In this beginner-friendly guide, Mr. Kunal Shah – founder of upsurge.club will explain the basics of stock market investing – its operations, terminology, and concepts. We will also bust some myths around the stock market and explore stock market analysis platforms that can help in efficient stock screening.

Preview – What to Expect

Before we dive in, let’s take a peek into what we will be covering…

- Understanding the power of compounding & how to use it to your advantage

- Busting myths around the stock market

- Understanding important stock market concepts and terminologies

- How to invest in the stock market

- How to analyze a company

- How to use Screener.in for generating stock ideas & analyzing them

Learn from the instructor himself, get the comprehensive course here.

Why the stock market?

Introduction

Before we jump into the basics of stock market investing, let us first understand the importance of investing.

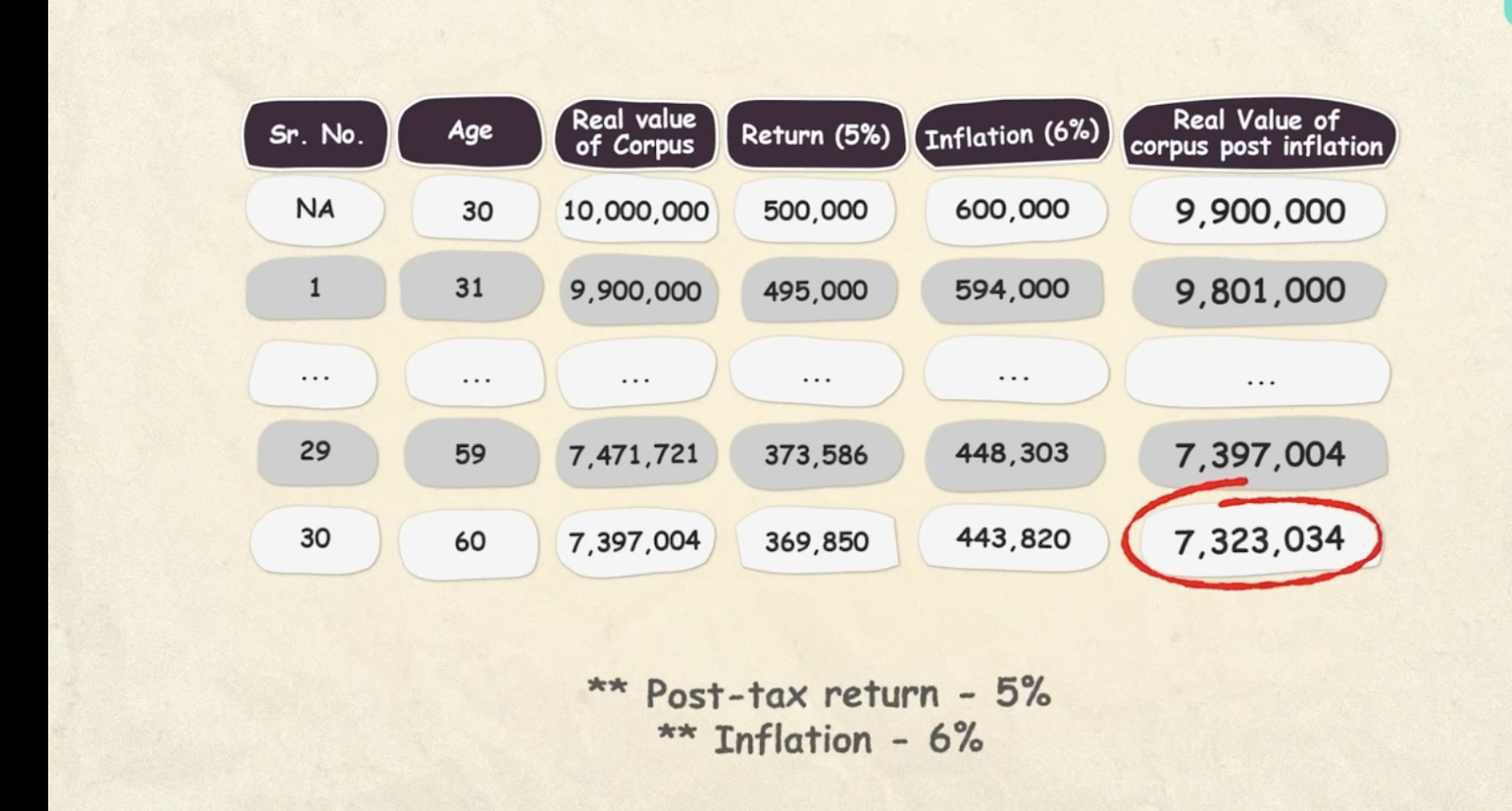

Say, for example, you are 30 years old and you have INR 1 Cr in your bank account. This seems like a lot, right? But let me tell you that this 1 Cr won’t be worth the same 30 years down the line.

