As a popular strategy, scalping aims to profit from small price movements in financial markets. Traders employing this technique buy and sell multiple times a day to capitalize on short-term opportunities independent of the overall trend.

Scalping traders execute numerous trades, sometimes up to 40 to 50 per day, aiming for small profits in each trade. Their quick decision-making and precision can lead to impressive daily profits, like earning rupees 10,000 a day from 40 trades with a profit of rupees 250 each. However, mastering scalping requires expertise in risk management and understanding market trends.

This article is about learning the scalping strategy, exploring its key principles and shedding light on executing an exit strategy to become a successful scalper. Join us to learn scalping trading and uncover the secrets to this fast-paced and potentially rewarding approach.

Different Types of Scalping Trading

Scalping needs a great level of expertise and quickness, which takes time to develop. Thus, you should opt for this approach only when you are comfortable with intraday trading and can successfully handle 2 to 4 trades a day. This technique has various approaches and techniques. Here are three common types of scalping trading:

1. Market Making

As a scalper, you constantly monitor the bid and offer prices, aiming to compete with market makers on both sides. You focus on stocks with high volume but minimal real price change, as these are ideal for scalping.

2. Small Price Move

This approach does not require large price jumps or dramatic market movements. Instead, it’s about capitalizing on minor changes and rapidly making trades to accumulate profits over time. The key is consistency and vigilance in monitoring these slight price shifts.

This fast-paced strategy requires precision and discipline to capitalize on even the tiniest price shifts for potential gains.

3. Classic Method

When executing trades, you adhere to the classic method of employing a 1:1 risk/reward ratio, a favored approach among scalpers.

Based on your understanding of and expertise, you can choose a type of scalping that suits you.

Steps to Learn How to Make Money Using Scalping Trading

While certain scalping techniques can be potentially profitable, it also has a certain level of risk and requires careful consideration and discipline.

Here are some steps to learn how to make money using scalping trading:

1. Educate Yourself

To make money using the scalping trading strategy, educate yourself first. Learn about the financial markets, technical analysis, and chart patterns. Understand how to use indicators like moving averages, Bollinger Bands, and the RSI.

Knowledge of these key elements will help you develop a successful scalping strategy for quick profits from short-term price movements. You can also enroll in a scalping trading course by Upsurge.club to enhance your skills and understanding.

Source: Upsurge.club

2. Pick the Right Trading Platform

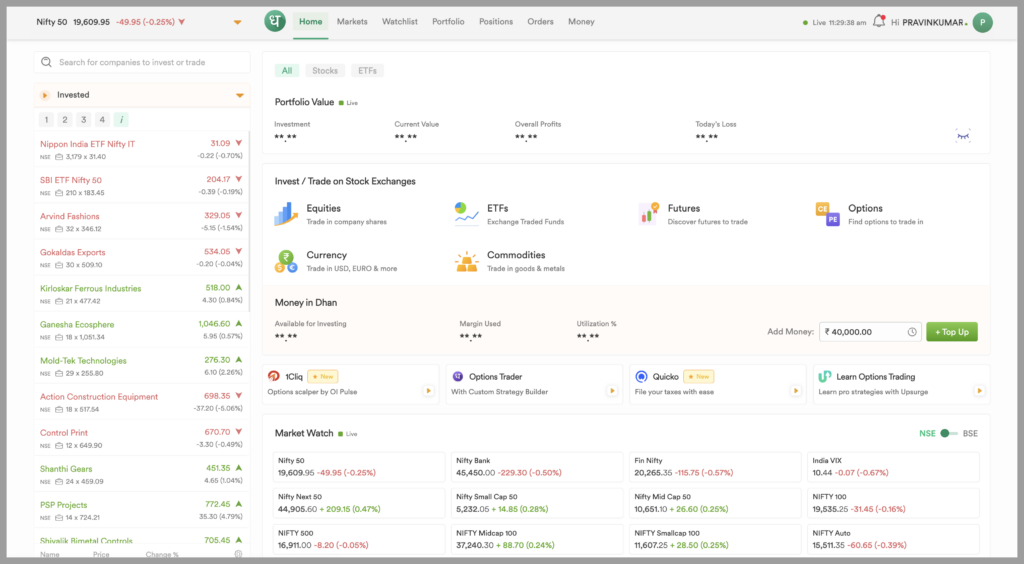

Select a reliable trading platform with fast execution and real-time data. Ensure it offers useful analytical tools for scalping trading.

