In the last few months, green energy sector stocks have given tremendous returns to their investors, out of which 1 stock has given more than 300% returns in the last 3 to 4 months. However, there was a time when the stock was trading at a price of Rs 400 and crashed down to Rs 2. Now, though, the stock is doing well and has climbed back to Rs 24 again, with building momentum. We’re sure you would have guessed the stock – Suzlon Energy Ltd.

The question is – Will the stock be able to recover to its original levels, or will prove to be a wealth destroyer?

Let’s start by understanding the company’s history.

History of Suzlon Energy Ltd.

Suzlon was founded by Mr.Tulsi Tanti, in 1995. He was a mechanical engineer who run a textiles business in Surat, Gujrat. However the business was not very profitable because of high operating costs, expensive electricity, and frequent power cuts. So Mr.Tanti went out to find a solution to this problem.

In 1994 Mr. Tanti had bought 2 wind turbines and gradually he found out that not only his business but several other businesses facing similar issues. This presented him an opportunity to start the journey of Suzlon Energy in 1995 with the aim to provide wind energy services to everyone.

The next 10 years were very good for Suzlon Energy and eventually on 23 September 2005, the company decided to launch its IPO. Suzlon started with manufacturing wind turbines and gradually inculcated the maintenance and operational services of wind turbines as well. This improved the efficiency of the turbines as well. Everything went right with the company, but a problem emerged after 3 years of the company going public.

Learn how to invest in green energy stocks by Mr. Arvind Kothari, founder and director of Niveshaay, practicing equity research and investment advisory for the last 12 years with our course – How to Invest in Green Energy Stocks.

A costly mistake

From 2003 to 2008, the company started expanding its business to global levels and made multiple acquisitions in Europe, the USA & Australia. In 2006 the company made 2 big acquisitions:

- Belgium company Hansen Transmission for which they paid Rs 2,643 crores

- In 2007, German company Senvion for which Suzlon paid Rs 7,899 crores

For both of these acquisitions, Suzlon financed the acquisition via debt. But then came the Lehman brothers crisis in 2008. Consequently in 2009, India saw a huge decline in the installation of wind turbines. Naturally, these setbacks affected the companies’ revenues and even their debt increased from 10,000 crores to 15,000 crores.

Till 2014 company faced heavy losses, their existing customers either postponed the project or canceled it. The reason behind this was the high setup cost of installing the wind energy turbine and the high maintenance cost.

Looking inward and a destiny-changing policy

The company started growing by raising funds, around Rs 1800 crores; and it even sold its stake in the German company Senvion. It also divested some of its non-core assets to pay up its debt and free up some cash for operations.

Over the years Suzlon sold their foreign business and started focussing on domestic businesses. They also manufactured new wind turbines that could produce higher energy on low wind sights at a lower cost.

Then came an event that changed their life. Earlier the Government used to fix the rates that they used to charge from the distribution company. This time, they came up with a new system, known as the e-reverse bidding system. In this bidding system, all the distribution companies bid their rates to the government and the lowest bidder won the contract.

The bidders, however, couldn’t execute it because of high costs. This led to a sharp decline in wind installations from 5.5GW in 2017 to 1.1GW in 2020 because no player in this industry was able to operate on these bids. Suzlon Energy Ltd. continued reporting losses from 2018 to 2022 due to a slowdown in the wind energy market.

Turnaround

Now let’s try to figure out why the company’s share prices are rising.

This is mainly because the whole world is turning towards renewable energy. People don’t mind paying a premium as long as they can see long-term benefits.

