In the past 1 year, Indian railway stocks like RVNL, Ircon International, IRFC, Railtel Corporation, Rites, etc. have given stellar returns to their investors. In some cases, returns have been more than 100%!

But recently, one can see a sharp correction in the prices of these stocks…

Why is this happening? And will they bounce back? Let’s find out.

Learn stock market valuations and a simple yet powerful investment strategy to outperform the markets from Mr. Kunal Shah, CFA in our Complete Course on Stock Market Valuation and Investing.

The Indian PSU Hurdle

Public sector companies, i.e. companies with government ownership in India have been looked down upon for years due to their poor management. But since the past couple of years, PSUs have started giving industry-beating returns to their investors, which reflects the underlying changes taking place in the Indian economy.

Our focus in this article will be the transport infrastructure space, especially the railway sector.

Indian Railways – A Transformation

Prime Minister Mr. Narendra Modi presented a vision to make India a developed country by 2047. He names the coming 25 years as ‘Amrit Kaal’, to describe the upcoming period of laying a strong foundation and making great progress. To achieve this goal, and to make India a $5 trillion economy by 2025, the government is boosting infrastructure spending (transport, power, electricity, etc.), which acts as a catalyst for the development of an economy.

The railways are an important component of the transport infrastructure system. An efficient railway network increases speed and reduces logistics costs. India’s existing railway infrastructure is quite inefficient and does not keep up with the speed of our growing economy. To combat this, the railway ministry is planning to build a dedicated freight corridor, which is nothing but a particular track for cargo trains. According to the Gati Shakti Multimodal Policy, the ministry plans to build 100 cargo terminals by 2025, out of which 48 have already been commissioned.

Our finance minister Nirmala Sitharaman allocated a capital of Rs. 2.40 lakh crores for Indian railways in the FY24 budget, which is the highest outlay to date and 9x that of the amount allocated in the FY14 budget.

India also plans to have 400 Vande Bharat Trains by 2025, for which manufacturing capacity is being set up. The Vande Bharat Express is India’s first semi-high-speed train with world-class amenities. 34 such trains are already operational. Under the Amrit Bharat scheme, 1300 stations are going to be redeveloped and modernized.

Why did we choose to study IRFC?

We have seen that the Indian railway sector is undergoing significant positive changes in the long term, and government funding support is also in place. If the railway sector performs well, railway stocks are bound to perform.

However, among all the railway stocks, we are most interested in IRFC – a monopoly business directly benefiting from the government’s railway infrastructure plans. Whether it’s capital spending on bullet trains, catering services, tracks, or any other railway-related activities, IRFC will definitely benefit.

History and Role of IRFC

Before the 1980s, Indian Railways relied solely on its revenue and government budget allocation. However, these funds were insufficient for the expansion and operation of the railways. When they needed additional funds, they had to approach the Ministry of Finance. However, because the Ministry of Finance had other responsibilities and couldn’t dedicate as much attention to the railways, the Indian Railways Finance Corporation was established on December 12, 1986.

Its purpose was to source funds from both domestic and overseas markets to meet the financial needs of Indian Railways. The main objective of IRFC is to raise funds for Indian Railways projects and provide them with financial support. IRFC can be referred to as the investment banker for the railways.

Mainly, IRFC does the following:

- Acquiring funds for rolling stock assets and project assets, which include locomotives, coaches, containers, maintenance equipment, etc.

- Funding the leasing of railway infrastructure assets, essentially supporting investments related to railway infrastructure.

- Last but not least, providing funds to other companies under the Ministry of Railways, such as IRCON and RVNL.

