In this guide, ‘The Noiseless Trader’ Kaushik Akiwatkar explains his rule-based price action option trading strategy that helps identifying market trends using price patterns and market structures. Putting to use his 10+ years of experience, he educates on techniques to capture market opportunities using the right instruments, supported by real-life executions of the trade.

Preview – What to Expect

Before we dive in, let’s take a peek into what we will be covering:

- Identify trending and non-trending markets using price patterns, moving averages, and other strategies

- Understand and analyze different market structures

- Trade options during both – trending/directional and non-directional markets

- Select the right options strategy, strike price, and stop loss for your trades

- Tweak your strategy if market structures fail

- Manage trades effectively depending on the way market conditions unfold

Learn from the instructor himself, get the comprehensive course here.

Introduction to Price Action Option Trading Strategy

There are many different types of options trading strategies one can venture into. In terms of direction, they can be long or short; and in terms of style, they can be single leg or double leg. Essentially, a trade can be:

- Long options with Single/Double Legs

- Short options with Single/Double Legs

Defining a Market Trend

Arguably the most important concept of technical analysis is understanding the trend of a market. A trend is nothing but the mass adoption of a behavior or behavioral pattern. It represents the view of the majority of the market participants or ‘herd’.

A bullish trend is formed when the majority of the people are optimistic about the market and a bearish trend comes into being when fear creeps into the majority of the participants and they view markets negatively.

Determining the trend is the first step for a trade set up as this will help us determine our directional position. A trend can be recognized by looking at the market structure (price patterns) or through indicators.

It is important to have a clearly defined rule-based system. This will assist us in anticipating the markets, devising an appropriate strategy, and following a rules-based system. We will be looking at 2 things to define the market trend – market structure and moving averages.

1/ Market Structure

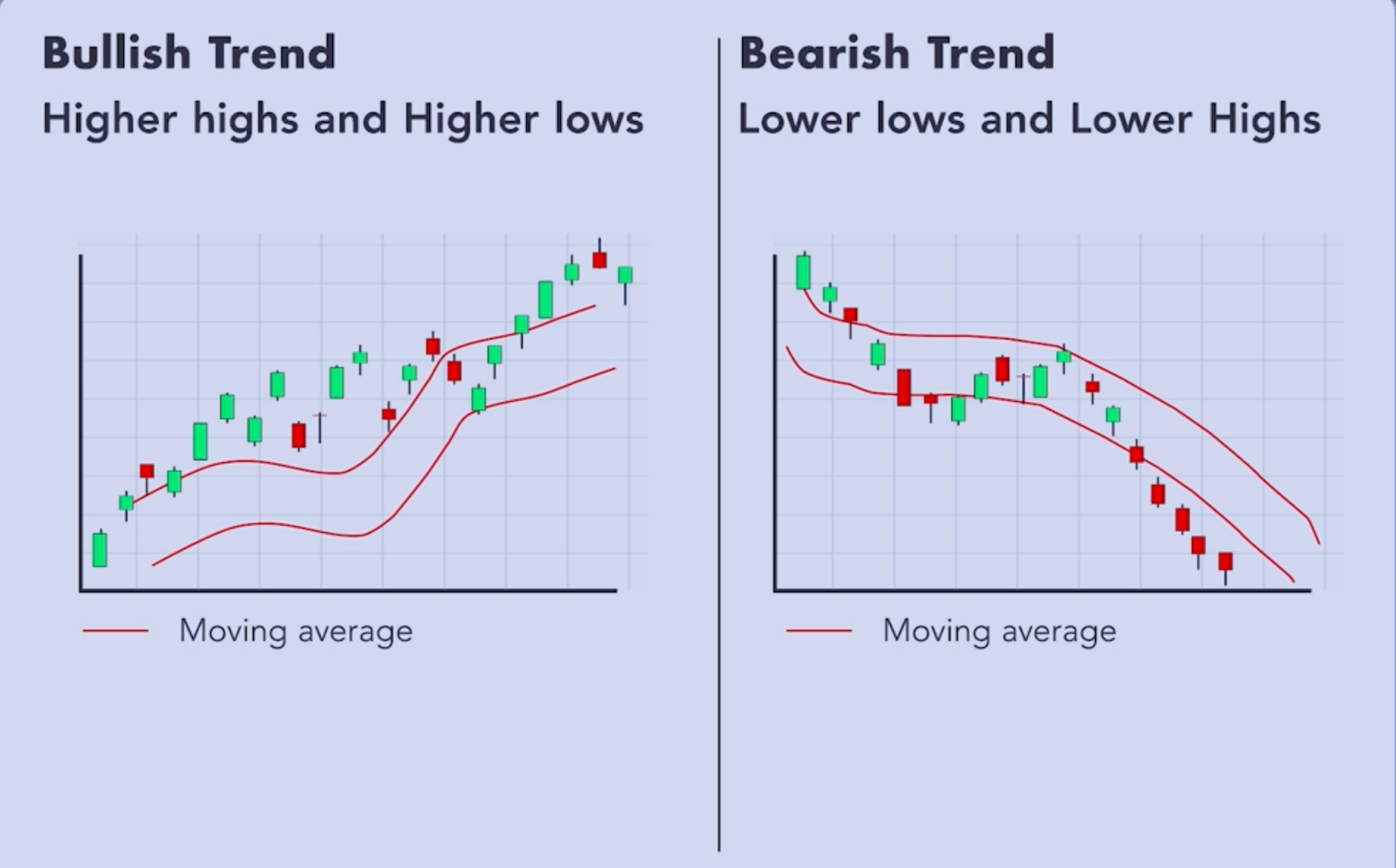

A market structure is the basic formation on the chart that reflects the market trend. It is the method of plotting higher highs & higher lows, and lower highs & lower lows, similar to plotting swing tops and swing bottoms based on the Dow Theory.

