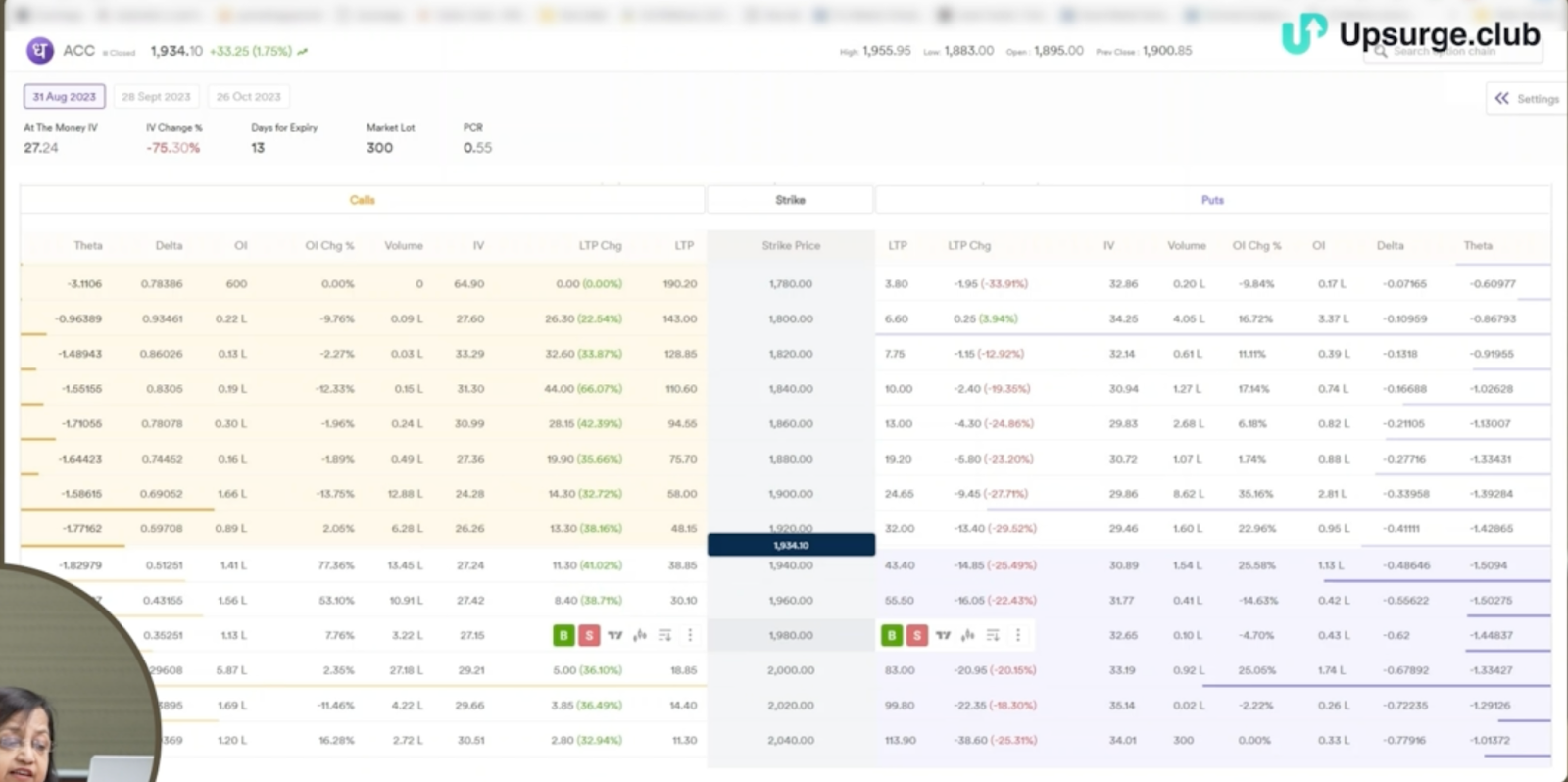

A similar option chain can also be obtained on the Dhan Trading platform:

Breakup of an Option Premium

An option’s premium price is made up of 2 parts – intrinsic value and time value.

The intrinsic value is based on the difference between the strike price and underlying price and the time value is the price paid for the total premium reduced by the intrinsic value.

For example, for a call option with a strike price of 500 at a premium of Rs 60; and the underlying price resting at 550, the intrinsic value is calculated as 50 (550-500), and the time value is calculated at 10 (60-50):

Call Option with a strike price of 500 | Underlying Price | Premium Price(P) | Intrinsic Value(I) | Time Value(P-I) |

| 550 | 60 | 50 | 10 | |

| 450 | 50 | 0 | 50 |

Note that when an option is out of the money, the entire option price is made up of time value.

Using this method, we can calculate an option’s intrinsic value and time value at any given time.

Understanding Terminologies & Indicators in Options Trading

Delta

The delta of an option shows the magnitude of change occurring in the option price due to a change in the underlying instrument’s price. A delta value is calculated by dividing the change in the underlying price by the change in the option price. If stock ABC’s call option price changes from 25 to 28 when its price jumps from 100 to 120, the delta is 0.67 (20%/12%). The put’s price would most likely depreciate, say from 25 to 21 and its delta will be -0.25 (20%/16%).

A call option has a positive delta and a put option has a negative delta. The delta of a call and put option on the same underlying at the same strike price and expiry sums to 1.