This will enable you to make quick decisions and seize opportunities promptly, reducing the risk of technical issues or delays that can affect your potential profits.

Source: Dhan

3. Use Tight Stop Losses

To implement the best scalping strategy, use tight stop-loss orders. Set clear and predefined levels to protect your capital from significant losses. Stick to your risk management plan and be disciplined. You can also use scalping trading indicators to ensure that you make the right decisions.

Emotional decision-making can be detrimental in fast-paced scalping, so stay focused and controlled. By placing tight stop-losses, you’ll safeguard your trades and enhance your chances of success in the markets.

4. Trade during High Volatility

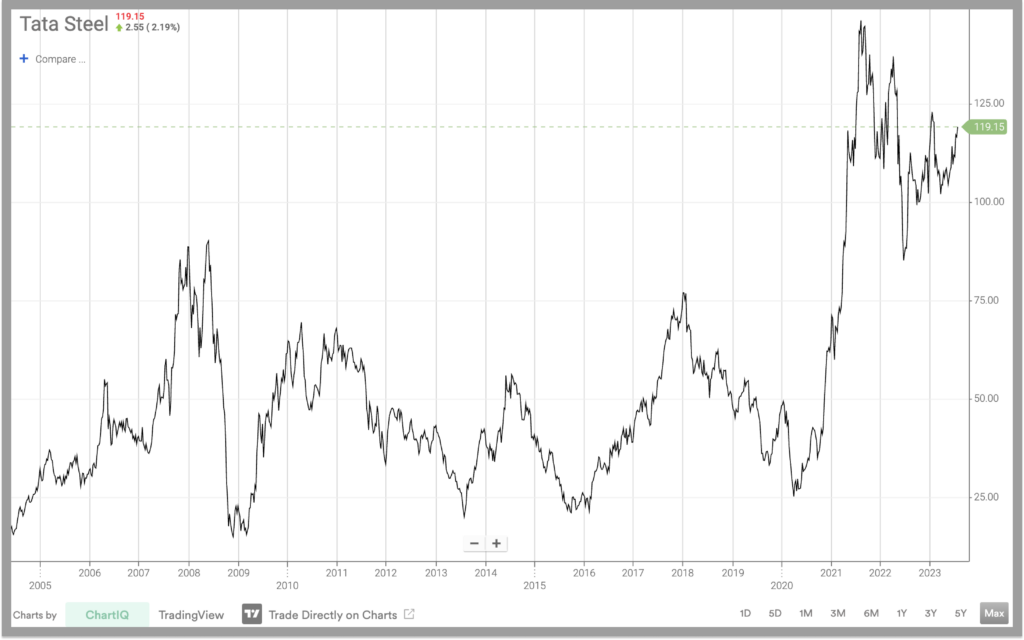

During scalping, focus on trading when market volatility is high. Look for periods of increased price movement as they offer more opportunities.

Increased market volatility provides more frequent and significant price movements, allowing for quick entry and exit points and higher profit potential. Monitor economic events, earnings releases, or major news announcements that can trigger volatility spikes.

Remember, volatility provides the ideal conditions for your fast-paced scalping strategy, making it more likely to be profitable.

Source: Dhan

5. Practice Using a Demo Account

You should start with a demo account. It’s a risk-free environment provided by trading platforms where you can simulate real trading without using actual money. This allows you to get familiar with the platform, test your scalping strategy, and gain confidence in your abilities.

Use the demo account to hone your skills and make mistakes without any financial consequences, helping you become a more competent scalper when you transition to live trading.

Enroll in an Online Scalping Course

Enrolling in an online scalping course is crucial as it equips you with the necessary skills and knowledge to execute this fast-paced trading strategy effectively.

At Upsurge.club, you can access a top-notch online scalping course, ensuring you’re well-prepared to navigate the markets and potentially profit from short-term price movements. With its comprehensive lessons and expert guidance, you’ll learn essential techniques, risk management and gain confidence in your trading decisions.

Wrapping Up

By now, you have gained valuable insights into the world of scalping and how to make money using this short-term strategy. Remember to stay disciplined, practice with a demo account, and continuously analyze your trades to improve your skills. With determination and knowledge, you can excel in the fast-paced world of scalping and potentially achieve profitable results.

To understand this concept better, consider enrolling in an online scalping course at Upsurge.club. Continuous learning is key to becoming a successful scalper, so take the next step towards achieving your trading goals with expert guidance and knowledge.