This is due to inflation.

What is inflation?

Inflation means the value of money is decreasing over time. Say you have INR 100 today and the inflation rate is 6%, then next year this money will be able to purchase goods worth only INR 94. This INR 94 is the real value of money.

Now, let’s understand what will happen to your INR 1 Cr if the return on your savings account is 5% and the inflation rate is 6%

The same INR 1 Cr today will be worth approximately INR 70 lacs after 30 years.

This is a reason why you need to invest in asset classes that can beat inflation. In the last few decades, equity has annually returned 12-15%, and it is expected to provide even higher returns in the future.

Why invest in Equity?

Let’s say you are positive about the growth of the steel sector. It might be difficult for you to take advantage of it by setting up a steel plant because it requires major capital investment. But you can still invest in the steel sector by purchasing the shares of steel companies. You can directly buy stocks from the stock market. The Stock market helps to connect buyers and sellers of stock. Buyers are the people who are bullish on the stock (they believe stock prices will go up) and sellers are bearish about the stock i.e. they believe that the stock price will fall.

What determines the price of the stock?

Demand and supply determine stock prices. If the demand for a stock is more than the supply, the price will increase and if the supply is more than the demand, the price will fall.

There are two exchanges in India namely, NSE and BSE where you can buy and sell stocks. You need two accounts – one is a trading account which helps you to trade in shares and the other is a demat account, where shares are stored. There are many organizations where you can open a trading account like Dhan, Groww, etc. but the demat account can be opened at only two places which are CDSL (Central Depository Service Limited) and NSDL (National Securities Depository Limited).

Power of Compounding

Let’s understand how compounding works –

I will give you two options:

Option 1: I will give you INR 0.01 on day 1 and double it for the next 29 days.

Option 2: I will give you INR 10,000 for the next 30 days.

Which one will you choose?

There’s a high probability that you will choose Option 2 because we think linearly. But the following result will astonish you:

| Day | Option 1 | Option 2 |

| 1 | 0.01 | 10,000 |

| 2 | 0.02 | 10,000 |

| ….. | …… | …… |

| ….. | ….. | ….. |

| 29 | 26,84,354.56 | 10,000.00 |

| 30 | 53,68,709.12 | 10,000.00 |

| Total | 10,737,418 | 3,00,000 |

At the end of 30 days, you will have INR 107 Cr in option 1 and INR 3 Lakhs in option 2. This is the power of compounding.

You can understand the power of compounding using the Future Value formula:

FV = PV(1+r)^n

Where FV = future value

PV = present value

N = no of years

R = rate of interest

Two basic rules followed by Warren Buffet:

He emphasized the importance of not losing money because of the time period it takes to recover the losses.

For example, if your portfolio is down by 50% then you need to generate a 100% return to regain the portfolio.

Also, it is important to generate consistent returns rather than generating higher returns in a particular period. We can understand this using a simple example:

This is the portfolio return of Shubh and Mridu. We might feel that Shubh would have generated better returns because he had higher returns as compared to Mridu but if you notice he also had higher losses. Hence, Mridu was able to generate higher returns by staying consistent. So staying consistent is much more important than having higher returns for one or two years. Here’s the math:

Bust Myths

Let’s bust some of the myths that are passed on to us by our Chachas and Mamas…

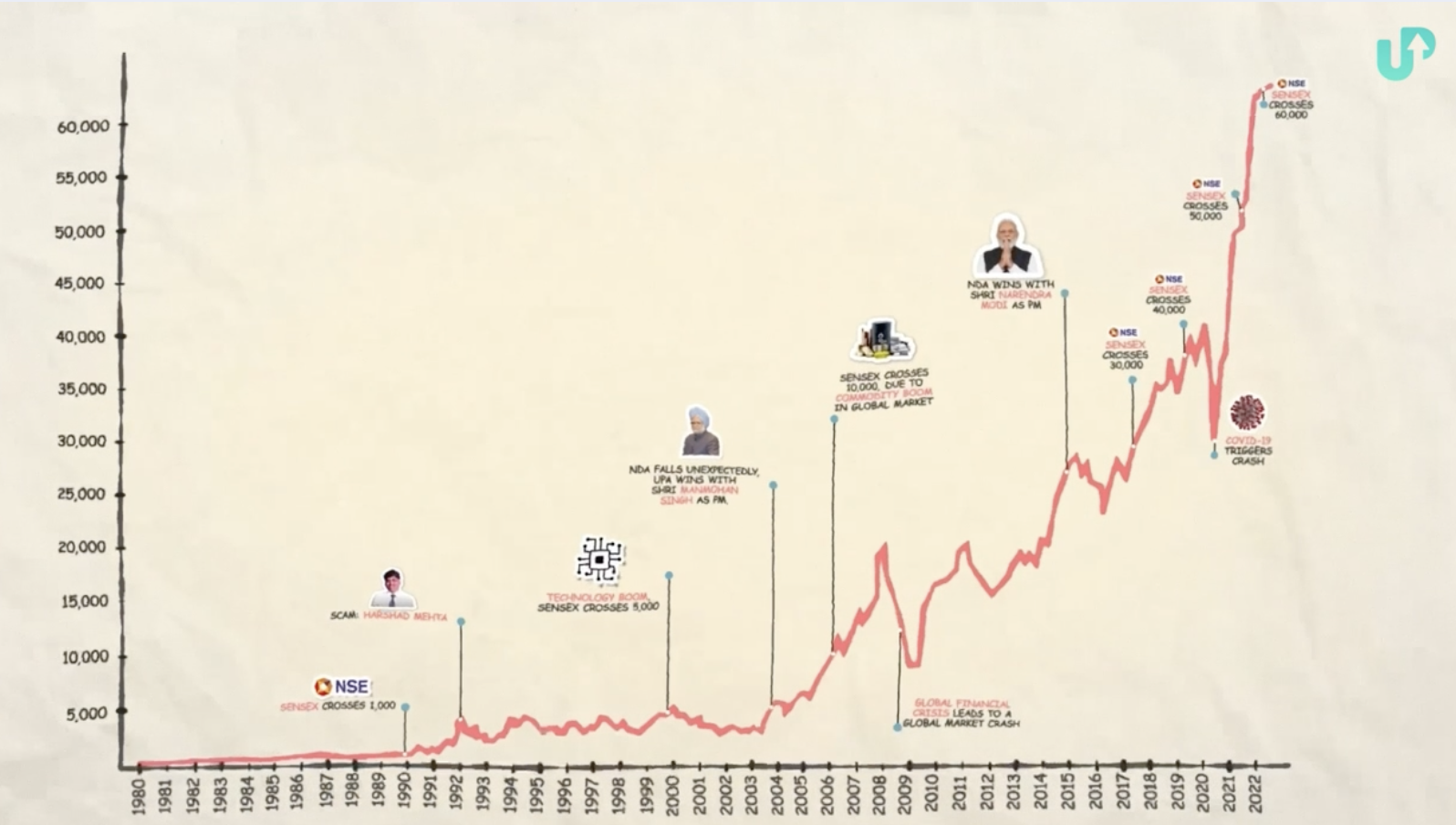

Myth 1 – People think the stock market is very risky

Very few people in India invest in stock markets as compared to other developed countries because they feel that the markets are risky. Let’s look at the Sensex returns chart over the years:

Sensex has increased from 1,000 points in 1990 to 60,000 points in 2022 which is a return of 60x in 32 years. There have been many hiccups like the 2008 global crisis and 2020 covid-19 but in the long run, Sensex has given good returns to its investors. So in the short run, the markets can be risky but they can fetch you good returns in the long run.

Myth 2 – You need a very strong knowledge base to do well in the markets

This is not true. In fact, people who use their common sense and are disciplined with their money make good money in the long run. On the other hand, people who are oversmart or try to overdo the market are the ones who lose money.

Let me tell you a short instance which is from the book “ Psychology of Money”.