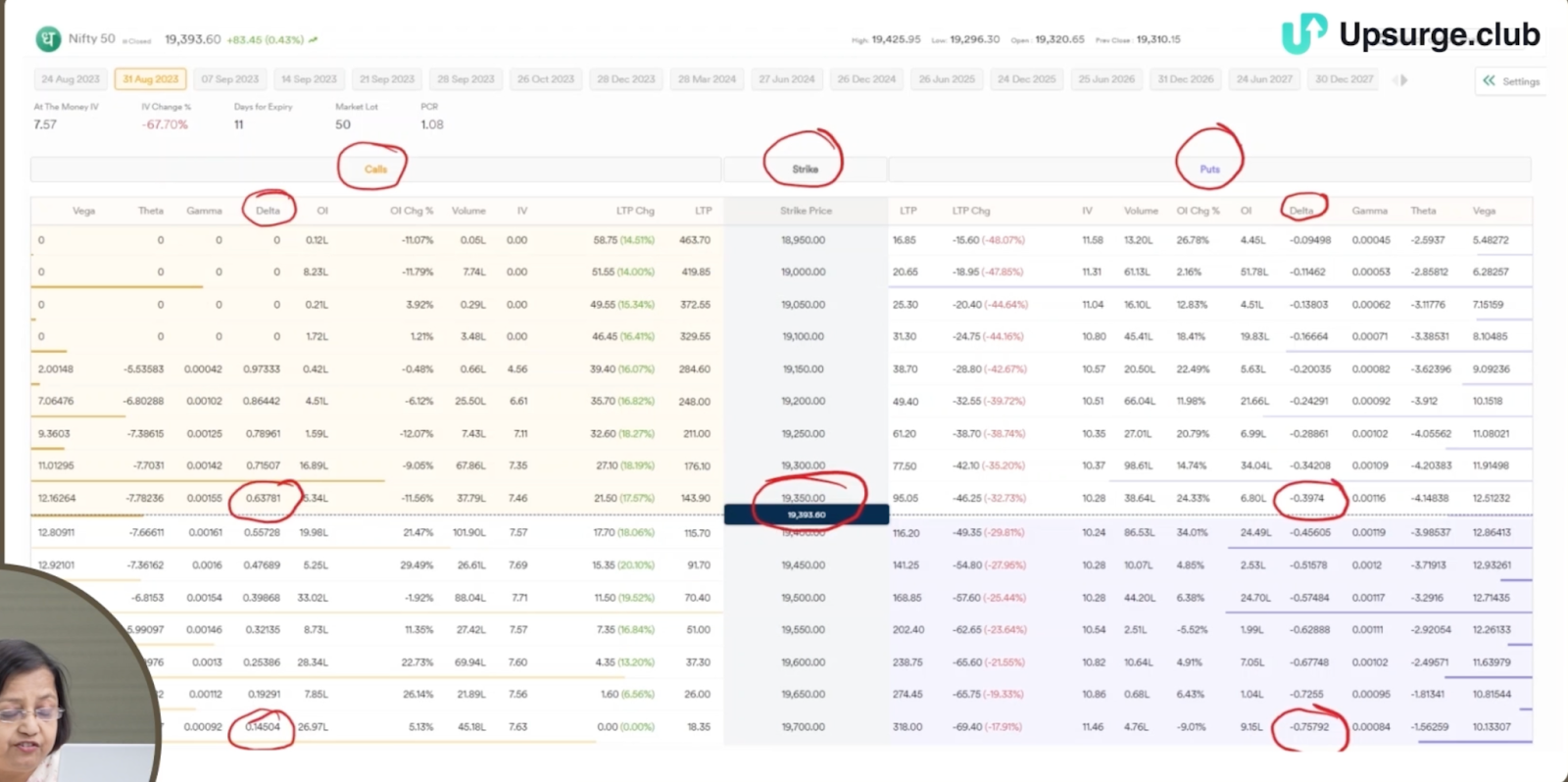

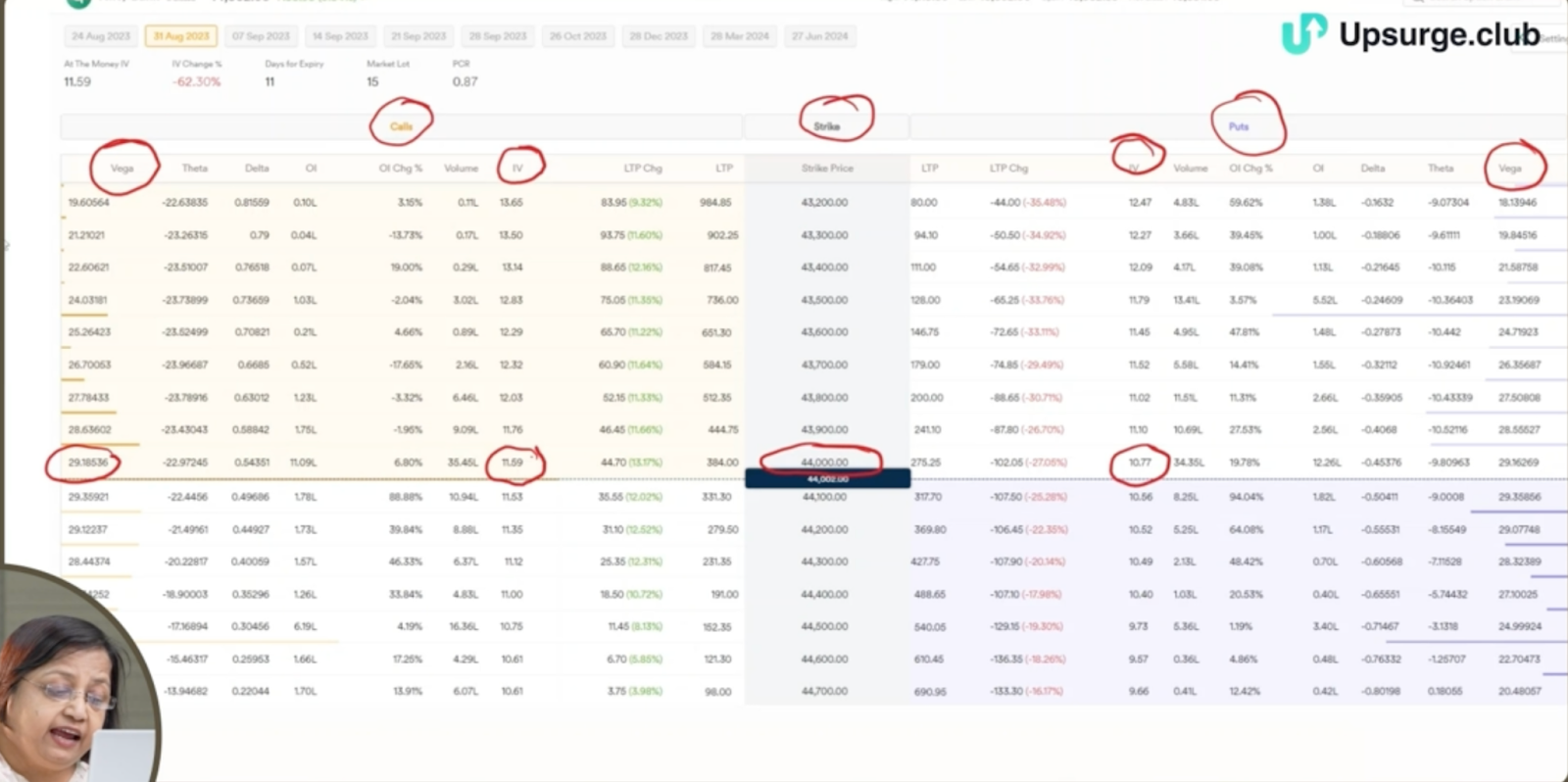

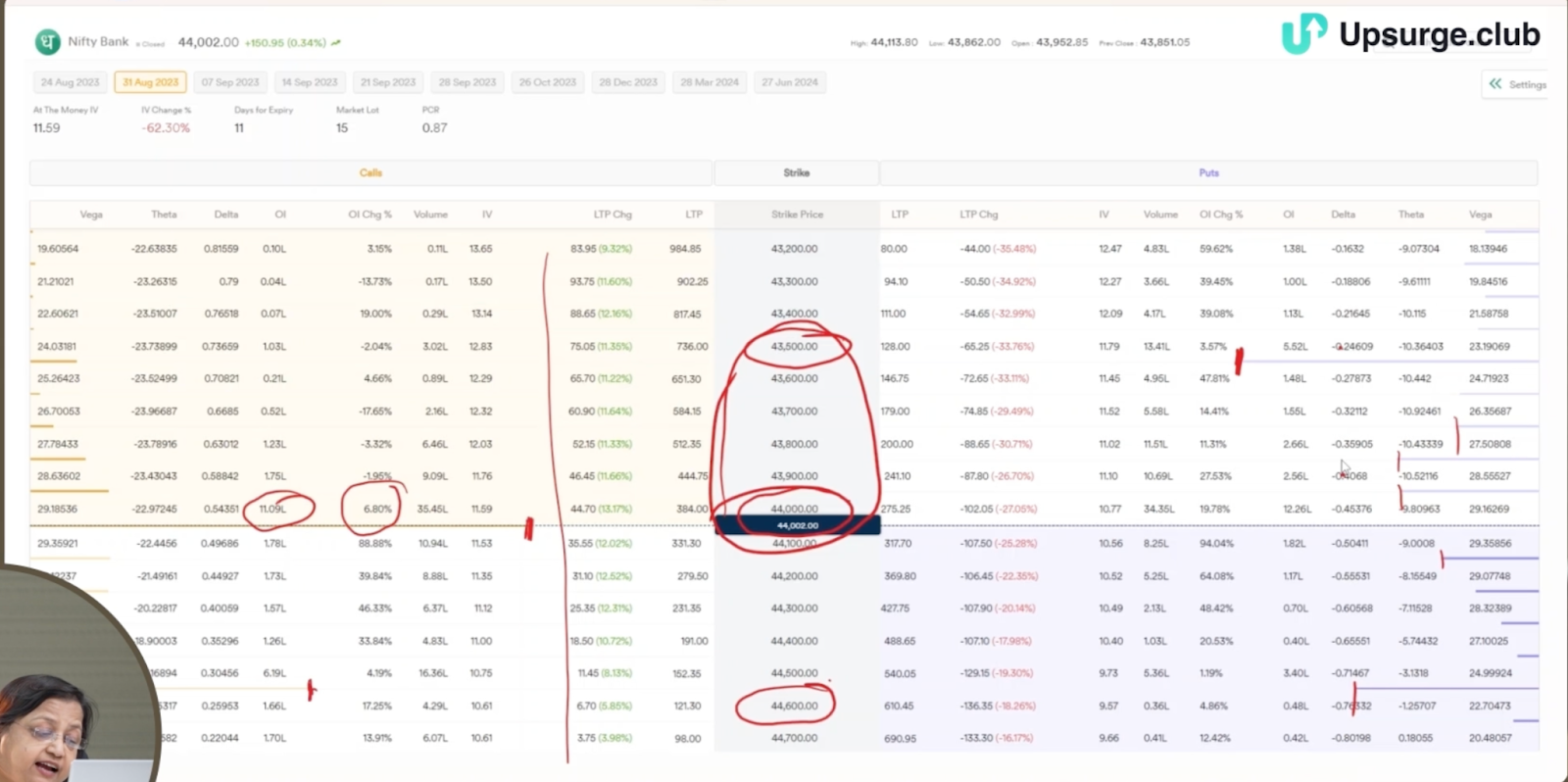

Deltas for calls and puts for 2 different strike prices have been highlighted for a Nifty 31st Aug 2023 expiry in the options chart provided by Dhan below. See how the opposite put and call deltas at the same strike price sum to ~1:

Options at different moneyness typically have the following observed deltas:

| Moneyness | Deep ITM | ITM | ATM | OTM | Far OTM |

| Delta | 0.8 – 1 | 0.6 – 0.8 | 0.4 – 0.6 | 0.2 – 0.4 | 0 – 0.2 |

Gamma

Gamma is the metric describing the rate of change in the delta for a change in the underlying price. Gamma is the highest for ATM options, as that is the time when deltas are the most sensitive to price changes; and decreases as options move out of the money.

This metric is most useful for traders operating at a large scale, especially during an expiry.