It is identified by observing the pattern formed by the latest 3 candles – their colors and positions.

The 2 types of market structures are:

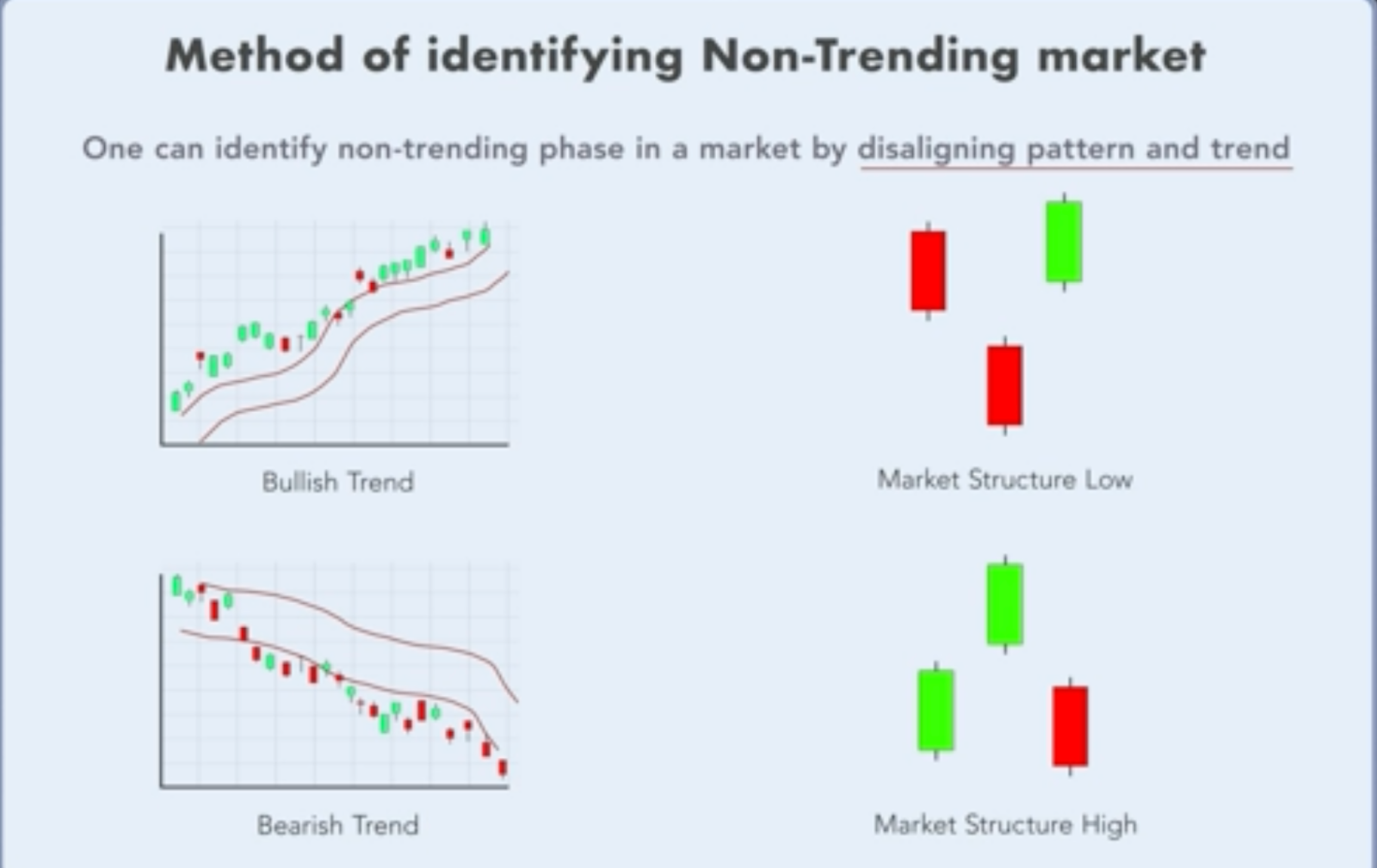

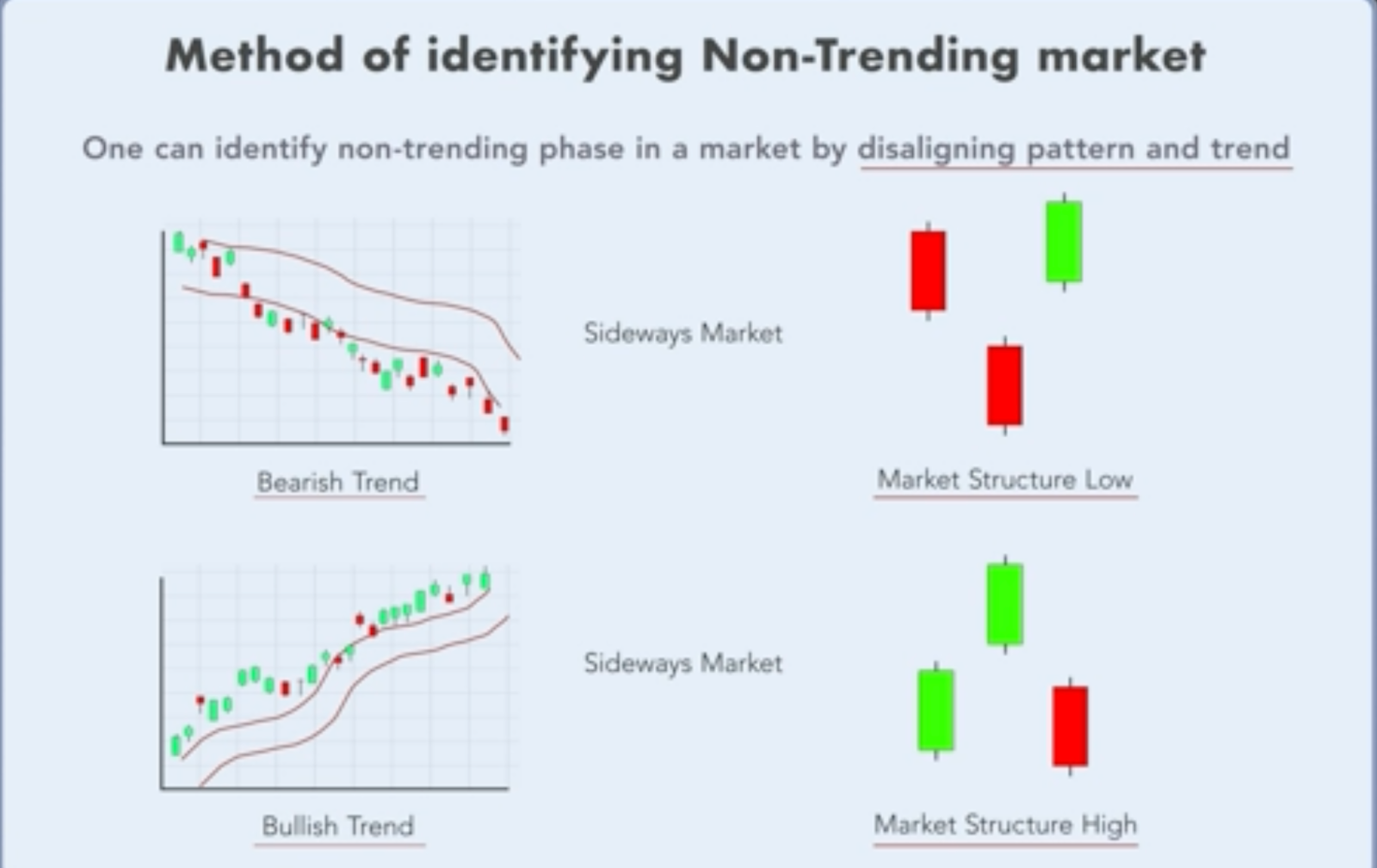

Market structure Low

A bullish pattern is formed with 2 red candles and 1 green candle, where the second candle forms a lower low relative to the first candle and the third candle closes above the second in the green. It is a method of plotting swing lows.

Market structure High

A bearish pattern is formed with 2 green candles and 1 red candle, where the second candle forms a higher high relative to the first candle and the third candle closes below the second in the red. It is a method of plotting swing highs.

On a price chart, a bullish and bearish pattern may look like this:

To make sense of the trend, we plot multiple market structure highs and market structure lows. Higher market structure lows together form a bullish trend and lower market structure highs together form a bearish trend. Following are some MSHs and MSLs spotted on the Nifty50 chart in 2022:

A market structure high formation:

A market structure low formation:

Exceptions

Note that certain exceptions are permitted if the overall market structure is indicative of a clearly bullish or bearish trend. The following example has the second candle as a doji candle instead of a long red candle, but can still be considered a market structure low:

Another exception of a market structure high can be seen with this interesting example. Even if the second candle here is green, the closing price is below the first candle’s, with a gap down, and the third candle is closing above the second one. Hence, this can be considered as a market structure low.

Remember that, paying attention to the closing price is more important, and the color of the candle is of secondary importance while identifying a market structure.

A morning star, therefore, is a market structure low and an evening star is a market structure high.

2/ Moving Averages

We identify the market trend with the help of market structures, but filter the trend, i.e. understand whether they are forming in the direction of the trend, through signals from moving averages.