It is a real story of two investors – Jesse Livermore and Grace Grooner. Jesse Livermore was a professional trader who had $100 Mn at the age of 30 but 4 years down the line he lost all his money as he incurred large losses in trade. So you see – Being wealthy and staying wealthy are two different things. Now let’s talk about Grace Grooner, she was an orphan and worked as a secretary all her life, leading a humble life. She made $7.2 Mn by investing a small amount of her savings in the stock market. From this example, we can understand that smart people do become wealthy but disciplined people stay wealthy.

So we recommend you invest 20% of your savings in markets and let the power of compounding work for you.

Myth 3 – Market participants often think that they can time the market

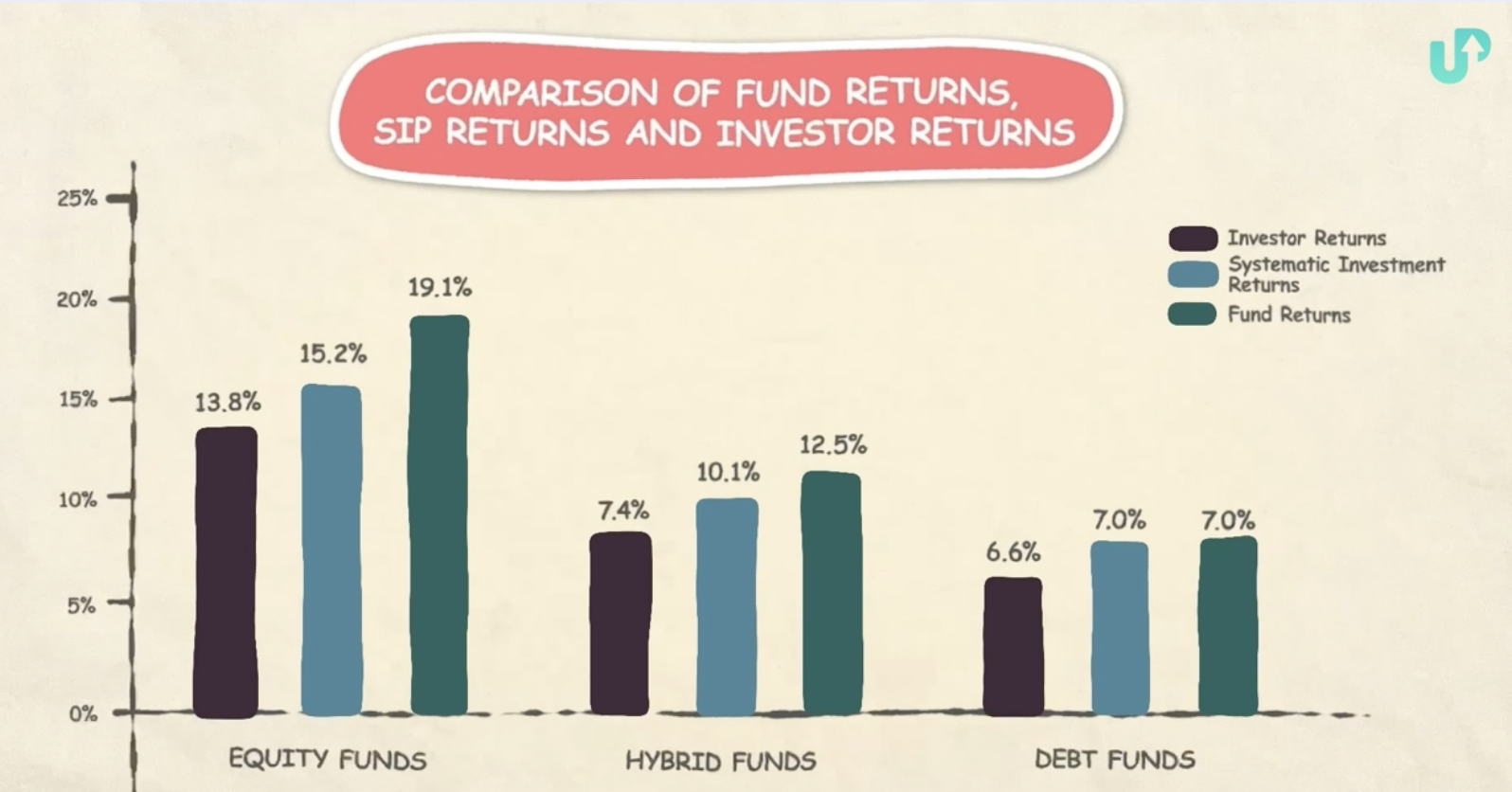

We can see that investor returns are lower than fund returns because investors try to time the markets. On the other hand, fund managers don’t get carried away with their emotions and remain invested for long periods of time.