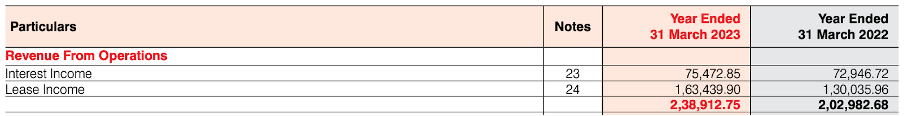

One can see that in FY23, 68.4% of IRFC’s revenue came from lease operations:

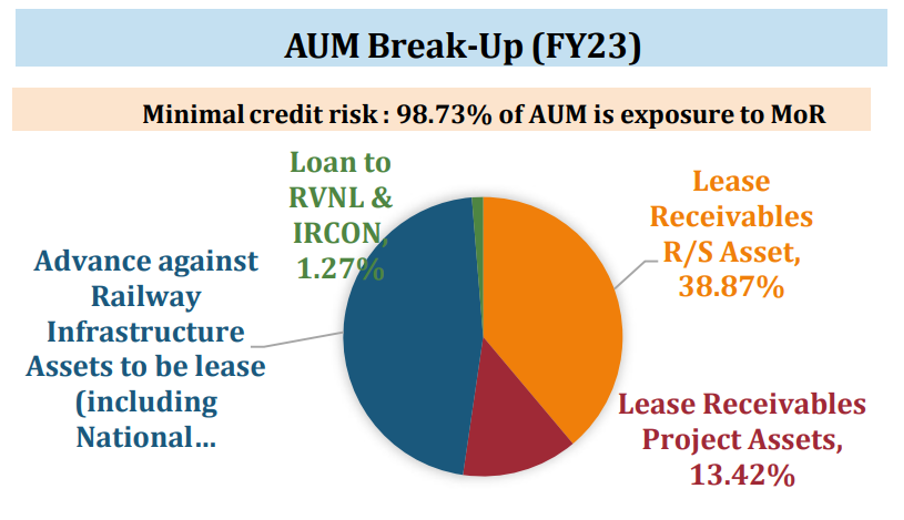

Out of the Rs. 4.67 lakh crores worth of AUM of IRFC, 98.73% goes to the railway ministry.

IRFC’s Business Model

IRFC does not directly provide the assets it acquires or raises money for to the Indian Railways. In fact, there is a very interesting and important agreement with the Ministry of Railways that needs to be understood. Every year, IRFC collaborates with the Ministry of Railways to create a Standard Lease Agreement in which IRFC agrees to lease out its rolling stock and project assets to the Indian Railways through a financial lease.

A financial lease is somewhat different from an operational lease. Let’s understand this with an example. Suppose you need to set up a factory for your business, but you don’t have the funds to purchase it. Now, you have two options: either you can rent the factory, which means you can only use it, but you won’t own it, even if you use it for many years. This is known as an operational lease. The other option is that you use the factory for a few years, pay rent, and at the end of a fixed term, say 15 years, you can purchase the factory for a nominal amount. This option is called a financial lease, and it’s what IRFC employs.

IRFC purchases rolling stock assets and leases them to Indian Railways for a period of 15-30 years, during which they recover their principal amount, borrowing costs, and interest margins. After the agreed term, these assets become the permanent property of Indian Railways.