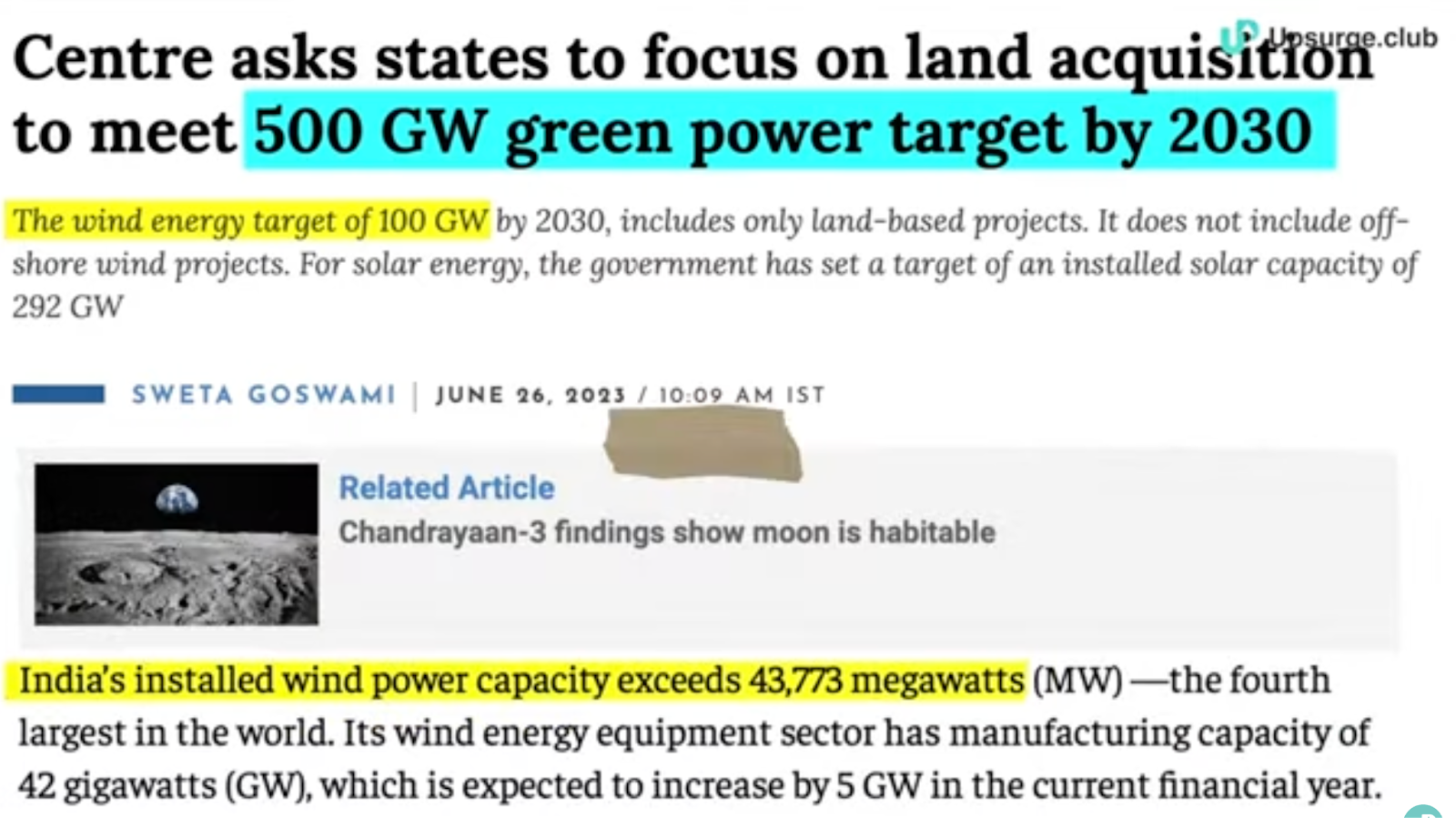

The combination of wind and solar is found to be a cheaper source of energy, when compared with conventional sources. Currently, India is also focusing on generating 500GW of renewable energy by 2030 out of which 100 GW will come from wind energy, which currently produces only 43 GW. It is intuitive that Suzlon being the market leader with 33% market share will definitely benefit from this policy.