Theta

Theta represents the rate of decline in the value of an option over time, as the expiry date comes nearer. The premium of an option decays at the rate of theta with time, all else equal. The more time passes, the more the decay.

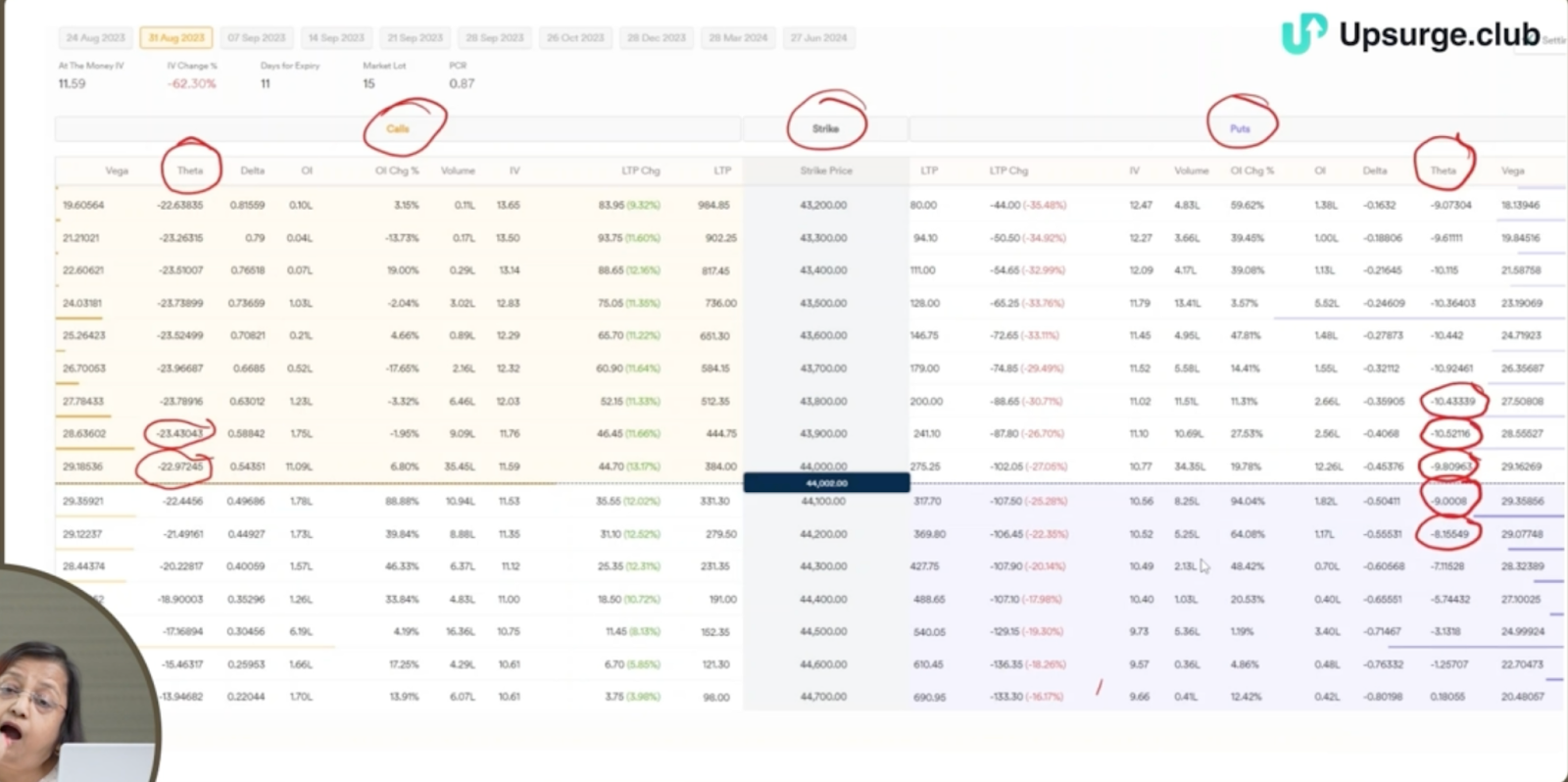

The highlighted thetas in Dhan’s platform below show the rate at which the premium of an option depreciates per day:

Vega

The volatility of a stock or index is expressed as a percentage. Usually, the volatility index (VIX India) represents the implied volatility, which is the market’s forecast on the potential movements of the underlying. Similarly, every option has an implied volatility.

Vega represents the rate of change of an option’s price, given a change in the underlying asset’s volatility. A vega of 3 means that the price of an option increases by Rs 3 with a 1% change in underlying’s volatility. A vega is mostly positive since an option’s value moves directly with the change in volatility.

Look at the highlighted implied volatility and vegas of the option contracts below:

With Dhan’s trading platform, one can easily see the changing premiums and expected profits/losses simulating different thetas and vegas.

Open Interest

Open interest indicates the number of contracts held by traders in active positions. These positions are open and haven’t been closed out yet. It is called ‘open interest’ since both parties still have an interest in the contract.

We can derive important information by looking at the levels of changes in open interest.

The highest call open interest (HCOI) indicates the strike price with the highest number of call option contracts and such a strike price acts as a market resistance. Similarly, the highest put open interest (HPOI) indicates the strike price with the highest number of put option contracts and acts as a market support. An increase of open interest in the call and put side suggests a strengthening of the resistance and support levels respectively.

Highlighted below are the strike prices with the highest open interest, both on the call and put side, representing strong resistance and support for the market.

These concepts not only work for equity indices but can be applied to commodity and currency contracts as well.

Volatility

Market volatility is nothing but the rate of change or fluctuations in prices. The more the prices of a stock or index fluctuate, the more volatile it is. It is important to keep a tab on the volatility to position ourselves and act according to market conditions.

The volatility index of India, known as the VIX, is a signal that tracks the existing volatility in our flagship index, Nifty 50. A high and low VIX indicates the market’s high and low volatility, respectively. VIX shows us the historical volatility of the index. Over the long term, the VIX is positively correlated to negative periods in the market. You can easily find the VIX number on Dhan’s platform.