Spreads earned by IRFC

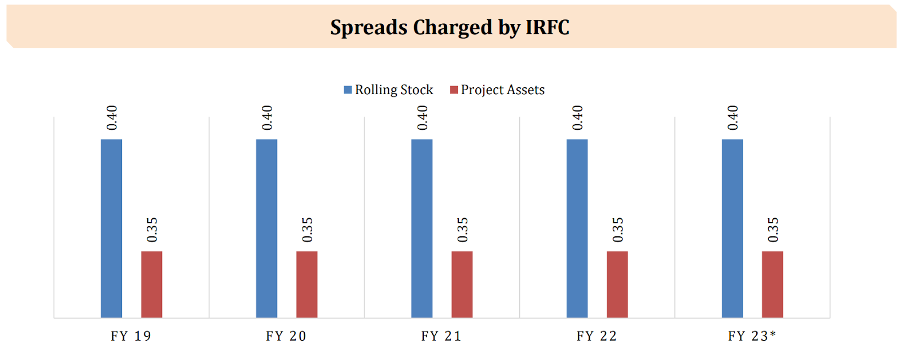

When IRFC provides funds to Indian Railways or leases assets to them, it adds additional margins on top of its cost of borrowing. The cost of borrowing and margins are discussed and fixed annually in the Standard Lease Agreement between the Ministry of Railways and IRFC. So, you can guess that this is a significant advantage for IRFC. Even if the cost of funds raised from the market increases in a given year, it won’t be a significant problem for IRFC because it will pass on the final cost to Indian Railways after adding its markup. These spreads have remained quite stable in recent years – 0.4% for rolling stock and 0.35% for project assets.

These margins may seem quite small, but IRFC has generated good and increasing revenues and profits on a very large Asset Under Management (AUM). In FY23, the company earned revenue of Rs. 23,892 crores and a profit after tax (PAT) of Rs. 6,337 crores. Over the past 5 years, its revenues have grown at a Compound Annual Growth Rate (CAGR) of 21%, and the PAT has increased at a CAGR of 25%.

IRFC’s Sources of Borrowings

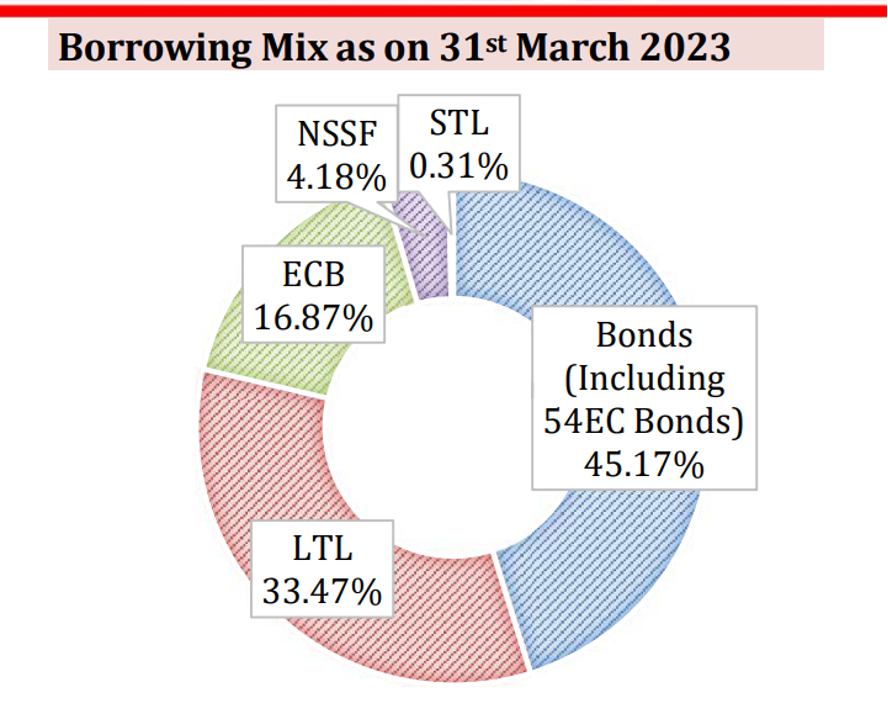

In order to fulfill the requirements of the Ministry of Railways (MoR) and finance lease assets, IRFC raises funds from diversified sources in the form of bonds, long-term loans, short-term loans, national small savings funds, and foreign borrowings. The bonds issued by IRFC have received the highest possible ratings from ICRA, CRISIL, and CARE, which helps in reducing borrowing costs.

The long maturity of these borrowing instruments closely matches their financed long-term assets. This duration-matching principle is called asset liability management, and it is very important for the liquidity and stability of any non-banking financial company (NBFC). Furthermore, according to the Standard Lease Agreement, any funding shortfall should be provided to the Ministry of Railways.

