Are you interested in trading options and making smart trading decisions? Understanding price action and how it works can be your key to success.

Price action is the study of a financial asset’s price movement on a chart. It involves analyzing patterns, candlestick formations, and support/resistance levels without relying on indicators or external factors.

By observing how prices behave, you can make informed trading decisions, identifying potential buy or sell opportunities.

This guide covers the top 5 ways to trade options using price action. Let’s dive in and discuss options trading price action.

5 Ways to Trade Options using Price Action

Trading options using price action involves analyzing price charts and patterns to make trading decisions. Here are five ways to trade options using price action:

1. Candlestick Patterns

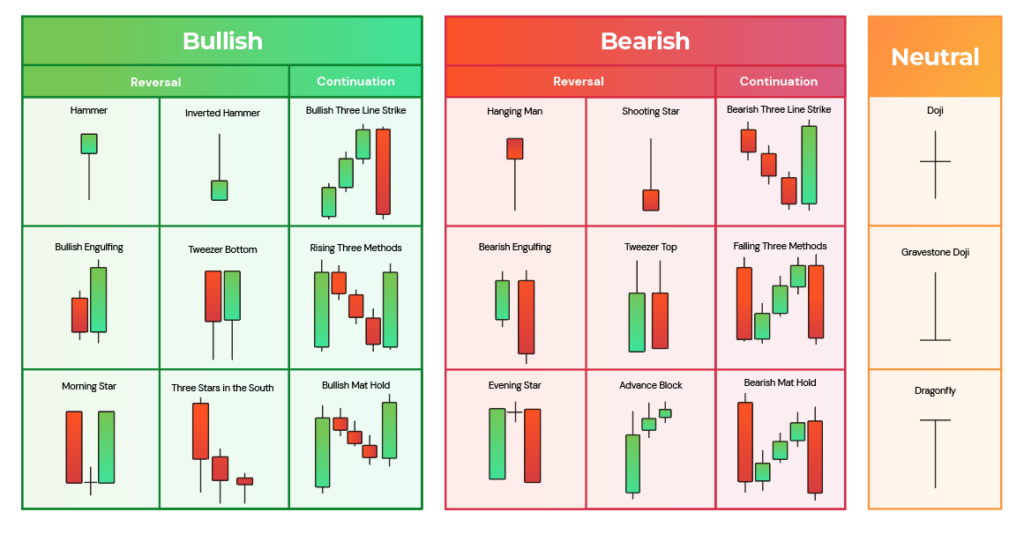

When trading options using price action chart patterns, focus on recognizing candlestick patterns. These patterns are essential for your analysis.

Look for well-known price action chart patterns like doji, engulfing, hammer, and shooting star candles. These patterns can signal potential reversals or continuations in the underlying asset’s price movement.

For example, a bullish engulfing price action chart pattern suggests a possible upward move, while a bearish engulfing pattern could indicate a potential downward shift. Keep a keen eye on these patterns as they provide crucial insights for your options trading decisions.