Moving averages are an average of the closing prices of the last few trading sessions. They are rightly called as the first derivative of price. For example, a 21-period moving average helps us plot the average price of the last 21 periods. A period can be a day, week, month, or even 15 minutes.

Moving averages are often used as support and resistance levels while taking trades.

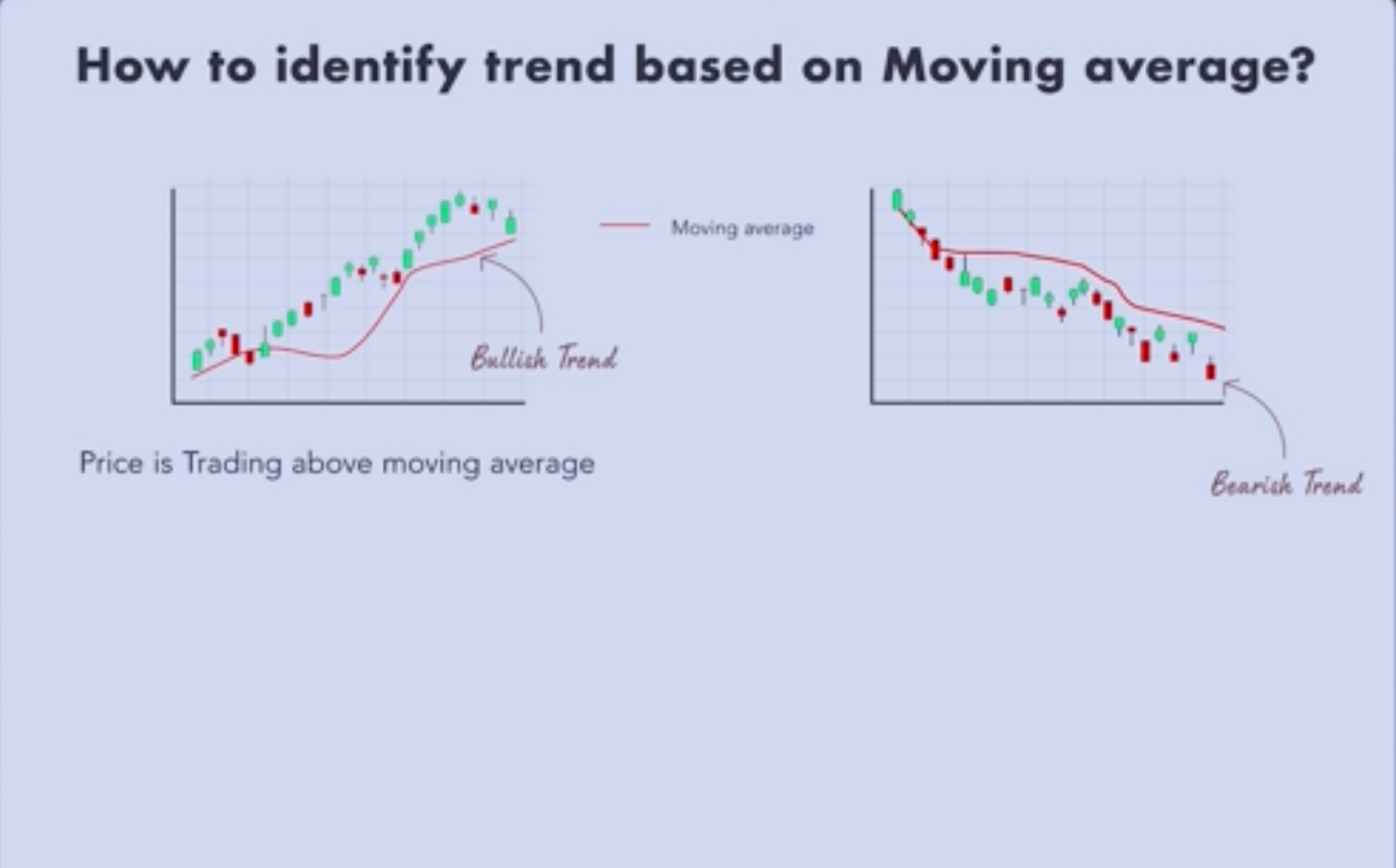

A bullish trend can be spotted when prices trade above the moving average line. A bearish trend can be spotted when prices trade below the moving average line.

Simple and Exponential Moving Averages

While simple moving averages give equal weight to all data sets, exponential moving averages give more weight to recent data sets. The latter is preferred by traders and options traders for forming short-term views and looking to capitalize on opportunities quickly.

Using a 21-day EMA gives us a sense of the activity over the past month since a month has 21 trading days, and is a reasonable time frame for options trades to get trailing support and trailing resistance. We will use a 21-day EMA for both the underlying, and option chart.