Govt. Shareholding and Strategic Importance

IRFC is a Miniratna and Schedule ‘A’ Public Sector Enterprise, under the administrative control of the Ministry of Railways. This company has been granted the status of a systematically important NBFC. A systematically important NBFC is an NBFC whose asset size is more than 500 crore and whose operations are important for the financial stability of our economy. By now, you must have understood how important IRFC is for the growth of the Indian railways.

As a PSU, the majority shareholder of this company is the Indian government, holding an 81.81% stake as of September 27, 2023.

Important Financials of IRFC

IRFC manages an Asset Under Management (AUM) of Rs. 4.66,938 lakh crores, and this AUM has grown at a yearly rate of 25.05% from FY19 to FY23.

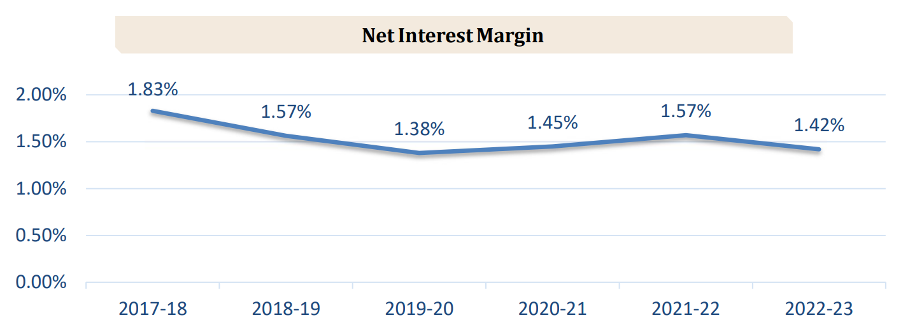

Because it operates on a cost-plus model, its net interest margins have remained stable over the years.

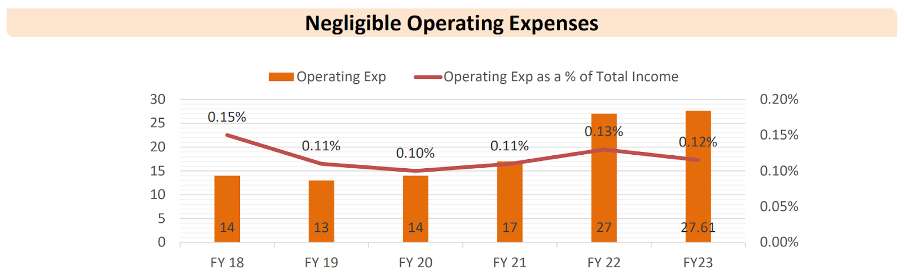

What is the Net Interest Margin?

The difference between earned interest and paid interest on earnings and borrowings is called the net interest margin. To calculate NIM, you divide the average earning assets by this difference.

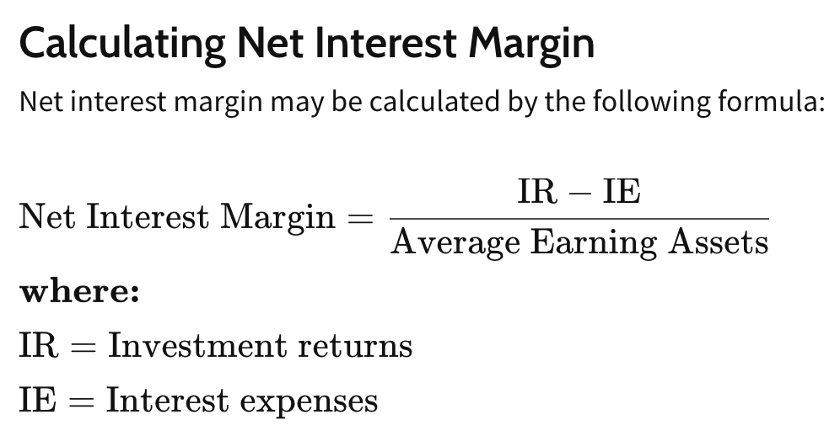

IRFC is an asset-light model whose job is to raise money and provide funding to the Indian Railways. For this purpose, it doesn’t require a large number of employees, and it also outsources some of its work, which is why its operating expenses remain quite low, not even 1% of its total income.