Implied volatility, as discussed, is the market’s forecast on the potential movements of the underlying. The higher an asset’s implied volatility, the higher an option’s premium derived on that underlying.

Put Call Ratio

Obtained by dividing the open interest of puts by the open interest of calls at the same strike price, the put-call ratio helps to gauge the overall sentiment of the market. A PCR of 1.25 suggests that there are 25% more puts than there are calls, and a PCR of 0.60 indicates that there are 40% fewer puts than there are calls. A PCR of 1 suggests an equal number of calls and puts. An increasing PCR indicates bearishness and decreasing PCR indicates bullishness. You can view the PCR for different expiries easily on the Dhan platform.

Here is what different PCRs suggest about market sentiment:

| Put Call Ratio (PCR) | <1 | 1 | >1 |

| Market Position | Oversold, bullish reversal likely | Indecisive | Overbought, bearish reversal likely |

You would notice that the PCR for stock options (relative to index options) is typically less than 1 because stockholders use covered calls.

Expiries available on a weekly and monthly basis can result in an abruptly changing PCR over different time frames and hence, relying solely on the PCR number for market direction is not advised.

Strategies in Option Trading

Now that we have familiarized ourselves with basic options terminologies, let’s look at how we can capitalize on our knowledge by implementing the right strategies. All the following strategies are a combination of buying and selling puts or calls, or both.

Long and Short Straddles

A straddle is used to bet on the volatility of an underlying asset, regardless of the direction of its price movement. A long straddle is used when one expects volatility to increase and a short straddle is used when one expects volatility to decrease.

Long Straddle

A long straddle is a strategy where a trader buys both, a call option and a put option on the same underlying at the same strike price and expiry.

Considering a straddle bought at a strike of 1,800 with call and put option prices of Rs 35 and Rs 40 respectively, and a lot size of 300. Let’s look at payoffs in 3 different situations:

| Long Straddle at strike of 1,800 with call & put premium of 35 and 40 (lot size 300) | ||||

| Underlying Price | Value of Call Option | Value of Put Option | Profit/Loss on 1 unit net of premium | Total Net Profit/Loss |

| 1,600 | 0 | 200 | 125 | +37,500 |

| 1,800 | 0 | 0 | -75 | -22,500 |

| 2,100 | 300 | 0 | 225 | +67,500 |

The profit potential is unlimited for a long straddle if the underlying rises above the strike and limited to the difference between the strike and underlying, if the underlying falls below the strike. Its maximum loss is limited to the total premium paid.

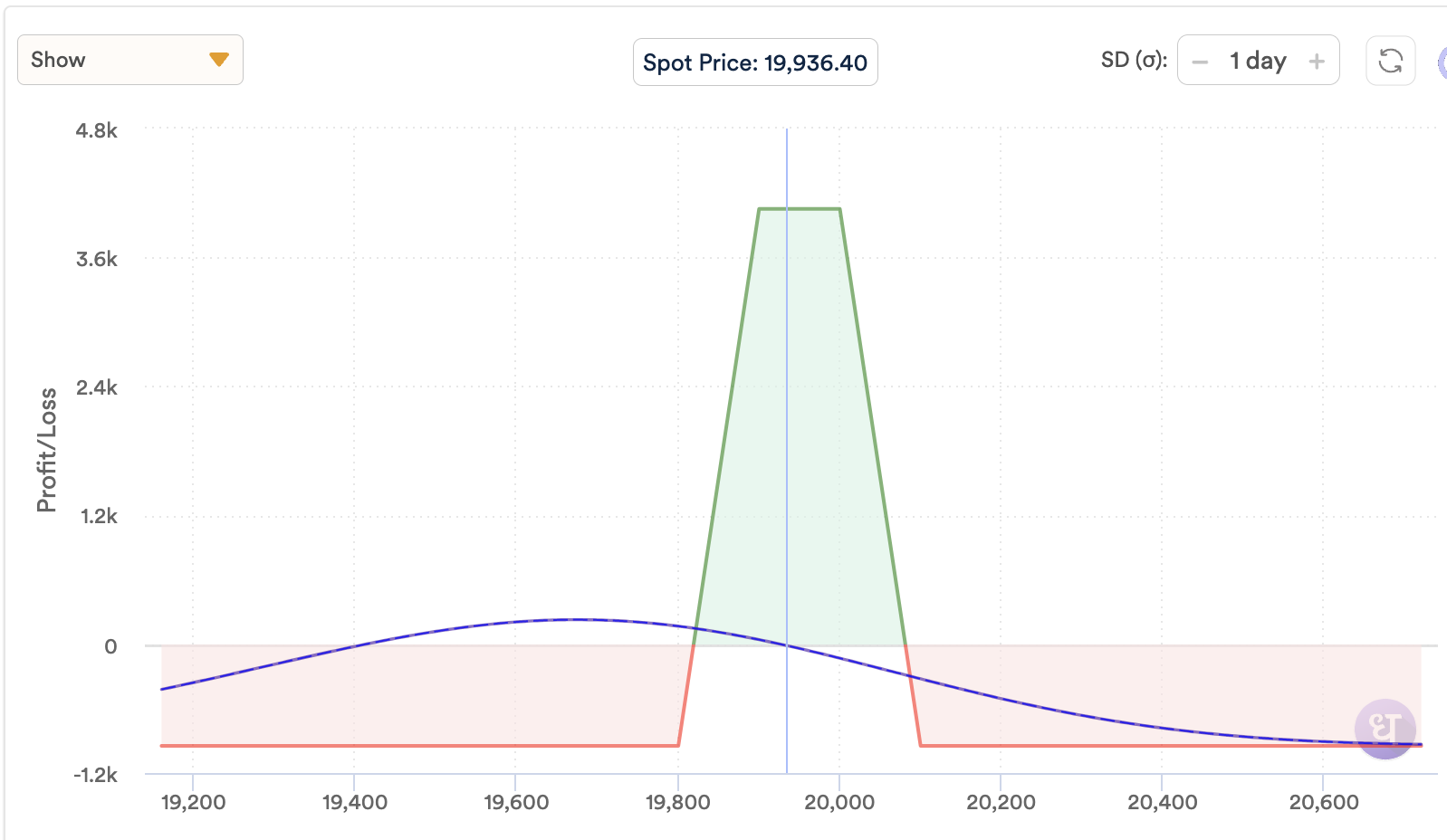

Here’s what the payoff looks like for a long straddle with a strike price of 20,000 as of 12th September 2023:

Short Straddle

In a short straddle, a trader sells both, a call option and a put option on the same underlying at the same strike price and expiry. Its maximum profit is equal to the total premium. The payoffs are exactly opposite to those of a long straddle. The straddle seller’s profit is equal to the straddle buyer’s loss and vice versa.

Let’s consider the same trade as above, but take the opposite position this time. Let’s look at payoffs in 3 different situations:

| Short Straddle at strike of 1,800 with call & put premium of 35 and 40 (lot size 300) | ||||

| Underlying Price | Value of Call Option | Value of Put Option | Profit/Loss on 1 unit net of premium | Total Net Profit/Loss |

| 1,600 | 0 | 200 | -125 | -37,500 |

| 1,800 | 0 | 0 | +75 | +22,500 |

| 2,100 | 300 | 0 | -225 | -67,500 |

The maximum profit for a short straddle is limited to the total premiums received. The maximum loss can be unlimited if the underlying rises above the strike and limited to the difference between the strike and the underlying, if the underlying falls below the strike.

For a straddle with a strike price of 1,800 and costing Rs 35 for a call option and Rs 40 for a put option, the payoffs for a long and short strangle would be:

| Type of Straddle / Underlying Price at Expiry | Long Straddle | Short Straddle |

| 1,600 | +40,000 | -40,000 |

| 1,800 | -10,000 | +10,000 |

| 2,100 | +15,000 | -15,000 |

Here’s what the payoff looks like for a short straddle of strike prices of 20,000 as of 12th September 2023:

Iron Butterfly

An iron butterfly strategy is a strategy that involves buying multiple call and put options at 3 different strike prices. It involves buying a call at a higher strike price and a put at a lower strike price along with a short straddle. This is a less riskier way to implement a short straddle, or a way of hedging it. The positions of an iron butterfly (using options of 28th Sept, 2023 expiry) may look like this:

Buying a 20,100 call option @109.55

Selling a 20,000 call option @157.00

Selling a 20,000 put option @176.10

Buying a 19,900 put option @136.10

The net premium of this position is receiving Rs 86.45 (157.00 + 176.10 – 109.55 – 136.10). If the underlying price closes within the range of 19,900-20,100, a maximum loss of Rs 627.50 would be incurred. But a price movement outside the range would yield a profit, a maximum of Rs 4,372.50. Let’s look at the payoff:

Iron Butterfly – Short straddle @20,000 + buy call @20,100 + buy put @19,900 (For 1 lot) | ||

| Maximum Profit | Maximum Loss | Breakeven Price |

| 4,372.50 | 627.50 | 19,912.55 & 20,087.45 |

Hence, an iron butterfly strategy can be called a safer version of the short straddle, where the range of profit and loss can be predicted.

Long & Short Strangles

Long Strangle

A long strangle is a milder version of a long straddle. Although strangles are used to bet on the volatility of the underlying asset’s price movement as well, options bought and sold are not at the money, and are rather chosen to form a range. A larger movement in the underlying is required for a strangle to be profitable. The premiums are lower than that of a straddle.

Let’s consider a strangle that involves buying a 250 lot size call option at a strike price of 2,000 and a 1,900 put option that costs Rs 20 each. Let’s see what happens in each of the 3 scenarios:

| Long Strangle with call strike 2,000 & put strike 1,900 with call & put premium of 20 each (lot size 250) | ||||

| Underlying Price | Value of Call Option | Value of Put Option | Profit/Loss on 1 unit net of premium | Total Net Profit/Loss |