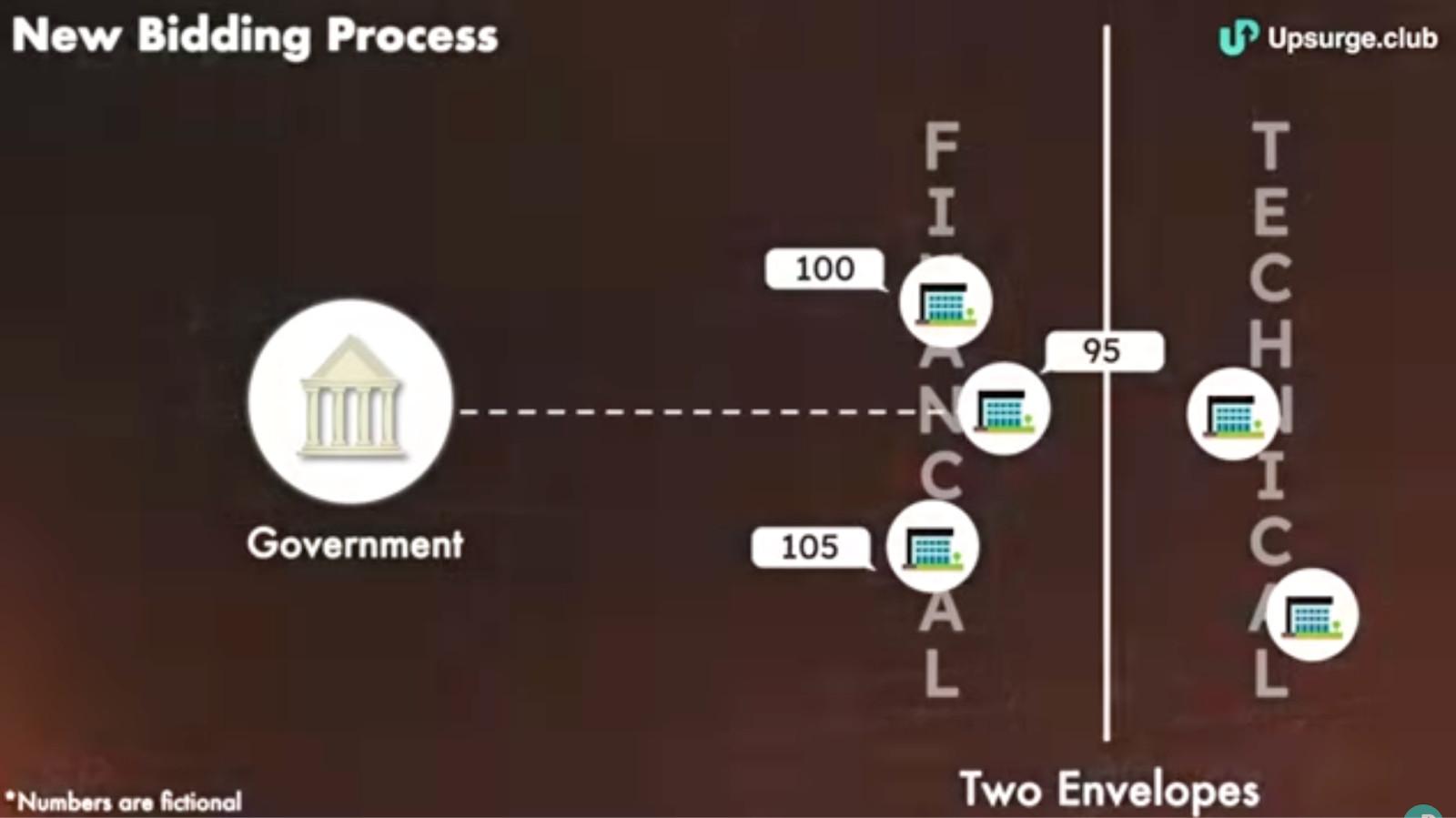

Another interesting development is that the government changed the bidding process again. Under the new bidding process, a company has to submit 2 envelopes – one on the basis of technicals and the other on the basis of financials. After submitting the technicals the bidders who will qualify will enter into a second, where the lowest bidder will be awarded the contract.

A Change in Suzlon’s Approach

The company also changed a few things, that can be considered good steps. Because of the company’s debt restructuring practice, their debts are very low. Suzlon also raised 2000 crores, out of which 1500 cores will be used for debt repayment and the balance will be used for capital expansion. This would make the company net debt free.

The company’s order book stands strong because the company is manufacturing a new series of wind turbines that can be used in low-windy areas. Their recurring business of operating and maintaining wind turbines is also showing promising results. This part of the business contributes ~30% of the total business revenues. Note that services business margins are relatively steady over the long term.