Source: Andy Kong – Medium

2. Support and Resistance Levels

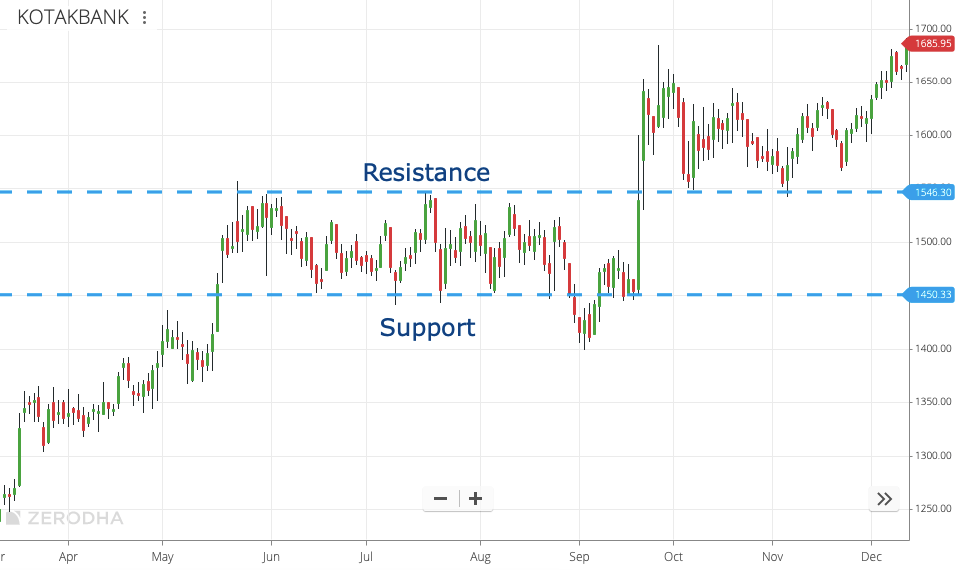

In your options price action strategy, pinpoint key support and resistance levels on the price chart. These levels act as crucial barriers. When prices approach support, consider call options for potential bounces.

Conversely, when near resistance, think about put options for possible reversals. These levels are like checkpoints in your trading journey, helping you navigate the market’s twists and turns.

Keep an eye on them as they can guide your options trading decisions effectively, adding a layer of precision to your overall strategy.

Source: Learn Stock Market

3. Trend Analysis

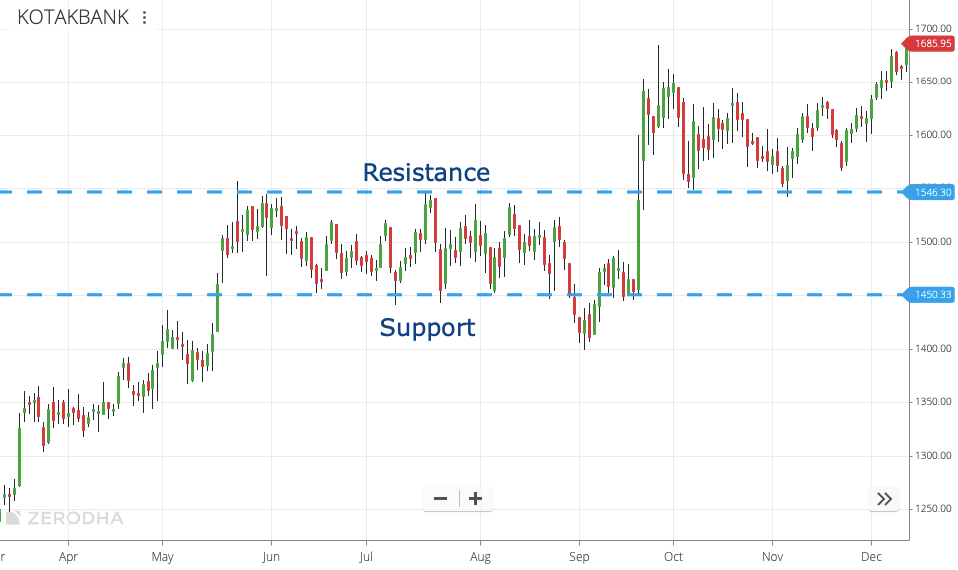

In Trend Analysis, you should focus on identifying the current trend of the underlying asset you’re considering for options trading. This means assessing whether the asset’s price is generally moving up (an uptrend), down (a downtrend), or sideways (a ranging or consolidating market).