Myth 4 – Market participants think they can catch the bottom of the markets

They feel that they can buy at the bottom of the market and sell at the highest price. This is not the case, in fact, if they could do that they would have doubled their money in 5-7 years. Well, you will be astonished to know that none of the portfolios have been able to achieve this.

Myth 5 – Markets are only for big institutional investors

Even small investors can invest in markets and generate decent returns by investing regularly and staying invested for a long period of time.

Delayed Gratification

Let me explain to you the importance of delayed gratification with the help of a story.

The story is between Radhakishan Damani (owner of Dmart) and Kishore Biyan (owner of Big Bazaar). When Radhakishan Damani was starting his business, he was sure that he didn’t want to leverage his business so he went slow. He started slowly, he acquired Apna Bazaar and took 4-5 years to start his own D’Mart outlet. And he owned the outlets rather than renting them. He reinvested his profits to buy more land for his outlets. That’s how he grew his business. On the other hand, Kishore Biyani took leverage in order to grow his business. So, the Future group was obliged to do well to repay the interest and debt. They weren’t able to fulfill the debt obligations and eventually, they had to file for bankruptcy.

You can see how delayed gratification plays a very important role in being successful over a long period of time.

Important Concepts of the Stock Market

What is market capitalization?

Market cap or market capitalization refers to the total value of all a company’s shares. It is calculated by multiplying the price of a stock by its total number of outstanding shares. The higher the market cap, the better it is. Let’s understand this with the help of an example:

Say, the current stock price of Reliance Industries is INR 2,437 and the number of shares outstanding is approximately 6,76,61,09,014. The total market cap of the company is 16,48,781 crores.

The shareholders of the company include promoters, FIIs, DIIs, and the public. Later, we will learn about the shareholder in detail. If we remove the shares held by the promoters and multiply the remaining shares by the price of the share we get the value of Free Float market cap. We use the Free Float Market cap to form an index.

How are indices formed?