Growth Reflected in Financials

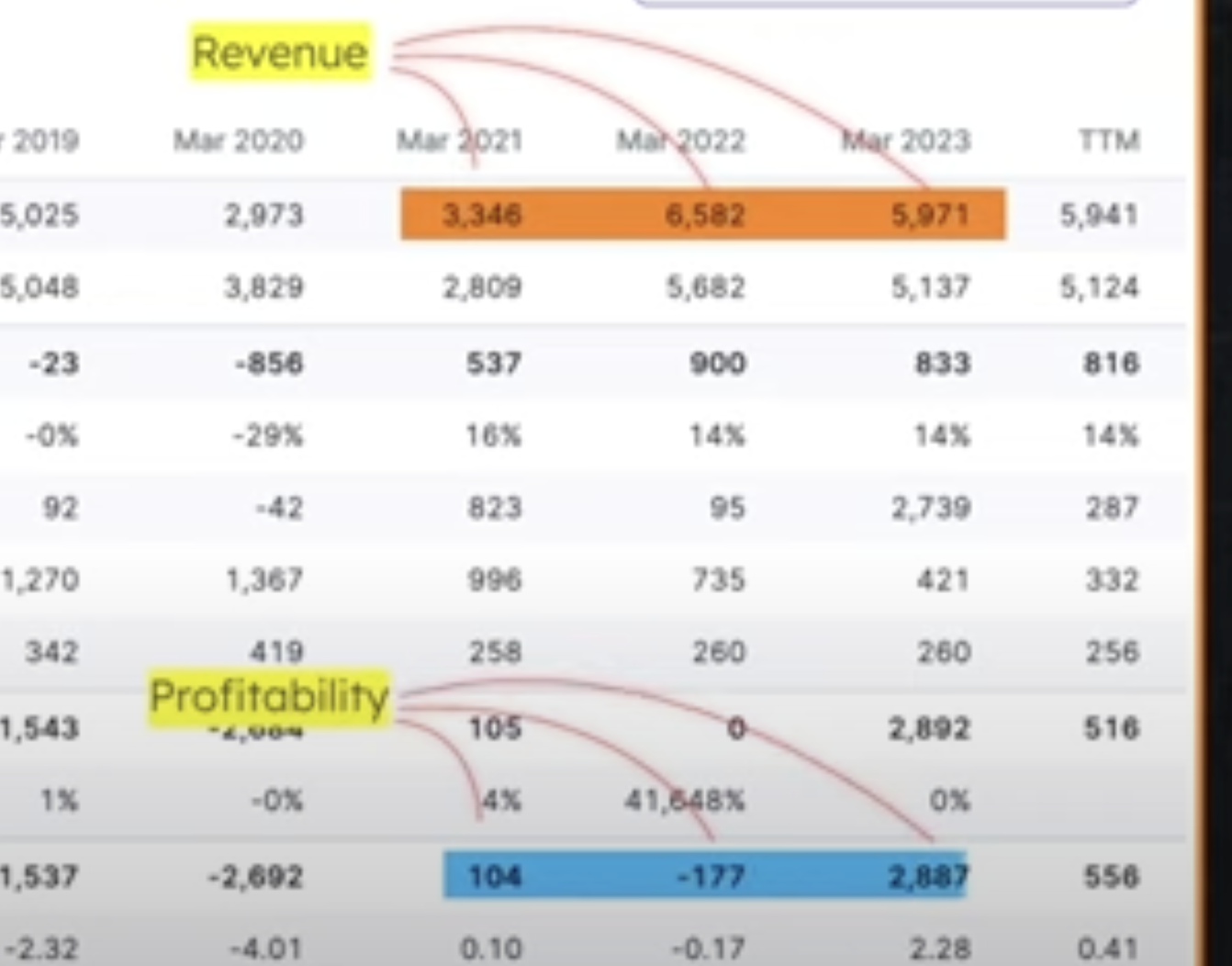

And all these factors are also reflected in the company’s financials. Suzlon’s revenues have started growing again from 3,346 crores in 2021 to 5,971 crores in 2023. Likewise, the company has started showing signs of profitability and hopefully, the trend will continue.

The most important ratio is the company’s debt to EBITDA ratios which basically talk about how much debt the company has vs. how much profit it is making at the operational level. Ideally this ratio should not increase more that 3x or 4x. Currently, Suzlon’s debt to EBITDA ratio is 1.4x, which is very decent for a manufacturing company. Suzlon’s net interest coverage ratio is also increasing from 0.5x to 2.1x, reflecting that it can easily pay back debt.

Shareholding analysis & promoter pledging

Analyzing the company shareholding pattern is also an important component. As you can see the company’s promoter holding has decreased from 17.46% to 13.28%. Since a lot of debt has been converted into equity the promoter holding has decreased. Generally, it is considered that the greater the promoter share the better the company as its promoters will be more inclined to grow the company. But here we see that the promoter share is low, so that could be an issue as well. As promoters have also pledged 80% of their shares to raise funds for the company, this can be seen as a warning sign.

Would you consider investing in Suzlon Energy Ltd. at these levels?