| 2,200 | 200 | 0 | +160 | +40,000 |

| 1,940 | 0 | 0 | -40 | -10,000 |

| 1,800 | 0 | 100 | +60 | +15,000 |

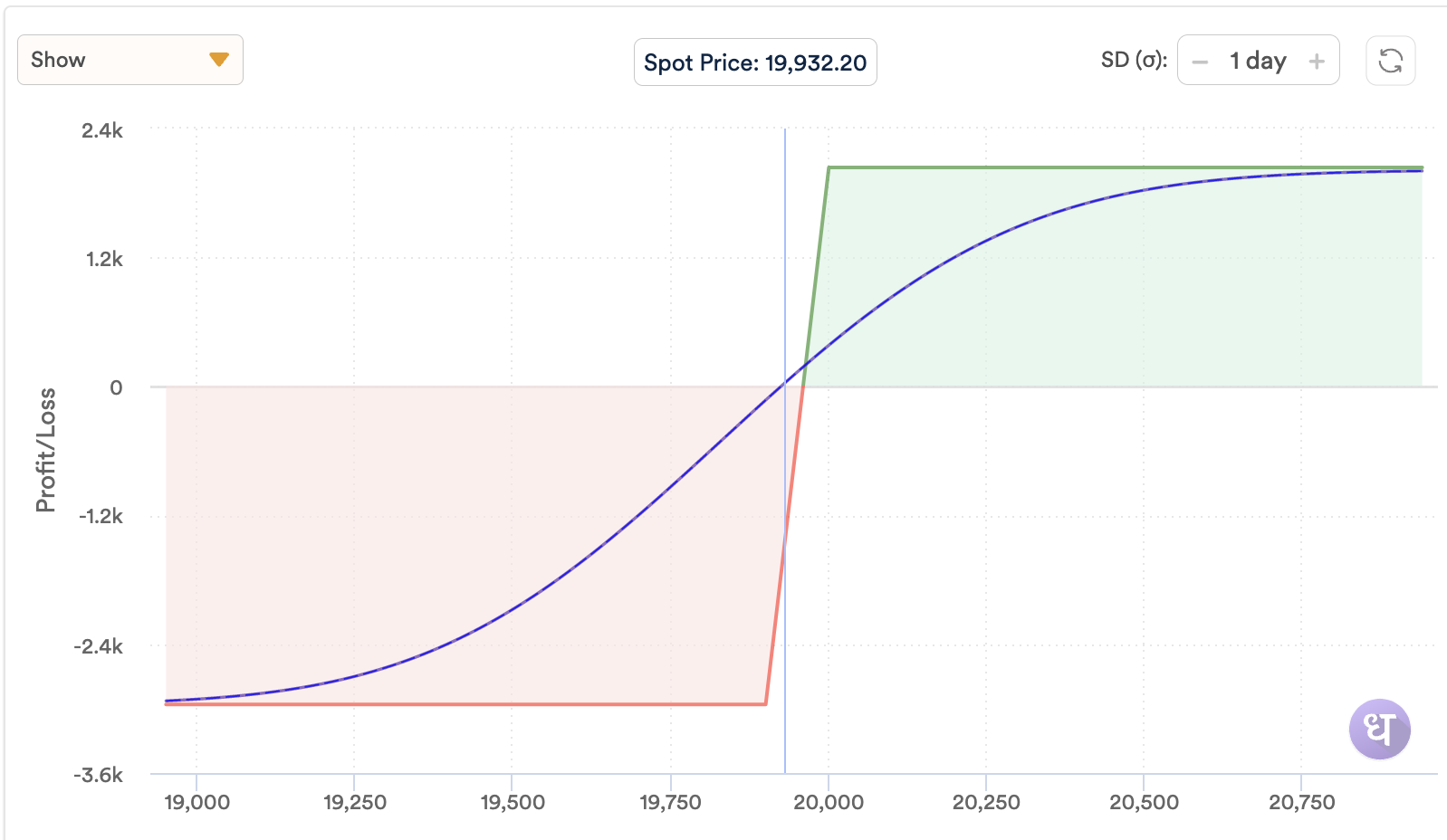

Here’s what the payoff looks like for a long strangle with a strike price of 20,100 & 19,900 for call & put options as of 12th September 2023:

Short Strangle

In a short strangle, a trader sells both, a call option and a put option on the same underlying at different strike prices, but the same expiry. Its maximum profit is equal to the total premium. The payoffs are exactly opposite to those of a long strangle. The strangle buyer’s profit is equal to the strangle seller’s loss and vice versa.

Let’s consider a short strangle that involves selling a 250 lot size call option at a strike of 2,000 and a put option at a strike price of 1,900 that costs Rs 20 each. Let’s see what happens in each of the 3 scenarios:

| Short Strangle with call strike 2,000 & put strike 1,900 with call & put premium of 20 each (lot size 250) | ||||

| Underlying Price | Value of Call Option | Value of Put Option | Profit/Loss on 1 unit net of premium | Total Net Profit/Loss |