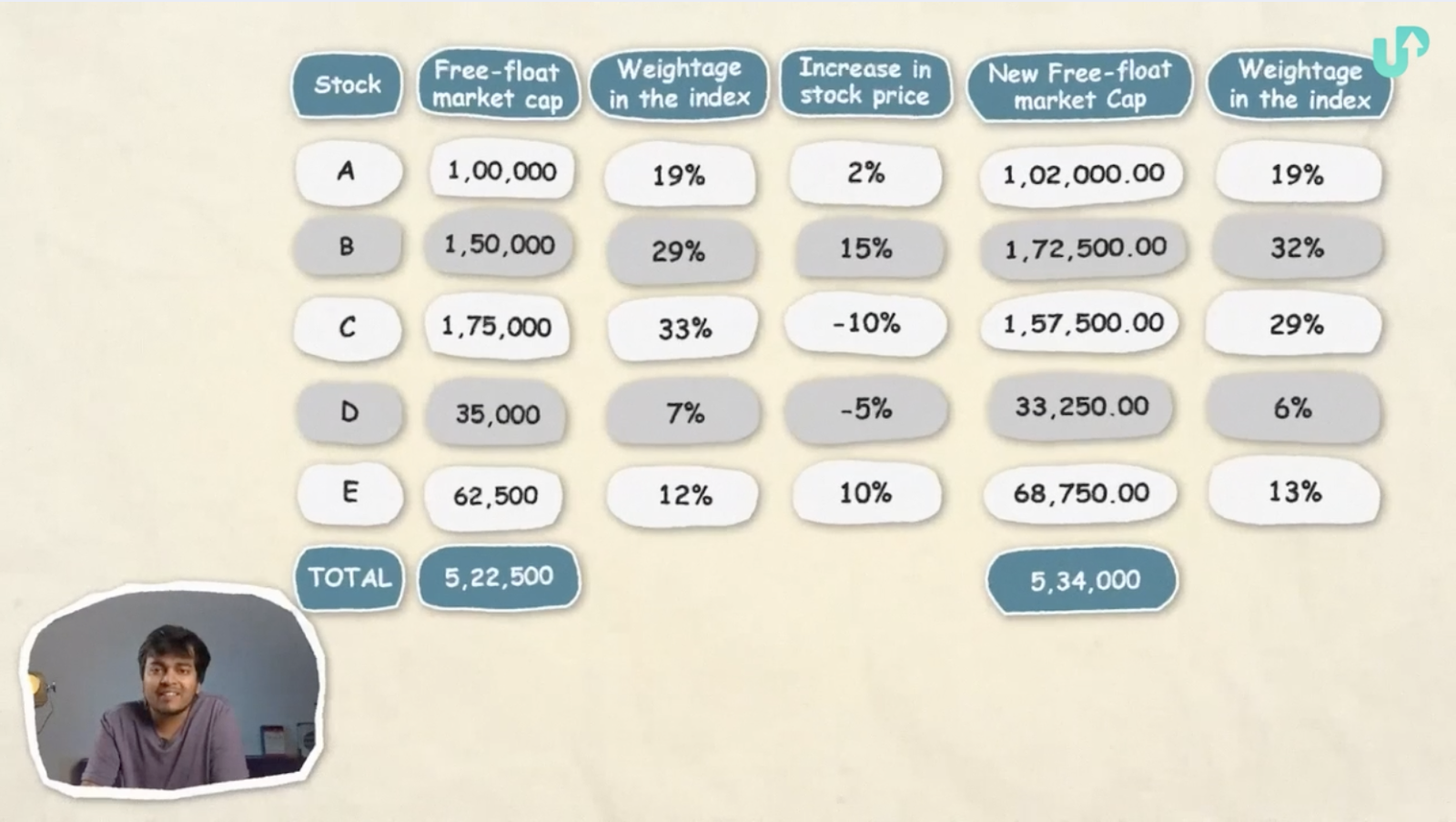

We use the Free Float Market cap to form an index. Companies are assigned weights as per their free-float market capitalization. The higher the market cap, the more the weights in the index.

Initially, Stock C had the highest weightage but as the price of the stock increased, the weights were revised, and according to the new weights Stock B was given more weightage in the index.

Market Participants

- Depositaries – It is a place where our shares are held in a dematerialized form. There are two depositories in India namely – CDSL (Central Depository Service Limited) and NSDL (National Securities Depository Limited).

- Broker – When you open an account with a platform like Dhan, you get a trading account, and simultaneously a demat account is opened with the depositaries. Dhan acts as a broker and helps you buy and sell securities at the exchanges.

- Exchange – Say there is a stock A which you want to buy and there is someone who wants to sell stock A. Both can engage in a transaction at an exchange, with the help of a broker. There are two major exchanges in India which are NSE (National Stock Exchange) and BSE (Bombay Stock Exchange). NYSE, NASDAQ, London Stock Exchange, and Tokyo Stock Exchange are some of the global exchanges.

- Foreign Institutional Investors (FII) – Foreign banks, mutual funds, or pension funds that invest in India are called FIIs.

- Domestic Institutional Investors (DII) – Mutual funds and AMCs that are based out of India and invest in Indian stock markets are called DIIs.

- High net worth investors (HNI) – HNIs are people with huge portfolios like Ashish Kacholia, Rakesh Jhunjhunwala, and so on. These include people having investable assets exceeding INR 5 Cr.

- Individual Investors – These are small investors like you and me having small portfolios.

- Promoter groups – These are the owners of the company, say the Ambani family’s share in Reliance.

Primary and Secondary Markets

Let’s understand this with Zomato’s example. Before Zomato got listed on the exchanges it was listed in the private market. Private market investments provide access to innovative, high-potential companies in their early stages of growth. In 2021, Zomato was listed on the exchanges.

A company can get listed either through a fresh issue ie. by offering new shares to the public or through an offer for sale wherein the original investors/promoters sell their shares to the public. Fresh issues are usually taken as a positive sign because the money raised will be used for the company’s growth. In an offer for sale, the money raised will go into the pockets of the promoters or existing shareholders who are selling their stake. The primary market is a place where the stock gets listed for the first time and here the transaction is between the company and investors.

Once the stock gets listed, it trades on the secondary market. In secondary markets, the trades are between investors and traders rather than from the companies that issue the securities.

Few important terminologies

Market order – A market order is an order to buy or sell a stock at the market’s current best available price. A market order typically ensures an execution, but it doesn’t guarantee a specified price.