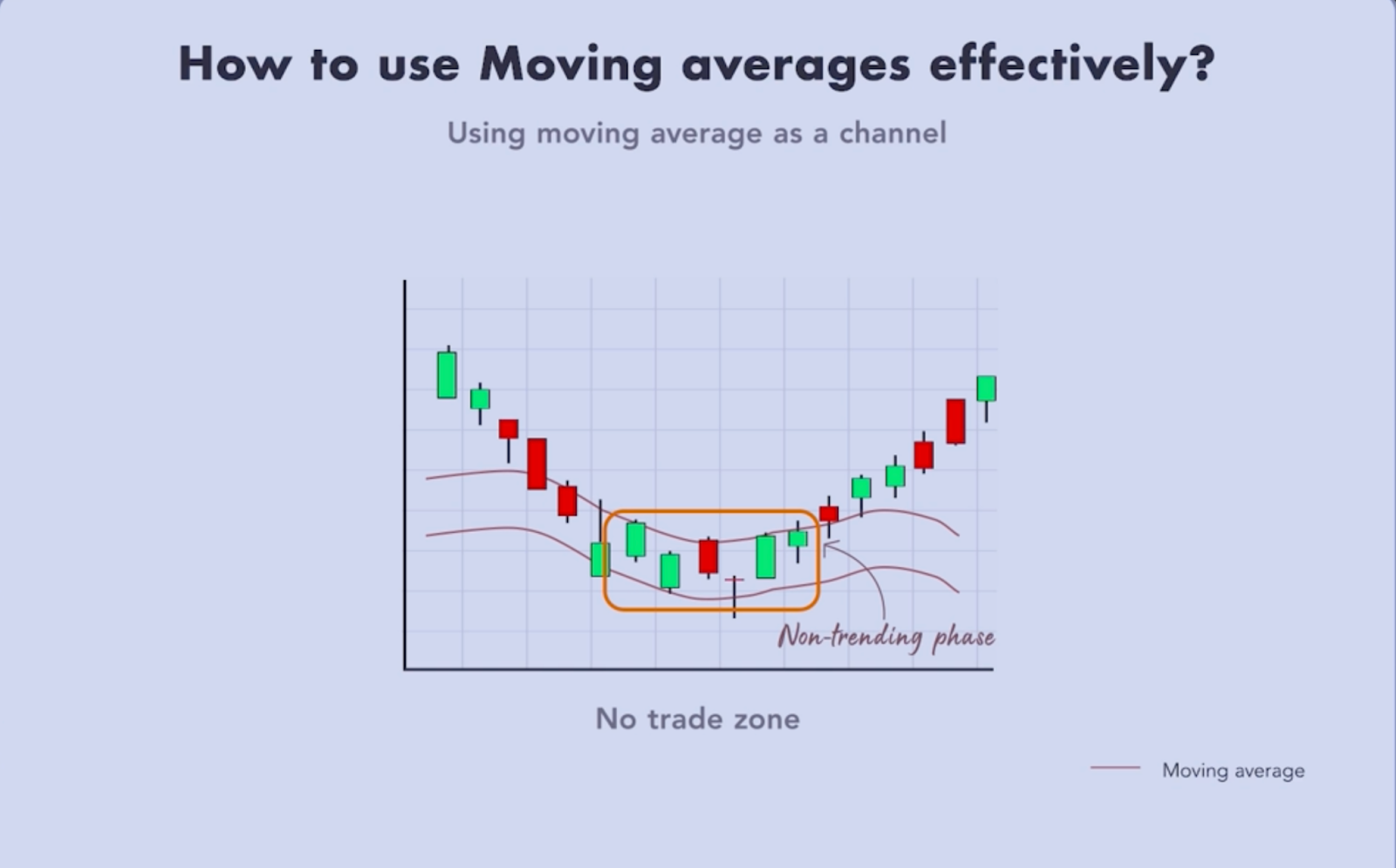

We use an exponential moving average band, which plot the moving averages of the highs and lows of the prices. Prices trading above and below the moving average bands, with an upward and downward slope, are considered bullish and bearish respectively. It may look like this:

When prices fluctuate above and below the average line, or trade within the moving average band, we consider them to be in a channel. A channel resembles a sideways market:

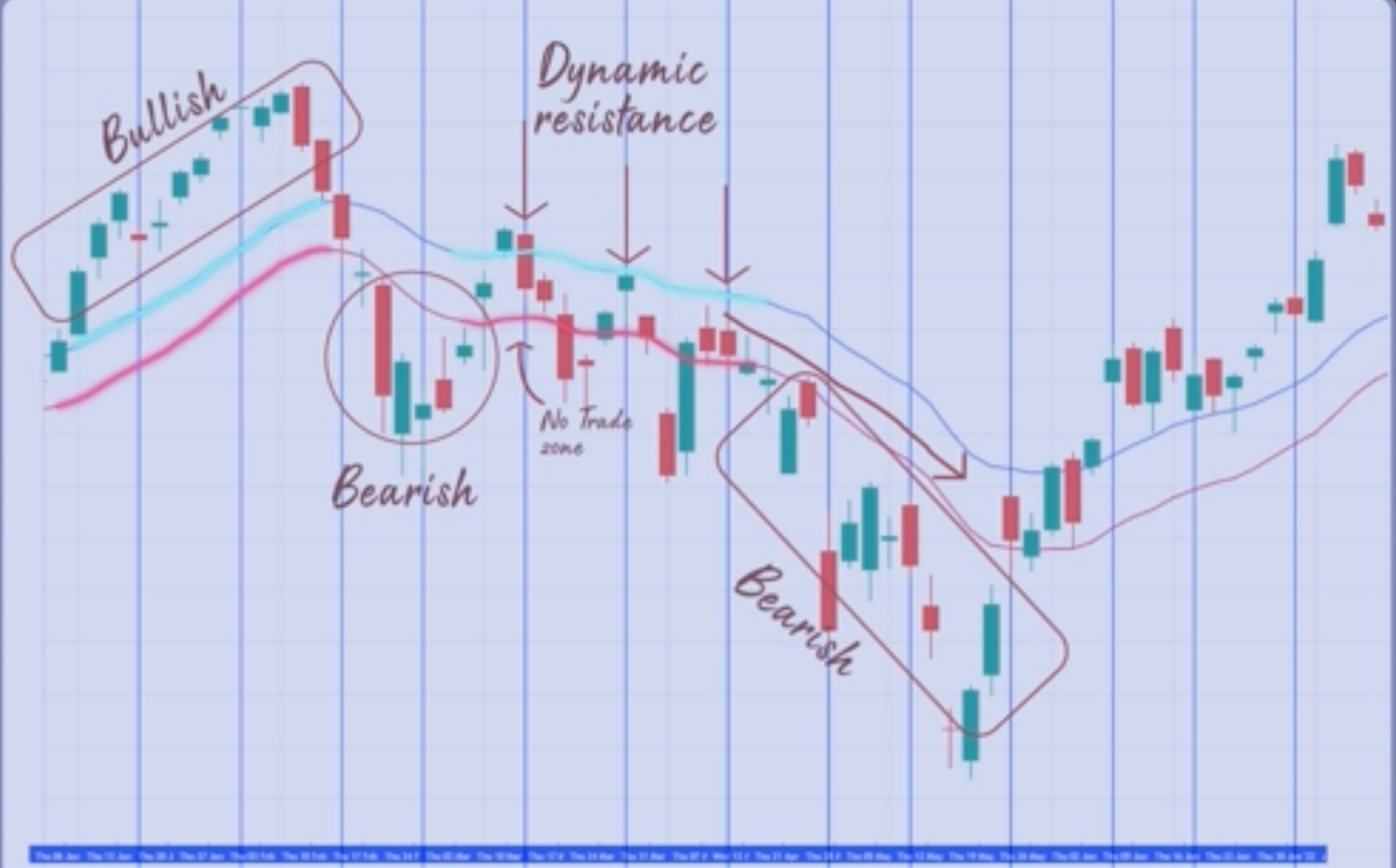

A few trends plotted on the Nifty chart:

Principle of Polarity

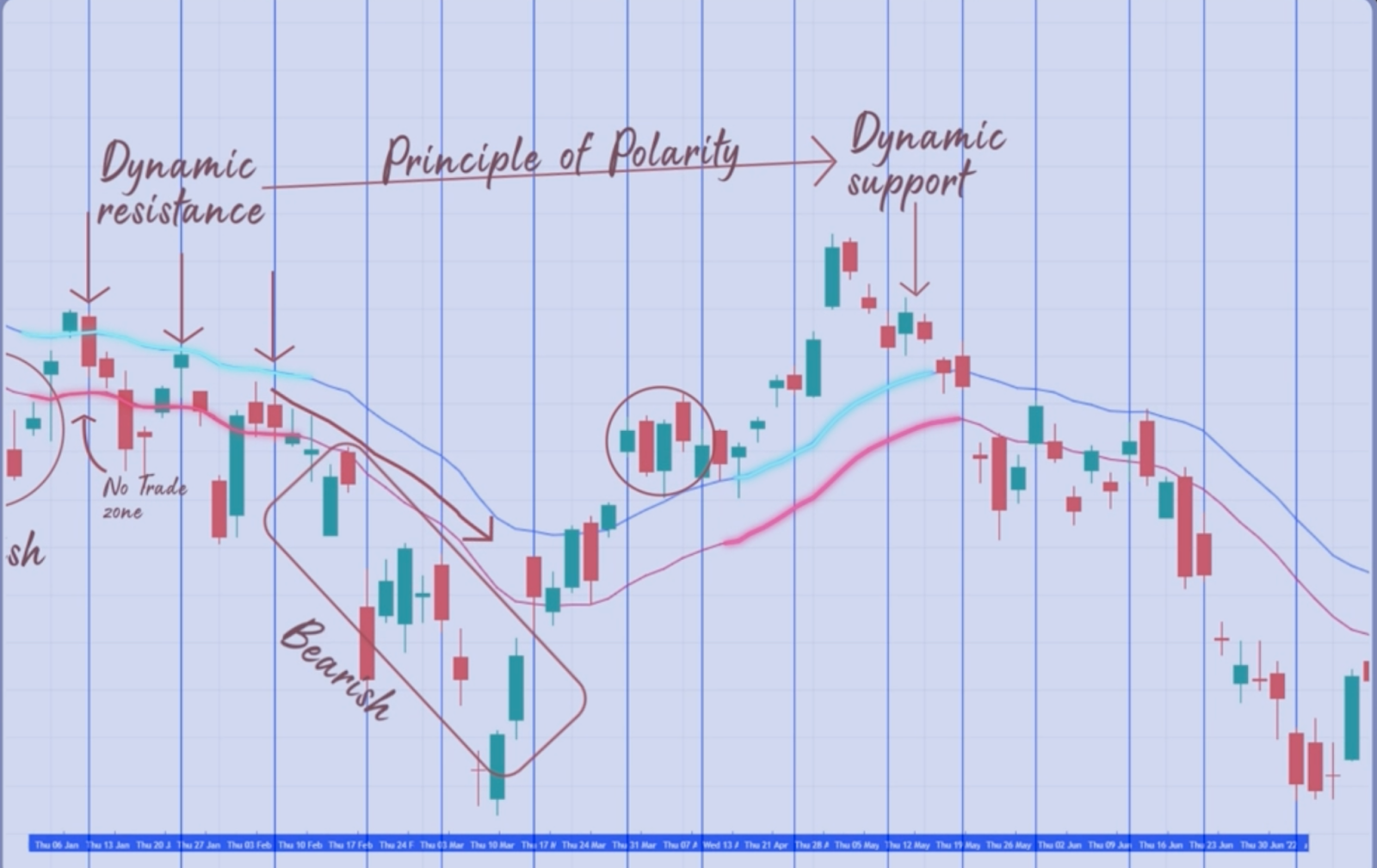

Moving averages act as a dynamic support and resistance and help us identify whether the MSHs or MSLs are forming in the direction of the trend or not. A moving average can also act as a support in some markets and resistance in others, especially when the trend reverses. This is known as the principle of polarity. Whenever the price starts consolidating within the high-low band, and moving averages become flat, it is suggestive of a sideways market. This is a time when the principle of polarity is changing.

Take a look at the example below. The market kept taking dynamic resistance from the moving average line, and started acting as a dynamic support after a trend reversal.

Identifying Trends and Range in the Market

As an options trader, it is critical to know whether markets are trending or sideways.

Conjunction of price patterns and moving averages

Looking at the price pattern and moving averages in conjunction guides us in defining the market trend and selecting the correct price action option trading strategy. We look at the price pattern and trend filter both to correctly define the market trend. There are 2 types of situations that we may encounter:

Trending Markets

Trending markets give a clear directional signal, with an alignment of the market structure and moving average indication:

When a market structure low is formed and the price is above the moving average, we conclude that the markets are trending and bullish. Once the trend is confirmed on a 15-minute chart, we will short a put 1% in the money. Considering Nifty to be at ~19,000; this translates to shorting a put with a strike price of 19,200. You should place the stop loss at the lowest point of the second candle.

When a market structure high is formed and the price is below the moving average, we conclude that the markets are trending and bearish. Once the trend is confirmed on a 15-minute chart, we will short a call 1% in the money. Considering Nifty to be at ~19,000; this translates to shorting a put with a strike price of 18,800. You should place the stop loss at the highest point of the second candle.

Once we have identified the strike price, we will move our focus to the options chart, look at that strike price on a 15-minute chart, and short a market structure high below the moving average. Regardless of the position, we will always trade this pattern when on an options chart.

The idea of shorting an option 1% in the money is that accuracy at the time of shorting is high, and aiming for a ~200 points gain every week (considering Nifty at ~19,000) is a reasonable target to aim for.

Non-Trending Markets

One can identify non-trending phases in a market by disaligning the pattern and trend, i.e. when they give diverging signals. We use straddles and strangles to trade in non-directional markets.

A misalignment of trend can be seen when a market structure low and bearish moving average trend are seen together. It’s also evident when a market structure high and bullish moving average trend are seen together.