Here’s how you can apply trend analysis using price action:

- Uptrend:

When you observe that the underlying asset’s price has been consistently rising over time, it indicates an uptrend. In this scenario, you may want to consider options strategies that align with a bullish outlook. For instance, selling covered calls can be a suitable strategy to generate income in an uptrending market. - Downtrend:

If you notice that the underlying asset’s price has been consistently falling, it signifies a downtrend. In a downtrend, you might explore options strategies that capitalize on bearish movements. For example, selling cash-secured puts can allow you to benefit from a continued downward trend while generating premium income. - Sideways or Ranging Market:

When the price appears to move within a relatively tight range without a clear upward or downward trend, it’s a sideways or ranging market. During such times, you might consider strategies that take advantage of limited price fluctuations, such as iron condors or calendar spreads.

Source: IG International

Identifying the prevailing trend using price action analysis, you can align your options trading strategies with the market direction. This can help you make more informed decisions, whether you want to generate income, hedge your positions, or speculate on price movements in options trading.

4. Breakout Trading

When you trade options using price action, pay close attention to breakout opportunities. These occur when the underlying asset’s price surges above or plunges below significant support or resistance levels. Breakouts often lead to substantial price movements.

If you spot a bullish breakout, consider buying call options to profit from the anticipated upward trend. Conversely, if a bearish breakout occurs, think about buying put options to capitalize on the expected downward movement.

Source: TradingwithRayner

Keep in mind that breakout trading requires careful timing and risk management, so be sure to use appropriate strategies and stay vigilant for potential breakouts on the price chart.

5. Trading Patterns

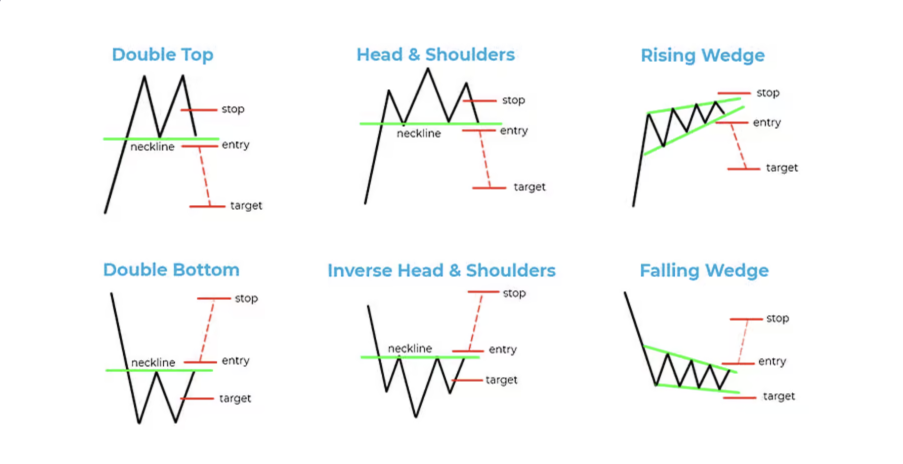

Finally, consider watching for key price action patterns like head and shoulders, double tops, and flags. These patterns on the price chart can help you make informed decisions.

For instance, when you spot a double top pattern, it might signal a potential trend reversal, prompting you to think about purchasing put options to profit from a downward move.

Source: SurgeTrader

Remember that while these patterns offer valuable insights, always combine them with sound risk management practices and stay updated on market news to make well-informed options trading choices.

Learn Price Action Option Trading

If you want to hold a solid command in option trading, then learn Price Action Option Trading from Upsurge.club. Its options price action course encourages you to make informed decisions by analyzing historical price movements and identifying potential trends, reversals, or breakouts.

This course also provides comprehensive guidance on integrating price action strategies into your trading, ultimately helping you achieve better results and navigate the complexities of the options market more effectively.

A solid grasp of price action can enhance trading skills, leading to more profitable and risk-controlled options trading strategies.

Conclusion

Mastering option trading price action is crucial for successful options trading. By using this 5 ways in your price action strategy, you can make more informed decisions and improve your chances of success.

However, to delve deeper into this exciting world of trading, don’t forget to explore Upsurge.club’s best price action trading course. It’s a valuable resource that can help you refine your skills and become a more confident and profitable trader.