| 2,200 | -200 | 0 | -160 | -40,000 |

| 1,940 | 0 | 0 | +40 | +10,000 |

| 1,800 | 0 | -100 | -60 | -15,000 |

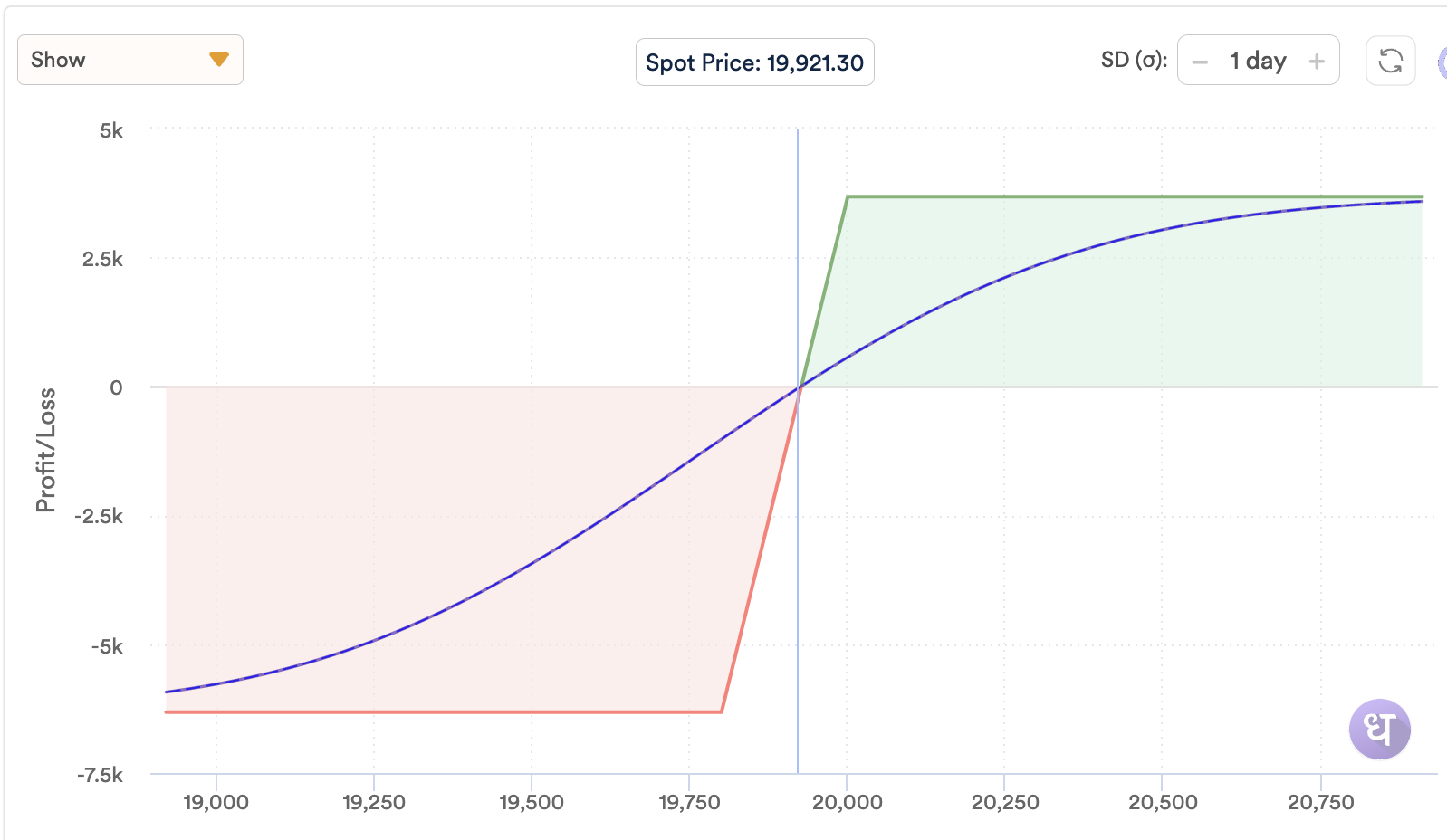

Here’s what the payoff looks like for a short strangle with a strike price of 20,100 & 19,900 for call & put options as of 12th September 2023:

Strangle payoffs for our original example depending on direction:

| Type of Strangle / Underlying Price at Expiry | 2,200 | 1,940 | 1,800 |

| Long Strangle | +40,000 | -10,000 | +15,000 |

| Short Strangle | -4,000 | +10,000 | -15,000 |

Iron Condor

An iron condor strategy is a strategy that involves buying multiple call and put options at 4 different strike prices. It involves buying a call at a higher strike price and a put at a lower strike price along with a short strangle. This is a less riskier way to implement a short strangle, or a way of hedging it. The positions of an iron condor may look like this:

Buying a 20,100 call option @109.55

Selling a 20,000 call option @157.00

Selling a 19,900 put option @136.10

Buying a 19,800 put option @102.50

The net premium of this position is receiving Rs 81.05 (157.00 + 136.10 – 102.50 – 109.55). If the underlying price closes within the range of 19,900-20,000, a maximum loss of Rs 947.50 would be incurred. But a price movement outside the range would yield a maximum profit of Rs 4,052.50. Let’s look at the payoff:

| Iron Condor – sell call @20,000 + sell put @19,900 + buy call @20,100 + buy put @19,800 | ||

| Maximum Profit | Maximum Loss | Breakeven Price |

| 4,052.50 | 947.50 | 19,818.95 & 20,081.05 |

A key difference between an iron butterfly and an iron condor is that an iron butterfly is executed when the expectation of market volatility is close to 0, and an iron condor is preferred when volatility is expected to be within a range.

Bull Call Spread

A bull call spread can be applied when we expect markets to appreciate and trade within a range above the current price. It is implemented by buying an at-the-money call option and selling an out-of-the-money call option.

Assume we buy a 19,900 call option for Rs 216.25 and sell a 20,000 call option for Rs 157.00. Let’s look at the payoff:

| Bull Call Spread – Buy call @19,900 + sell call @20,000 | ||

| Maximum Profit | Maximum Loss | Breakeven Price |

| 2,037.50 | 2,962.50 | 19,959.25 |

In short, a bull call spread is like buying a call, but with limited profit potential, in exchange for a decrease in net premium to be paid.

Bear Put Spread

A bear put spread can be applied when we expect markets to depreciate and trade within a range below the current price. It is implemented by buying an at-the-money put option and selling an out-of-the-money put option.

Assume we buy a 20,000 put option for Rs 176.10 and sell a 19,900 put option for Rs 136.10. Let’s look at the payoff:

| Bear Put Spread – Buy put @20,000 + sell put @19,900 | ||

| Maximum Profit | Maximum Loss | Breakeven Price |

| 3,000.00 | 2,000.00 | 19,960.00 |

In short, a bear put spread is like buying a put, but with limited downside protection, in exchange for a decrease in net premium to be paid.

Bear Call Spread

Bull call spreads and bear put spreads were option-buying strategies. We will now look at option writing strategies for implementing similar views.

For an option writer, the risk of overnight information disrupting stock prices is an essential risk to consider. Here, gap ups and gap downs caused due to such activity can trigger huge losses, especially for call writers. Bear call spreads and bull put spreads can help mitigate this risk.

A bear call spread strategy is pursued when one expects the underlying share price to depreciate by a limited amount. It is implemented by selling a call option and buying another call option with a higher strike price.

Assume we sell a 19,800 call option at Rs 282.35 and buy a 20,100 call option at Rs 109.55, the payoff would look something like this:

| Bear Call Spread – Sell call @19800 + buy call @20100 | ||

| Maximum Profit | Maximum Loss | Breakeven Price |

| 8,640.00 | 6,360.00 | 19,972.80 |

Hence, a bear call spread is a bearish strategy where the amount of profits and losses are known with certainty.

Bull Put Spread

A bull put spread strategy is pursued when one expects the underlying share price to appreciate by a limited amount. It is implemented by selling a put option and buying another put option with a lower strike price.

Assume we sell a 20,000 put option at Rs 176.10 and buy a 19,800 put option at Rs 102.50, the payoff would look something like this:

| Bull Put Spread – Sell put @20000 + Buy put @19800 | ||

| Maximum Profit | Maximum Loss | Breakeven Price |

| 3,680.00 | 6,320.00 | 19,926.40 |

Hence, a bull put spread is a bullish strategy where the amount of profits and losses are known with certainty.

Conclusion

We learned what options are – both calls & puts, when to buy and write them, and how the price of an option is determined.

We also learned about Greeks, how option prices fluctuate in different market environments, and several strategies to capitalize on, depending on our views.

Get the comprehensive course on options trading for beginners in Hindi here.