As a PSU (Public Sector Undertaking), IRFC also receives tax benefits. Due to these factors, IRFC’s return ratios, namely ROA (Return on Assets) and ROE (Return on Equity), have remained quite impressive and stable. It’s essential to understand one thing here. Typically, when analyzing the net interest margins, ROAs, and ROEs of banking or NBFC (Non-Banking Financial Company) stocks, they are scrutinized in detail. Changes in these metrics are used to anticipate changes in stock prices. However, in the case of IRFC, there isn’t much room for changes in these ratios because IRFC lends funds at a fixed mark-up, and there are fewer chances of fluctuations in its operating expenses.

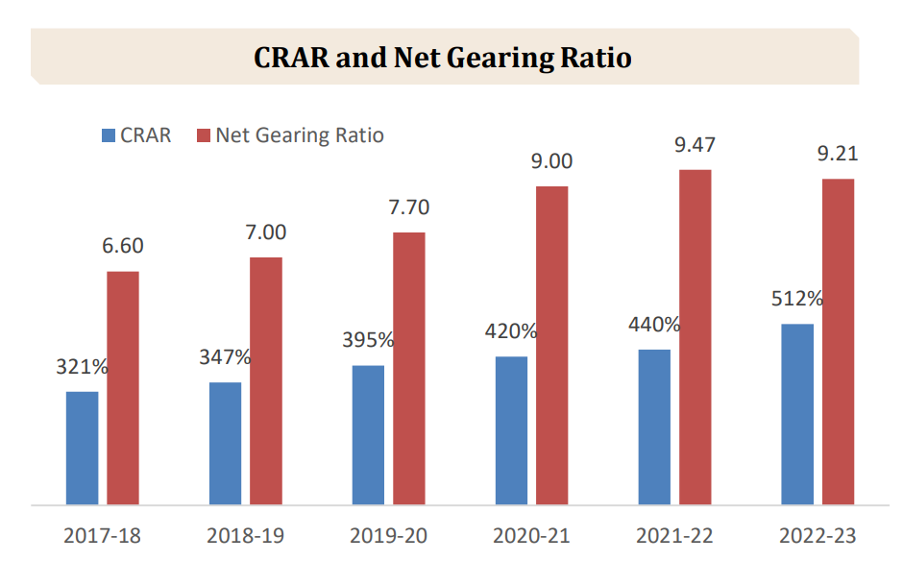

GNPA, NNPA, CRAR, and Net Gearing Ratios

Now, let’s talk about its GNPAs (Gross Non-Performing Assets) and NNPAs (Net Non-Performing Assets). When borrowers of a bank or NBFC fail to repay the money they borrowed, meaning they default on their loans, it is termed a “non-performing asset.” Since IRFC lends to the Ministry of Railways, which receives funding from the Union Budget, and the government rarely defaults on its loans, IRFC has reported zero NPAs from 1986 until now.

As for IRFC’s financial stability and risk, its capital adequacy ratio, also known as the capital-to-risk-weighted assets ratio, stands strong at 512%, and its net gearing ratio is also under control, as seen below:

Risks

So far, we have understood all the positive points of IRFC. But just as every train journey cannot be perfect, similarly, not every stock can be perfect.

Similarly, IRFC is not a perfect company, and it faces 4 major risks:

First, elections and government budget. Businesses like IRFC are highly dependent on government funding, especially because their major client is the Ministry of Railways. If a newly elected government does not prioritize infrastructure spending, there is a chance of disruptions in railway infrastructure funding, which can negatively impact IRFC.