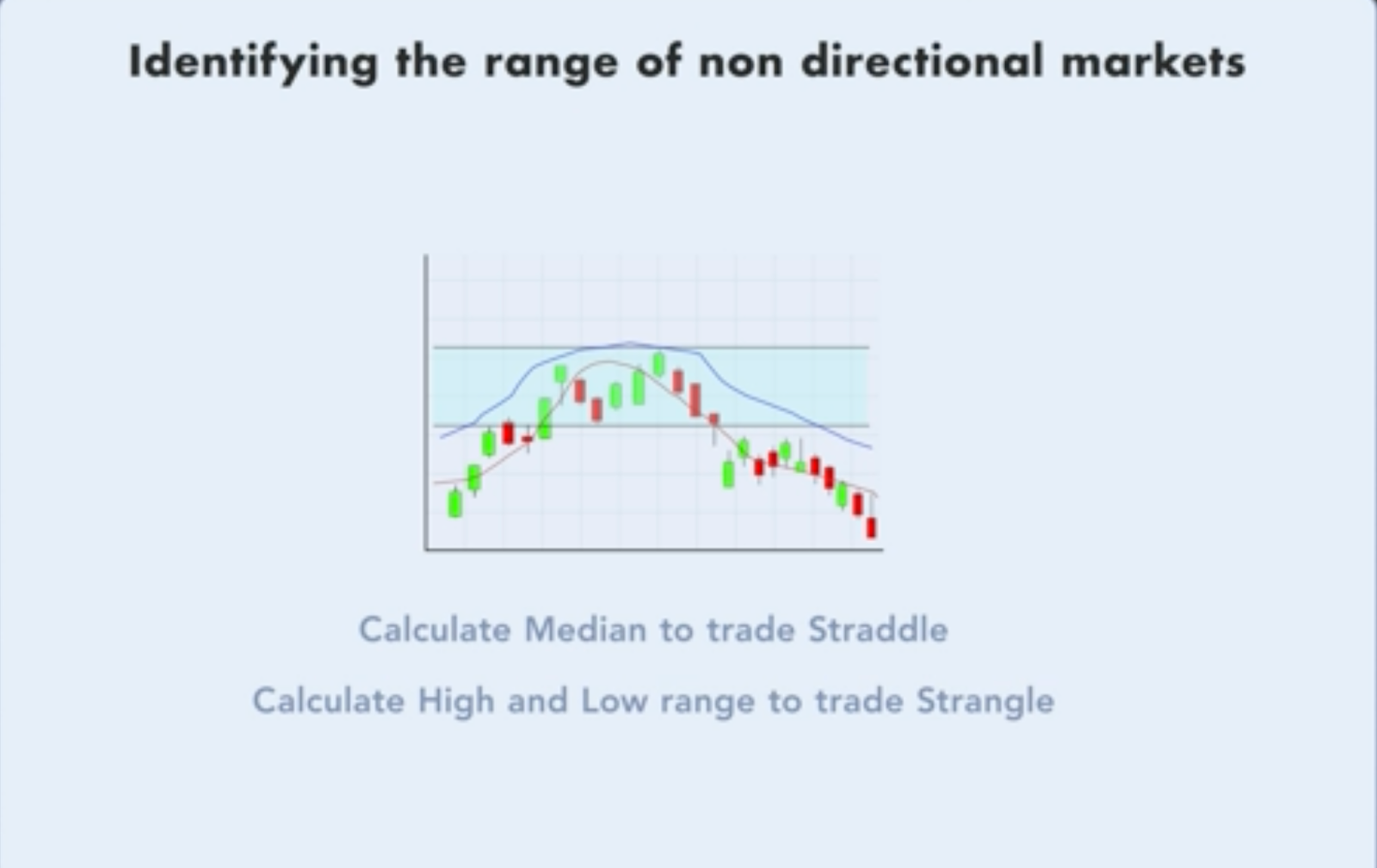

When markets trade non-directionally, we need to measure the range of the channel in which we intend to sell a straddle or strangle.

Strangles

When the moving average trend is bullish but a market structure high forms, expect a sideways market. Here, we mark the following:

- Highest high point of the 3 candles forming the market structure pattern

- Lowest point of the moving average band, which sits exactly below the above mentioned high point

Similarly, when the moving average trend is bearish but there is a market structure low formed, a sideways market can be expected where our range will be marked by:

- Lowest low point of the 3 candles forming the market structure pattern

- Highest point of the moving average band, which sits exactly above the mentioned low point

The area within these points would be our trade channel and one can short a call at the high point and short a put at the low point to implement a strangle trade.

Straddles

For a straddle, we will take the median value of the 2 points as discussed above as the exercise price and short a call and put at those prices to take advantage of the range.

Also note that since strikes at all price points are unavailable, we would round off the median value to the nearest strike price to get the exercise price. For example, if we obtain a median value of 19,289 for our range, we will use a 19,300 exercise price.

It’s intuitive that strangles are milder versions of straddles and their premiums are less compared to straddles.

To summarize, trading a range:

Liquidity

Application of this strategy is ideal in liquid instruments like Nifty, Banknifty, and Finnifty. We would not suggest getting into stock options for this strategy as they tend to be less liquid.

Failure of Market Structure

After establishing a sideways trend, if you find a market structure in the direction of the trend, it means the market structure has failed, i.e. your previously established (sideways) assumption would not hold. Hence, a failure of the opposite market structure, in direction of the trend, would suggest a trend-following trade instead.

You can summarize these 4 cases and the resulting trade actions as follows:

| Market Structure | Moving Average | Trade Action | Exercise Price |

| Bullish | Bullish | Short Put | 1% in the money |

| Bearish | Bearish | Short Call | |

| Bullish | Bearish | Short Straddle/Strangle | Based on high/low of the range for strangle and median value in case of straddle |

| Bearish | Bullish | Short Straddle/Strangle |

Using straddles and strangles during trending markets and relying on naked options during sideways markets can trigger stop losses.

Conclusion

We learned how to define a market trend using market structures and moving averages. In addition to that, we also learnt how to select the right instruments at the correct strike price to successfully execute a trade.

We also learned how to maintain the trade during different market environments and where to keep our stop losses.

Taking a total of 28 trades as per the strategy discussed on 1 lot of Nifty, we would have booked 4,345 points. This translates to a profit of Rs 2,17,250 per lot.

Learn directly from the potential trades discussed in the Price Action Option Trading Course here.