The Ichimoku Cloud is a versatile technical analysis tool that offers valuable insights into market trends, support and resistance levels, and potential entry and exit points.

By understanding the components of the Ichimoku Cloud and learning how to interpret its signals, you can gain a powerful advantage in your trading endeavors. Are you curious to learn Ichimoku trading? Without further delay, let’s dive into the world of Ichimoku trading and unlock its potential together.

What is the Ichimoku Cloud?

The Ichimoku Cloud or Ichimoku Kinko Hyo, is a popular technical analysis tool used in trading. The Ichimoku Cloud was developed by Japanese journalist Goichi Hosada in the late 1960s. It charts support and resistance levels during intra-day trading sessions, indicating momentum and trend directions.

This charting tool uses various trading average lines to plot a “cloud” that forecasts future support or resistance levels. It provides more data points than a standard candlestick chart, offering a comprehensive view of market dynamics.

Although Ichimoku Cloud charts may seem complex initially, with proper understanding and defined trading signals, they become easier to decode. Mastering the Ichimoku Cloud can enhance your ability to identify potential trading opportunities and make informed decisions in the market.

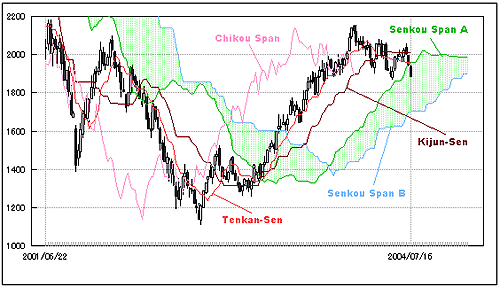

Below are a few elements of Ichimoku Cloud:

1. Kijun-sen (Base Line)

This line represents the midpoint of the highest high and the lowest low over a longer period compared to the Tenkan-sen. It is usually calculated using the last 26 periods. The baseline helps determine short-term price momentum. If the price is above the baseline, it indicates an upward bias as it is above the 26-period midpoint price. The cloud acts as a support or resistance barrier, providing potential levels to monitor.

2. Tenkan-sen (Conversion Line)

This line represents the midpoint of the highest high and the lowest low over a specified period. It is typically calculated using the last 9 periods. When the Tenkan Sen (conversion line) crosses above the Kijun Sen, it indicates increasing momentum and maybe a buy signal. The opposite crossover can be a potential sell signal.

3. Senkou Span

The Ichimoku Cloud has two types of “leading” lines known as Senkou Span A and Senkou Span B.

- Senkou Span A represents the midpoint between the conversion line (Tenkan-sen) and the baseline (Kijun-sen), and it forms the upper boundary of the cloud.

- On the other hand, Senkou Span B represents the midpoint of the 52-week range and forms the lower boundary of the cloud.

4. Chikou Span (Lagging Span)

This component represents the closing price of the current period, plotted 26 periods behind. It helps you evaluate the strength of the current trend by comparing it to historical price action. When it declines below the market price, it indicates a bearish market. Conversely, when it is above the market price, it suggests a bullish market.

To interpret the Ichimoku Cloud effectively, it’s important to complement the information with thorough technical and fundamental analysis before making trading decisions.

Also, consider the broader context, conduct a thorough analysis, and use the Ichimoku Cloud as a complementary tool in your trading strategy.

Source: Stack Overflow

How to Set up Trades Using Ichimoku?

Setting up trades using Ichimoku involves a combination of steps. Here’s a breakdown of the process:

1. Multi-time Frame Analysis

Begin by analyzing the market across multiple time frames. This helps to identify the overall trend and potential trading opportunities. For example, you can use daily, 4-hour, and 1-hour charts to get a comprehensive view of the market.

2. Cloud Breakout

The color of the cloud is significant. A red cloud indicates a downtrend, while a green cloud suggests an uptrend. This gives you a visual indication of the overall market sentiment. Wait for the price to break out of the cloud in the direction of the trend. This breakout can serve as a signal to enter a trade.

3. Tenkan-sen and Kijun-sen crossover

Look for the Tenkan-sen to cross above or below the Kijun-sen. This crossover can indicate a potential change in momentum and serve as an entry signal.

4. Chikou Span confirmation

Confirm the trade setup using the Chikou Span. It boosts the trading signal if it’s above or below the price.

5. Combining with Other Indicators

The Ichimoku Cloud can be used in conjunction with other technical indicators like the Relative Strength Index (RSI). The RSI helps identify momentum and overbought/oversold levels, as well as signals such as divergence or hidden divergence.

If you’re interested in learning more about the Ichimoku Cloud and how to effectively apply it to your trading strategy, consider enrolling in the Ichimoku Cloud course offered by Upsurge.club. This course is designed to help you understand the intricacies of the Ichimoku Cloud and provide you with practical insights on interpreting its components and identifying potential trading opportunities.

Conclusion

Mastering the art of Ichimoku trading can be a valuable addition to your trading repertoire. By understanding its components, interpreting signals, and incorporating them into your trading strategies, you can gain an edge in the market.

You can start learning this indicator by exploring educational courses offered by Upsurge.club, to deepen your knowledge and improve your skills in Ichimoku trading. Your commitment to learning and applying this technique can lead to greater trading success.