Second, share price volatility. IRFC’s public float is less than 15%, which is quite low. Whenever a company has a low number of shares in circulation, its volatility tends to be high. Such shares can trade over a wide range due to news and other market-influencing factors.

Third, IRFC’s management has mentioned in their conference calls that they are interested in financing private players in the long term to diversify their revenue. Currently, IRFC is a business with zero non-performing assets (NPAs), but if they start lending to private players, their NPAs could suffer.

Finally, most public sector companies have some inefficiencies, especially in India. Being a government company, IRFC is required to pay approximately 30% of its profits as dividends, which can restrict its growth. Additionally, there was a major issue raised concerning IRFC’s management when the CBI accused its former chairman and managing director, Amitabh Banerjee, of corruption and misuse of position.

Recent IRFC News – Offer for Sale

Before discussing IRFC’s valuation, it is essential to address recent news that has come to light. Government of India used to hold an 86.36% stake in IRFC. Recently, there was news that the government intends to dilute its stake by 4.55% through an offer for sale. An offer for sale is when the promoter sells its shares through the exchange, reducing its ownership stake in the company. Typically, a promoter’s stake dilution is viewed negatively, and as a result, IRFC’s shares dropped by approximately 9% after this announcement.

As a prudent investor, it’s necessary to understand the real reason behind this dilution before drawing any conclusions. In reality, this dilution is a normal step because, according to SEBI rules, any company needs to maintain a minimum 25% public float within the first five years of its IPO. After the 4.55% dilution, IRFC’s government stake will be reduced to 81.81%. It is easy to speculate that in the coming years, the government may further dilute its stake in IRFC.

IRFC Valuations – Buy or Sell at these levels?

Now that we have understood the pros and cons of this company, let’s take a look at its valuation.

With a lifetime high of Rs. 92.35, IRFC has recently crossed a market capitalization of Rs. 1 lakh crores, making it the most valued railway stock and the 10th most valuable PSU.

If you had bought IRFC shares a year ago, you would have made a return of 254% by now, despite the recent correction. If you had purchased them a month ago, you would have still gained 55%. But is this stock overvalued even after the correction?

To evaluate any banking or NBFC stock, we look at how well they are generating interest from their assets or funds and how they are controlling their NPAs (Non-Performing Assets).

What is price-to-book value?

Price-to-book value is a metric that helps us check this. This metric tells us how much we are paying for the company’s book value per share. To find the price-to-book value of any company, you can divide its price by its book value per share. In the past year, IRFC’s price-to-book value has gone from 0.64 to 2.1, despite having a steady book value, indicating that its valuation has increased significantly.

If we compare IRFC’s price-to-book valuation of 2.1 with other public sector financing companies like Power Finance and REC, which have multiples of 0.9 and 1.2, IRFC appears to be quite overvalued. You can see that currently, other railway stocks also seem more expensive compared to their historical valuations.

| Stock Name | Current Price to Earnings Ratio | 3Y Historical Price to Earnings Ratio |

| Titagarh Rail Systems | 58.0 | 28.4 |

| RVNL | 24.0 | 6.8 |

| Ircon International | 16.6 | 9.2 |

| Rites Ltd. | 23.2 | 14.2 |

| Container Corp. of India | 39.3 | 39.9 |

Learn to determine a company’s true market valuation by Mr. Kunal Shah, CFA in our Financial Modelling and Business Valuation course.

Conclusion

By now, you should have a good understanding of IRFC’s business, future prospects, risks, and valuation. However, making an investment in any stock or not is not a one-time decision. Especially for long-term investing, it is necessary to continuously track changes in the business and its industry. In the case of IRFC, make sure you are keeping an eye on developments in the Ministry of Railways, government policy changes, and the company’s NPAs because these factors can have a significant impact on IRFC’s stock price.

In this article, we have discussed the future prospects of the Indian railway sector and discussed the pros, cons, and valuations of IRFC.

Would invest in IRFC at these levels?