Limit order – A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. This order guarantees the price but does not guarantee the execution of the trade.

Bid price – It is the highest price a buyer will pay to buy a specified number of shares of a stock at any given time.

Ask price – It is the lowest price at which a seller will sell the stock.

How to invest in the stock market?

Mutual Funds and ETFs

Mutual Fund

It is a pool of money managed by a professional Fund Manager where the manager deploys the money in equities or debt securities depending on the type of mutual fund. You can invest in mutual funds by going directly to the fund’s portal, through distributors, or through direct mutual fund platforms like Groww, Paytm, etc.

Investment in mutual funds can be Regular or Direct. In a regular mutual fund, there is a distributor who invests money in the mutual fund on our behalf and charges a commission. In a direct mutual fund, you can directly invest without paying any middleman fees.

There are two types of mutual funds – open and closed-ended. In open-ended mutual funds, the buying and selling of units happen between investors and mutual funds. On the other hand, in closed-ended mutual funds, the buying and selling of units between the investors and fund happens at initial offerings and then the units are traded between investors.

One can invest in equity, bond, or commodity mutual funds and can also invest in a combination of all three assets. At the same time, equity mutual funds are further classified into small-cap, mid-cap, and large-cap funds. So one can choose the mutual fund depending on its risk appetite.

There are two management styles – active and passive. In active management, the manager actively picks up stocks and tries to beat the benchmark index. In passive management, the manager tries to replicate the performance of the benchmark index.

Expense ratio

It is the fees paid to the manager and the cost of running the mutual fund. Actively managed funds have a higher expense ratio than passively managed funds.

Asset under management (AUM)

It is the cumulative sum of investment of a particular Mutual Fund.

Exchange Traded Funds (ETFs)

ETFs are closed-ended funds that are passively managed. There are many types of ETFs like gold, Nifty 50, etc. They trade like shares and can be bought from brokers’ platforms, unlike mutual funds.

Hierarchy of Investing – Mutual funds, ETFs, and Direct Investing

A new investor should choose to invest in mutual funds and ETFs because fund managers with 15-25 years of experience manage these funds. Furthermore, the trend for passive mutual funds and ETFs is emerging now as it has been observed that passively managed funds outperform active funds.

One can start with investing in ETFs and passive funds then can move to midcap or small-cap actively managed funds once your risk appetite increases. Later, one can move to directly investing in stocks when you have enough knowledge about the markets.

What to read to analyze the company?

Sources for detailed information about the company are:

- Annual Report – The company issues it once a year, and it contains all the information regarding the company. Right from the business to management thoughts and also the financials of the company. You must read Management Discussion and Analysis and financial statements in annual reports.

- Investor presentation – The company issues it on a quarterly basis. Though it is not mandatory to publish it, most companies do come out with periodic investor presentations to keep their investors well informed.

- Conference calls – The management of the company holds these calls with investors or anyone else who’s interested. In the initial 15 minutes, management talks about the business and its performance followed by a Q&A wherein the investors can ask their queries.

- Forums – We can go through various forums like Value Pickr where people discuss their thoughts about the companies.

- Attending the AGMs – If you are a shareholder of the company, you can attend the AGMs which happen annually. It will provide you insights about management’s thoughts and how they are planning for the coming year

You can easily find these documents on Screener.in. Make sure to read earlier documents and then read the recent ones so as to understand the company’s growth and if the management can achieve their targets. For example, if you want to read a 5 years document, first start with 2019 and then read 2023 data.

Reading the company on screener

If you want to understand the fundamentals of the company, we recommend an excellent tool called screener.in. It’s very useful in understanding the fundamentals of the company, and will also help you determine whether a stock is a good investment. Additionally, it also contains all the documents listed above.

You can watch the video on “How to use screener.in” on the upsurge.club YouTube channel to understand how to use the tool effectively:

Conclusion

We learned why we should invest, which is mainly to beat inflation. Secondly, we touched upon about the power of compounding and busted a few myths related to the stock market.

Then, we learned about various ways to invest in Equities i.e. through Mutual Funds, ETFs and directly investing in stocks. We also learned about various market participants like depositories, brokers, HNIs, FIIs, DIIs, etc.

Lastly, we also threw light on the different sources that we can refer to and analyze in order to gain more insights into the company – annual reports, investor presentations, conference calls, etc.

Get the comprehensive course on basics of stock market investing here.